How to make contributions through your employer

To arrange either before-tax (salary sacrifice) contributions or after-tax contributions to your super through your employer's payroll department, here's what to do.

Action summary

- Time it takes

Approximately 15 minutes to complete the form - Cost

No set up fee - Result

You’ll help grow your super, which means you could enjoy a more 'comfortable' retirement - What to consider

The dollar amount or percentage you want to contribute

What you’ll need

- Printed form to complete

- To know the type of super account you have - GESB Super or West State Super

- Your payroll number, if you have it

Need help

- Call us on 13 43 72

1. Decide if you want to make a before-tax or after-tax contribution

We recommend you read the information below to help you choose which contribution option is right for you:

- The Contributing to your super brochure is about making extra contributions

- Visit the Salary sacrifice (before-tax) and After-tax personal contributions pages for more information

2. Work out how much you would like to contribute

Before you complete the form, you need to know how much you’d like to contribute to your super through your pay. You can choose any amount that suits you.

If you’re not sure how much to contribute, try our Contributions calculator.

3. Access the form

First, click the link to access our online Payroll deduction form or download our PDF Payroll deduction form. You will need to print out the PDF form as you cannot type directly into it.

You can use our 'Payroll deduction' form to make either salary sacrifice contributions or after-tax contributions.

Simply follow the instructions in our online form to complete and submit your request online, or keep reading for help with completing the PDF form.

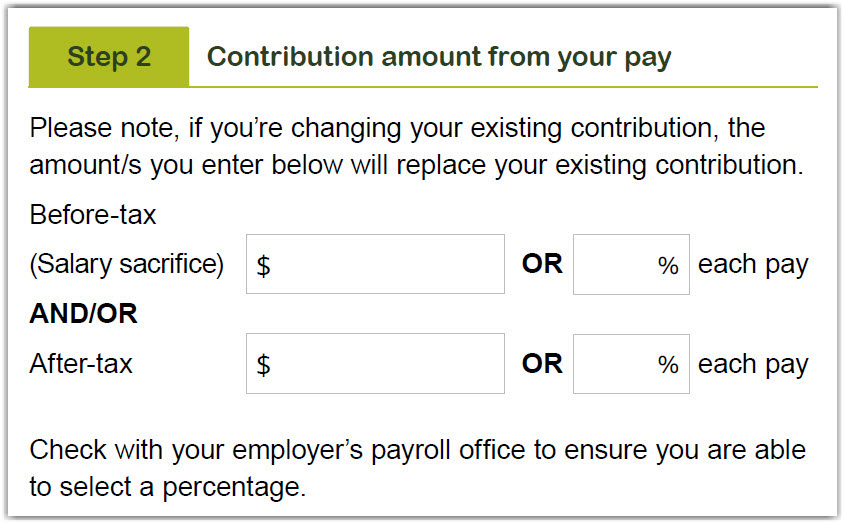

Please note, if you have an existing contribution, the amount you enter will replace your existing contribution.

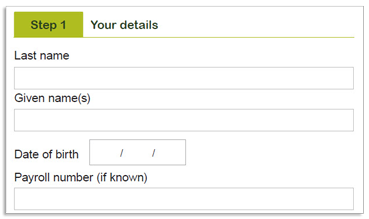

4. Provide your personal details

These details include your name, date of birth, and your payroll number if you know it. This will make it easier for your payroll department to process your request.

5. Enter the amount you would like to contribute

In this section, write the amount you would like to contribute from each pay. You need to enter the dollar amount or percentage of your pay that you would like to contribute in the top boxes for salary sacrifice contributions, or in the bottom boxes for after-tax contributions.

Please note, if you have an existing contribution, the amount you enter will replace your existing contribution.

If you’re still not sure how much to contribute, try our Retirement planning calculator.

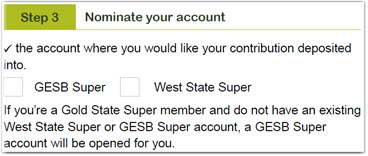

6. Confirm your super account

In this step, you need to select GESB Super or West State Super depending on which account you have. If you’re not sure which account you have, check your last member statement, visit the Which super account do you have page or login to Member Online.

If you’re a Gold State Super member and don’t already have a GESB Super or West State Super account, we’ll automatically open a GESB Super account for you.

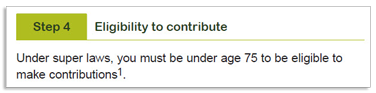

7. Check that you’re eligible to make contributions

To be eligible to make contributions to your super, you must under the age of 751.

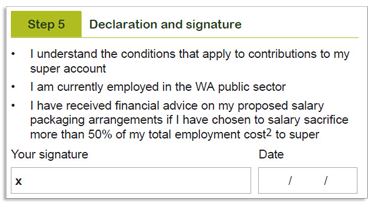

8. Read and sign the declaration

When you sign the form, you’ll need to acknowledge that you understand the conditions that apply to your super account. All of this information is included in the Contributing to your super brochure.

9. Give the form to your employer’s payroll department

Now that you’ve completed and signed the 'Payroll deduction' form, you need to give the form to your payroll department to process.

We can’t process these contributions as they are taken out of your salary before it gets paid to you.

1 We can accept contributions received up to 28 days after you turn 75.

® Registered to BPAY Pty Ltd ABN 69 079 137 518

Thank you for printing this page. Remember to come back to gesb.wa.gov.au for the latest information as our content is updated regularly. This information is correct as at 19 April 2024.