How to combine your super

You can combine your other super accounts into the account you hold with us by providing the details online or by completing a printed form.

Using Member Online is the quickest way. Visit the Member Online help guide for step-by-step instructions on how to do this.

If you’d prefer to complete the printed form, keep reading for the steps you need to take.

Action summary

- Time it takes

Approximately 15 minutes to complete the form - Hardest thing

Getting certified proof of identity if you choose not to provide your tax file number - Cost

We don’t charge a fee to combine your super - Result

You’ll have all your super in one place

What you'll need

- Printed form to complete

- Certified proof of identity (if applicable)

Need help

- Call us on 13 43 72

1. Understand your options

Combining your super into one account makes it easier to keep track of your retirement savings and only look after one set of paperwork. Before you decide to combine everything, it’s important to find out what will happen to your entitlements from your other fund or funds.

Some key points to consider:

- Fees - we don’t charge a fee to consolidate your super, but you should contact your other fund to find out about any fees or charges that might apply.

- Death and disability benefits - if you choose to leave your other fund, you may lose any insurance benefits you have with them. Find out more about our insurance cover

- Future contributions - consolidating your super won’t change which fund your employer pays your super contributions to. If you’re now working in the private sector, your employer can’t make contributions to the account you hold with us

2. Download the form

Download a Super consolidation form. You can type your details directly into the form, and then print out the form to provide your signature.

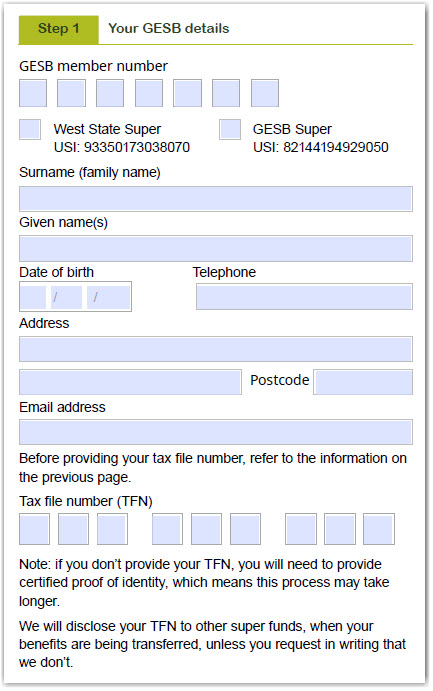

3. Provide your personal details

These details include your GESB member number, name, date of birth, address, email address and phone number.

We also ask for your tax file number (TFN). You don’t have to provide your TFN, but if you don’t, you will need to provide certified proof of identity, which means this process may take longer.

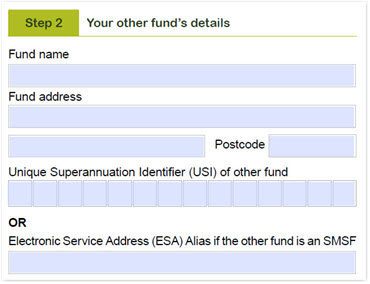

4. Enter your other fund details

In this section, write the name, address, Unique Superannuation Identifier (USI), or Electronic Service Address (ESA) if it’s an SMSF, and Australian Business Number (ABN) for the other fund. You’ll also need to write your account number.

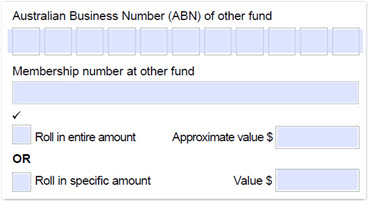

You need to decide if you want to transfer the entire amount (effectively closing your other account), or if you want to roll in a specific amount.

If you choose the top box, we ask you to include the approximate value of your other account here.

If you tick the bottom box, you just need to choose the amount you’d like to roll into your GESB account.

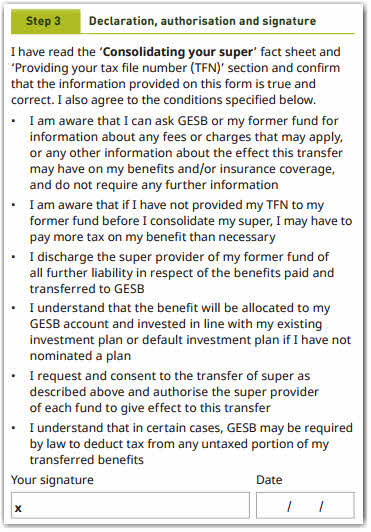

5. Read and sign the declaration

When you sign the form, you’ll need to acknowledge that you have read the Consolidating your super fact sheet. You confirm that you can ask both us and your other fund about fees, and that by asking for your super to be transferred to us that the other fund no longer has an obligation to you for that amount.

You also acknowledge that in certain cases we may need to deduct tax from any untaxed portion of your transferred benefits.

The super you roll into your GESB Super or West State Super account will be invested into your choice of investment plan or our default Readymade investment plan if you haven’t made a choice.

6. Send the form to us

Now that you’ve completed and signed the 'Super consolidation' form, you need to send your completed form (and certified proof of identity if you haven’t supplied your TFN) to us at:

GESB

PO Box J 755

Perth WA 6842

Australia Post can take up to six business days to deliver regular mail. Please take this into account when submitting forms to us, especially when you need to meet a processing deadline.

Thank you for printing this page. Remember to come back to gesb.wa.gov.au for the latest information as our content is updated regularly. This information is correct as at 16 April 2024.