How to start salary sacrificing

Salary sacrifice contributions are a simple way to grow your super. You can contribute to your GESB Super or West State Super account through your payroll if you’re currently working in the WA public sector.

If you’re a Gold State Super member and you would like to make salary sacrifice contributions over your maximum Average Contribution Rate, they need to be made to your GESB Super or West State Super account. If you don’t already have one of these accounts, we can automatically open a GESB Super account for your extra contributions.

To start making salary sacrifice contributions, you can either:

- Complete our online Payroll deduction form

- Download and fill out our PDF form and give it to your employer

Action summary

- Time it takes

Approximately 15 minutes to complete the form - Cost

No set up fee - Result

A set and forget way to grow your super faster - What to consider

The dollar amount or percentage you want to contribute

What you’ll need

- Printed form to complete

- The type of super account you have - GESB Super or West State Super

- Your payroll number, if you have it

- Check with your payroll department to see if you need to provide any other details

Need help

- Call us on 13 43 72

1. Learn about salary sacrificing

We recommend you read the information below to check that making salary sacrifice contributions is the right option for you:

- The following pages outline what you need to know about making salary sacrifice contributions, including caps that apply if you have a GESB account.

- Salary sacrifice for GESB Super

- Salary sacrifice for West State Super

- Contributing to your super is about making extra contributions to your super, including salary sacrifice. It also includes a practical example highlighting the difference between no contributions, after-tax contributions and before-tax contributions.

2. Work out how much you would like to salary sacrifice

Before you complete the payroll deduction form, you need to know how much you’d like to contribute to your super through salary sacrifice. You can choose any amount that suits you.

If you’re not sure how much you’d like to contribute, try our Contributions calculator.

3. Access the form

First, click the link to access our online Payroll deduction form or download our PDF Payroll deduction form. You will need to print out the PDF form as you cannot type directly into it.

You can use either Payroll deduction form to make sacrifice contributions or after-tax contributions.

Simply follow the instructions in our online form to complete and submit your request online, or keep reading for help with completing the PDF form.

Please note, you can also cancel your existing contribution using either Payroll deduction form.

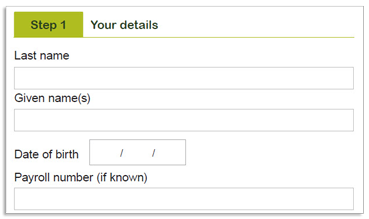

4. Provide your personal details

These details include your name, date of birth, and your payroll number if you know it. This will make it easier for your payroll department to process your request.

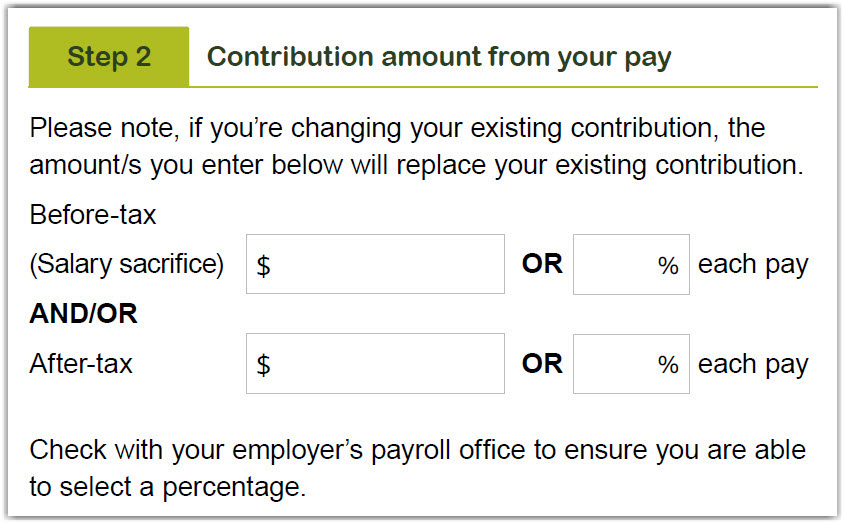

5. Enter the amount you would like to contribute

Here is where you need to write the amount you would like to contribute from each pay. You need to enter any dollar amount or the percentage of your pay that you would like to contribute in the top boxes for salary sacrifice contributions.

Please note, if you have an existing contribution, the amount you enter will replace your existing contribution.

Again, if you’re not sure how much you’d like to contribute, try our Retirement planning calculator.

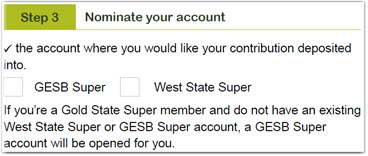

6. Select your super account

In this step, you need to select GESB Super or West State Super depending on which account you have. If you’re not sure which account you have, check your last member statement, visit the Which super account do you have page or login to Member Online.

If you’re a Gold State Super member and don’t have one of those accounts yet, we’ll open a GESB Super account for you.

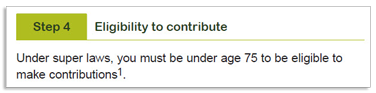

7. Confirm that you’re eligible to make salary sacrifice contributions

You can only contribute extra to your super when you are under the age of 75.

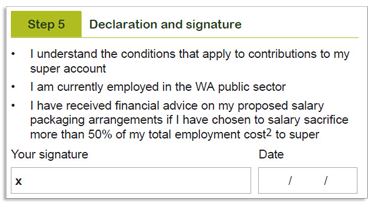

8. Read and sign the declaration

When you sign the form, you’ll need to acknowledge that you understand the conditions that apply to your super account. All of this information is included in the Contributing to your super brochure.

You can contribute more than 50% of your salary to super through salary sacrifice, but the government requires you to talk to a financial adviser if you do this. This is to make sure that your salary sacrifice contributions won’t have a negative impact on your situation.

9. Give the form to your employer’s payroll department

Now that you’ve completed and signed your payroll deduction form, you need to lodge the form with your payroll department.

We cannot process salary sacrifice contributions as they are taken out of your pay. So you will need to hand the form to your employer to start salary sacrificing.

For most WA State Government employers, this is all you need to do. If you’re using a salary packaging provider for another salary packaging arrangement, check with your employer first. Some employers will ask you to go through that provider to make salary sacrifice contributions to your super.

Thank you for printing this page. Remember to come back to gesb.wa.gov.au for the latest information as our content is updated regularly. This information is correct as at 19 April 2024.