How working part-time affects your Gold State Super

If you are a Gold State Super member, your super continues to grow while you work part-time. Here, we explain how choosing to work part-time will have an effect on your final Gold State Super benefit.

How is your benefit calculated?

To calculate your Gold State Super Final Benefit, we use the following formula:

Completed Months of Service is the number of equivalent full-time months you have been a Gold State Super member.

Your Service Multiple is calculated according to the hours you actually work. If you work part-time, your Service Multiple will accrue at a slower rate. The table below provides an example.

| Full-time employee (FTE) | Part-time employee |

|---|---|

| Normally accrues one month of service every 30.4 days | At 75% of FTE equivalent, normally accrues one month of service every 40.5 days |

The Average Contribution Rate is the average percentage rate of your contributions made during your employment in the WA public sector.

If you change to part-time work, your Gold State Super contributions will be based on your part-time salary. For example, if your standard full-time salary was $50,000 and you start working 50% of the normal full-time hours and are paid $25,000 per year, the contributions you pay will be based on $25,000. This means the contributions you pay are reduced.

Final Remuneration is your average salary based on three key dates during your last two years of employment in the WA public sector.

When we calculate your Final Remuneration to determine your Gold State Super benefit, it is based on your equivalent full-time salary, regardless of whether you are working part-time or full-time.

Meet Tom

The examples below illustrate how working full-time or part-time for the next five years will affect Tom’s final Gold State Super benefit.

- Tom is 60 years old

- His Average Contribution Rate is 5%

- His Final Remuneration is $100,000 (full-time equivalent)

- His Completed Months of Service is 120 months

Example 1 - working full-time

Tom continues to work full-time for the next five years.

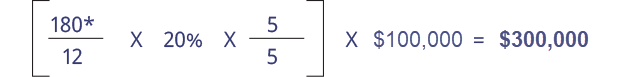

Gold State Super benefit formula:

* Full-time for five years equates to 60 months of service. Tom’s original 120 months of contributory membership + 60 months = 180 months.

Example 2 - working part-time

Tom decides to switch to part-time work (i.e. 50% full-time equivalent) for the next five years.

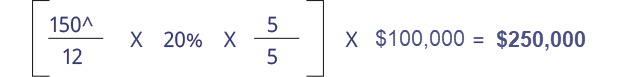

Gold State Super benefit formula:

^ Part-time for five years equates to 30 months of service. Tom’s original 120 months of contributory membership + 30 months = 150 months.

When Tom reverted to part-time work, he paid less in contributions to his Gold State Super account.

Therefore, although his super is $50,000 less than if he had worked full-time, Tom would have saved $12,500 in contributions (5% of $50,000 multiplied by 5) and would have worked 50% less time for the last five years.

Making extra super contributions

If you’re already at your maximum Average Contribution Rate for your Gold State Super account, you can keep growing your retirement savings with voluntary contributions to your existing West State Super or GESB Super account.

If you don’t have one of these accounts, we can automatically open a GESB Super account for you to receive any extra contributions.

To find out whether you are making your maximum contribution to Gold State Super, login to Member Online or call us on 13 43 72.

Your employer should let us know if you decide to start working part-time

Once we know about your reduced hours, we will advise your employer to your fortnightly contributions.

If your contributions do not reduce after the start of your part-time service, please call us on 13 43 72.

You will notice a change to your member statement. Within the membership details section and under the title ‘Contributory membership’, it will indicate that your months of credited service have accumulated at a slower rate, when compared to previous periods when you were working full-time.

Returning to full-time employment

If you return to full-time work, you can’t increase your contributions into Gold State Super above the maximum Average Contribution Rate. Your contributions will continue to be made at your elected contribution rate.

If you make sure you are paying at your maximum Average Contribution Rate, you will receive the maximum benefit.

Thank you for printing this page. Remember to come back to gesb.wa.gov.au for the latest information as our content is updated regularly. This information is correct as at 19 April 2024.