How to set up a Transition to Retirement Pension

If you’ve explored your options and decided that transition to retirement is right for you, here are the steps you need to take to open an account.

We aim to process your application within 10 working days of receiving your form and all the necessary details, including information from your employer. Sometimes this can take longer, depending on your situation.

Please read the Product Information Booklet and the documents recommended in the booklet before you apply for a Transition to Retirement Pension. The booklet includes the forms you will need to fill out to open an account.

For a guide on how to complete these forms, please read the steps below.

Action summary

- Hardest thing

Get certified copies of your IDs - Cost

There’s no set up cost - What to consider

Work out how much and how often you want to be paid - Result

You’ll have an account ready to use as an income stream

What you’ll need

- Certified proof of identification for your date of birth

- A copy of a recent bank statement

- Certified proof of identification for your reversionary pensioner’s date of birth

Need help

- Consider personal financial advice before opening your account

- Request an appointment with our Retirement Options Services team for more information about your options

- Call us on 13 43 72

1. Read the Retirement Income Pension Product Information Booklet

In the Product Information Booklet, you’ll find:

- The forms you need to fill out to open an account

- A summary of the benefits, options and features that are available with your Transition to Retirement Pension, including your investment options

- A guide to choosing your annual pension income

- Details of other important documents that relate to your Transition to Retirement Pension

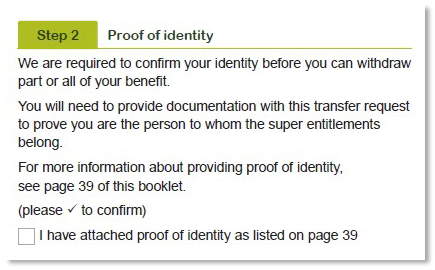

2. Get certified copies of your ID documents

For your security, we need to confirm your identity before you can withdraw any of your super benefit. You could provide:

- A certified copy of your passport only

- A certified copy of your driver’s licence only

- Certified copies of your birth/citizenship certificate or Centrelink pension card AND an Australian Taxation Office (ATO) notice of assessment from the last 12 months or your local government rates notice from the past three months with your name and address

For more details on providing certified identification, please see page 43 of the Product Information Booklet or read our proof of identity page.

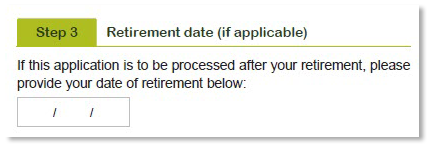

3. Work out your retirement date

As you're opening a Transition to Retirement Pension you can skip this question and move on to step 4.

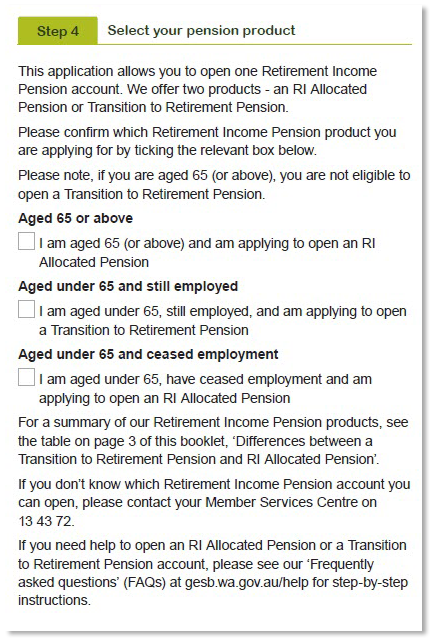

4. Select your pension product

Confirm if you are applying to open an RI Allocated Pension or Transition to Retirement Pension.

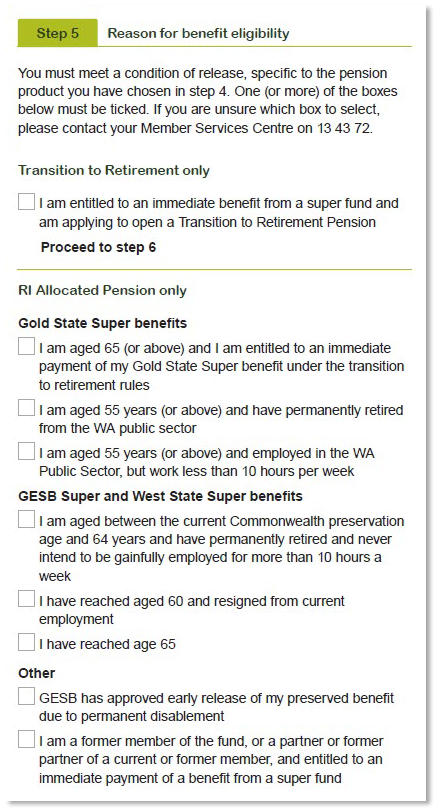

5. Provide your reason for benefit eligibility

Confirm that you meet a condition of release.

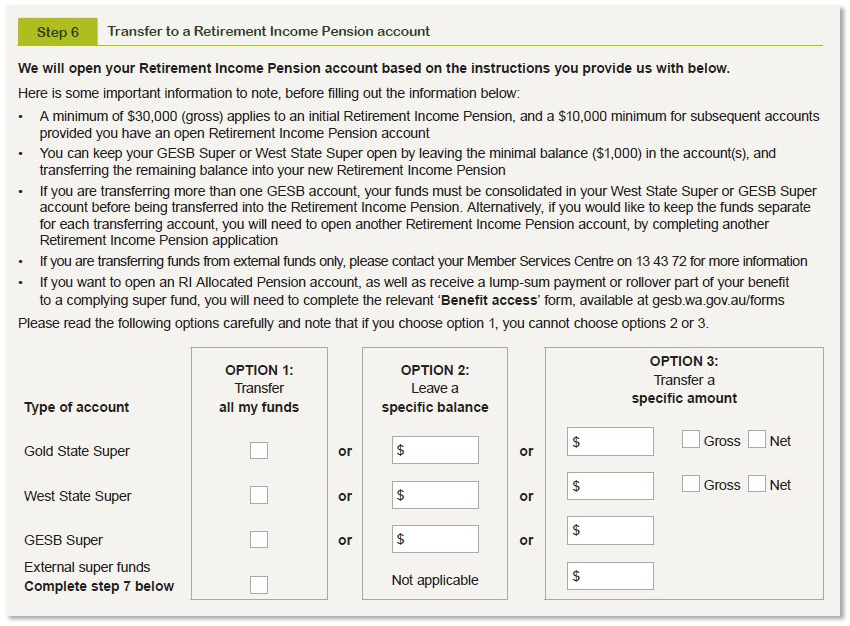

6. Choose the amount you'd like to transfer

For your first RI Allocated Pension, you need a minimum of $30,000 (gross). If you already have an allocated pension with us, you’ll need $10,000 (gross) to open another account.

You’ll need to indicate if you want to transfer the entire balance of your super account or just part of your account. You can also choose to transfer a specific amount or a certain percentage of your account.

If you want to keep your super account open, you need to write on the form how much you would like to leave in the account. This amount needs to be at least $1,000 to keep your account open.

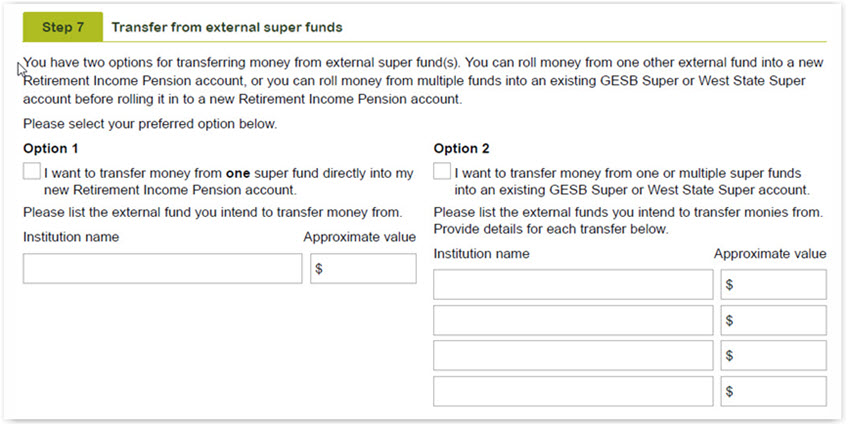

7. List any other related super funds

If you intend transferring your money from any another super funds into your GESB Super or West State Super account, please list those external funds in this step.

Remember, you’ll need to roll in your other super to an existing GESB Super or West State Super account before transferring to an RI Allocated Pension.

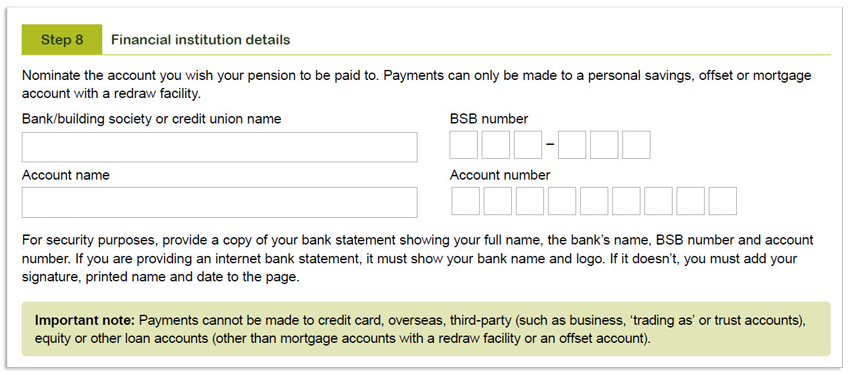

8. Provide your bank account details

We need to know the details of the account you’d like your income to be paid into. For your security, we’ll need a copy of your bank statement showing your full name, the name and BSB of your bank and your account number. If you are providing an internet bank statement, it must show your bank name and logo. If it doesn't, you must add your signature, printed name and date to the page. Payments cannot be made to a credit card, overseas, third-party (such as business, ‘trading as’ or trust accounts), equity or other loan accounts (other than mortgage accounts with a redraw facility or an offset account).

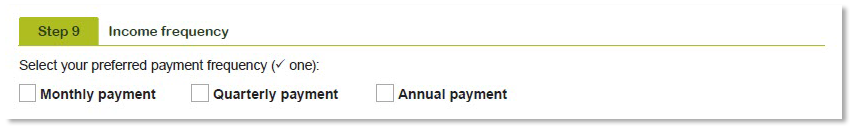

9. Choose monthly, quarterly or annual payments

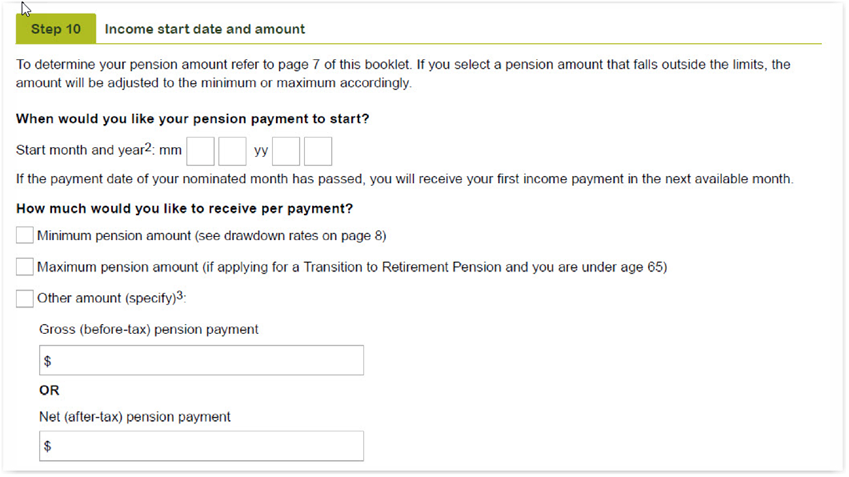

You can choose to receive the minimum pension drawdown amount or apply for another amount (gross or net). You can alter payments to meet your changing lifestyle needs, subject to minimum limits set by the Commonwealth Government.

10. Decide when you would like your pension payment to start

If the payment date of your nominated month has passed, you will receive your first income payment in the next available month.

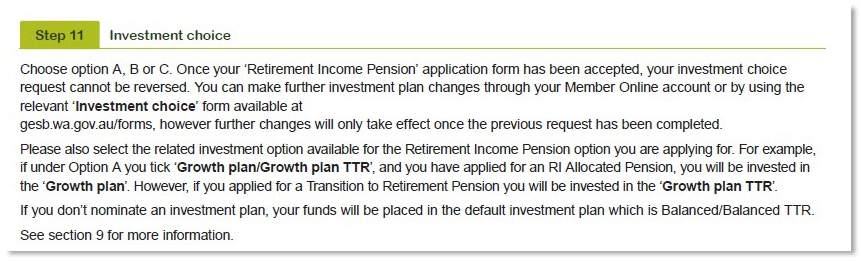

11. Choose your investment plan

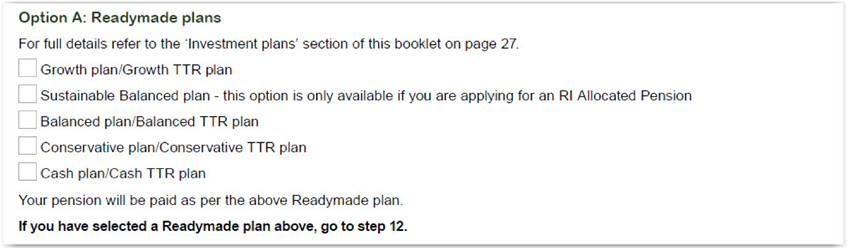

At this point in completing the form, you’ll need to choose how you would like to invest your money. Please note: the Transition to Retirement Pension investment plans are also listed here. For example, if under Readymade plans you tick ‘Growth plan/Growth plan TTR’ and you are applying for an RI Allocated Pension, you will be invested in the ‘Growth plan’.

You can choose from three investment types:

- A Readymade plan - choose from our range of Readymade plans.

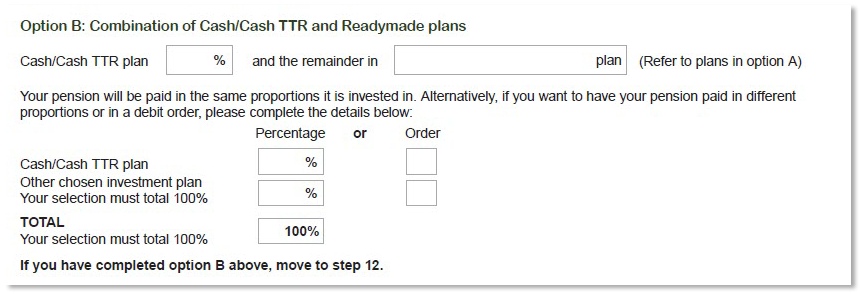

- A Cash plan and another Readymade plan - you can decide to invest your money in two Readymade plans, one of which will be the Cash plan. You can also allocate from which investment plan your income payments will be made by percentage or in what order.

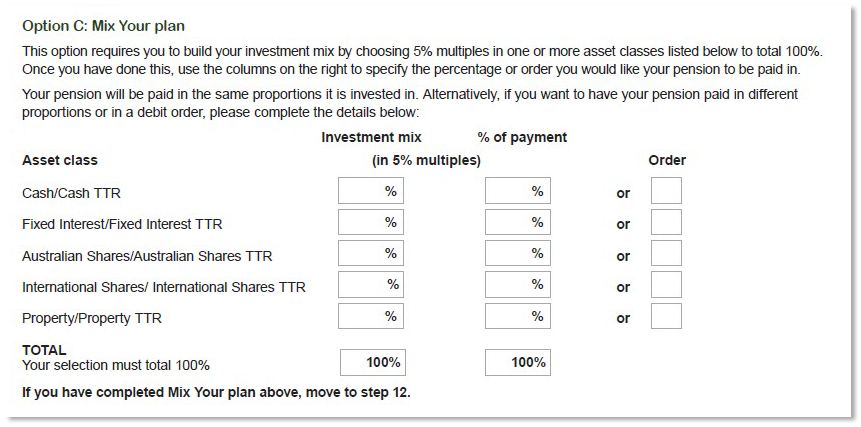

- The Mix Your plan option - you can build your own investment mix by choosing 5% multiples in one or more Mix Your plan asset classes to total 100%.

12. Plan for the future of your account

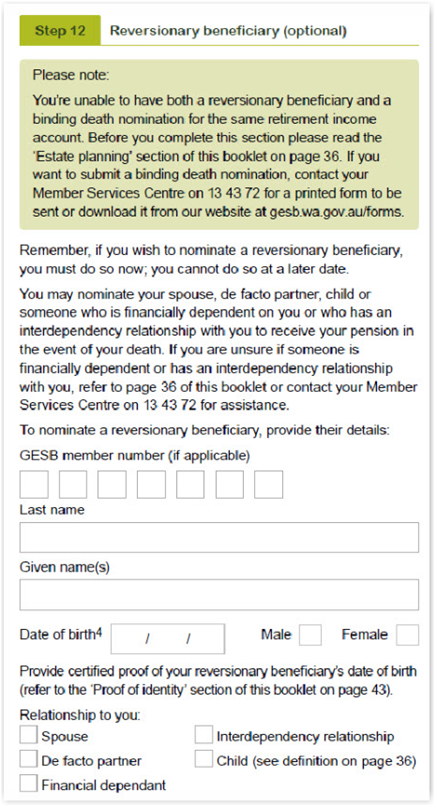

You can choose to nominate what we call a reversionary pensioner for your account. This could be your spouse, de facto partner, child or someone who is financially dependent on you or who has an interdependency relationship with you.

It’s optional but nominating someone means they will receive your pension in the event of your death.

If you want to nominate a reversionary pensioner, you need to do this when you apply for your account. It can’t be done at a later date.

If you’re not sure if someone is financially dependent or has an interdependency relationship with you, read section 13 in the Product Information Booklet or contact your Member Services Centre on 13 43 72 for help.

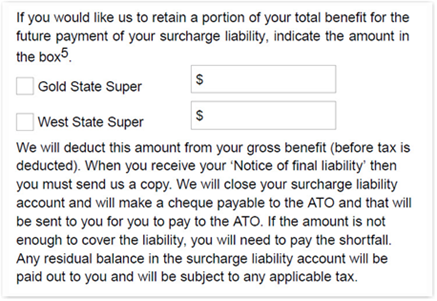

13. Complete this if you’ve received a Surcharge Assessment notice

If the Australian Taxation Office (ATO) has sent you a Surcharge Assessment notice, you can use this step to choose an amount of your benefit that we can hold for you. This means you can later pay your final assessment to the ATO from your pre-tax benefit.

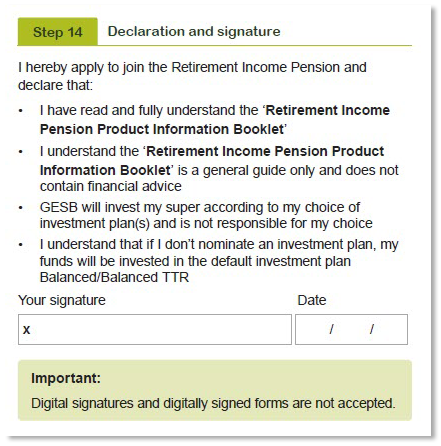

14. Sign the declaration

As you finish the application process, you’ll need to read and agree to the declaration, confirm that you’ve read the relevant information and sign and date the form.

15. Post your form and other relevant documents to us

At the end of the form, you’ll find a checklist of the documents that you need to send into us with your form.

Please note:

- We can only process your application once we have all of the details and documents

- Your member number needs to appear on all supporting documents

Once your form has been submitted, we aim to process your application within 10 working days. Sometimes it can take us longer to process, depending on your situation. If you’re opening an allocated pension to access your Gold State Super, please allow some extra processing time before your application is finalised.

We’re here to help

If you have questions about setting up your Transition to Retirement Pension or need more help with the application form, please call us on 13 43 72 between 7.30am and 5.30pm (AWST), Monday to Friday.

Thank you for printing this page. Remember to come back to gesb.wa.gov.au for the latest information as our content is updated regularly. This information is correct as at 20 April 2024.