What information is available on the Member Online dashboard?

Your personalised Member Online dashboard shows you all your account information at a glance, once you have logged in.

The information on your dashboard is personalised based on whether you have a GESB Super, West State Super, Gold State Super or Retirement Income Pension account. You can find information about your account balance, investments, insurance and more.

An example of the Member Online dashboard

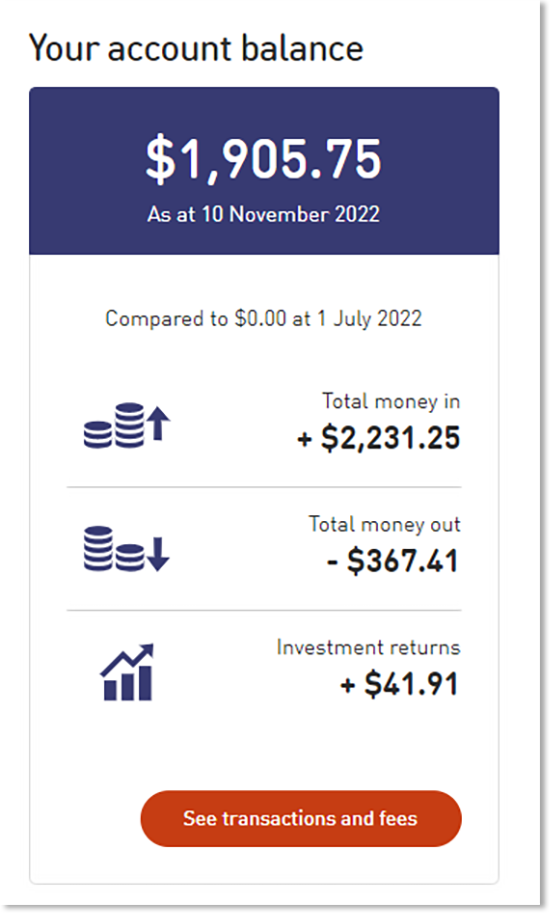

At the top of the dashboard, you'll find your account balance. This figure is based on the end of day for the previous business day and shows the date at which the balance is current.

You can also see how your current balance has changed since the start of the financial year, including how much money has gone in and out of your account and your investment returns over the current financial year.

For more information about individual transactions, fees and your account balance history, click the 'see transactions and fees' link.

An example of your account balance

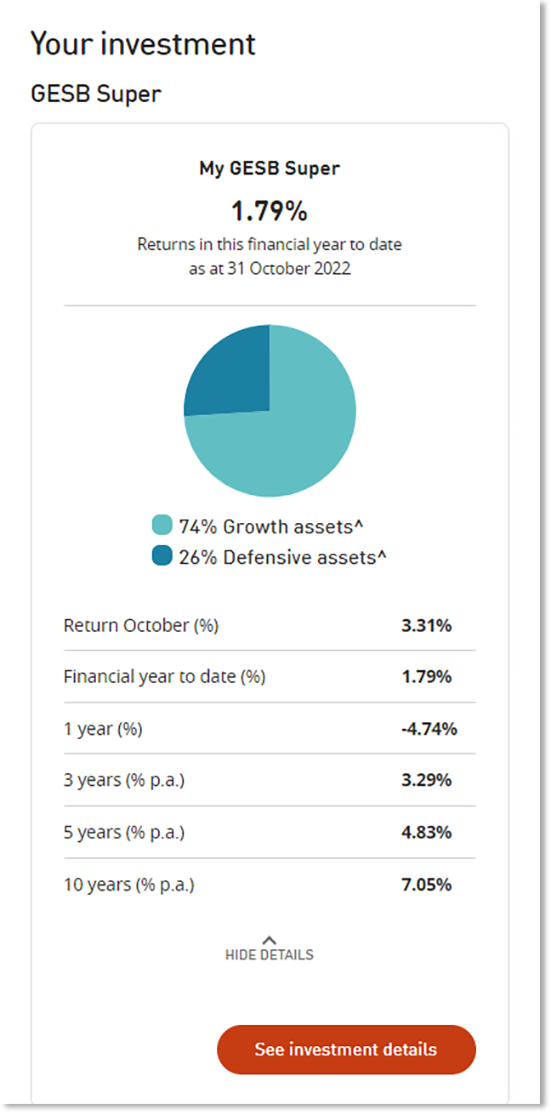

Next, you'll see your investment information – except for Gold State Super accounts.

In this section of the dashboard, you can see:

- The name of your investment plan

- Investment returns for the financial year to date for that plan

- The mix of Growth and Defensive assets that make up your plan

You can also see the investment returns your plan has delivered over the short and long term, starting with the returns for the last month, and ending with the annual return this plan has delivered over the past 10 years. Remember that super is a long-term investment, so it’s normal to see returns move up and down over time.

For more information about your investment plan, you can click the 'see investment details' link.

An example of the investment information

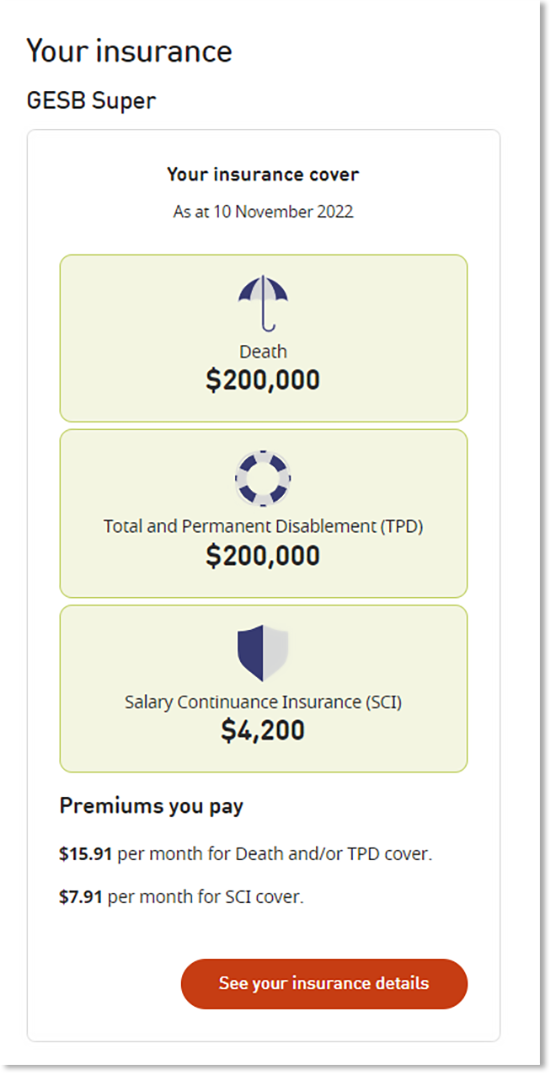

Your insurance cover information is also on this page. You’ll find a summary of which insurance you have and your level of cover.

To find out more, including how much insurance you may need, you can click the 'see insurance details' link.

An example of the your insurance cover information

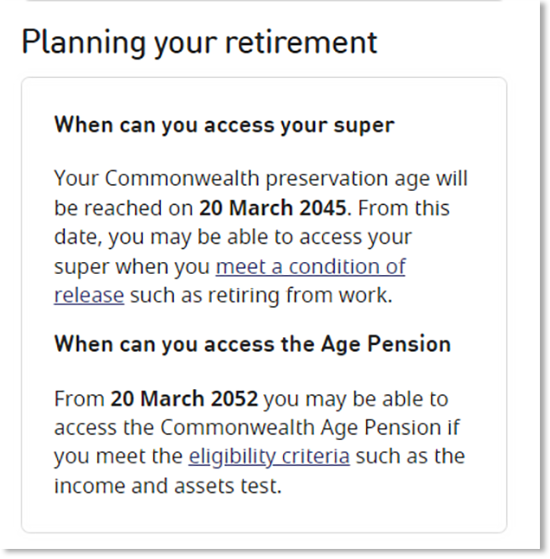

Your personalised dashboard will also show you the dates you will reach:

- Your Commonwealth preservation age

- The age at which you can access the Age Pension

- Gold State Super preservation age (if you have this type of account)

These dates may be not all be the same, depending on your date of birth, but you could use them to help plan your retirement date.

An example of your important dates

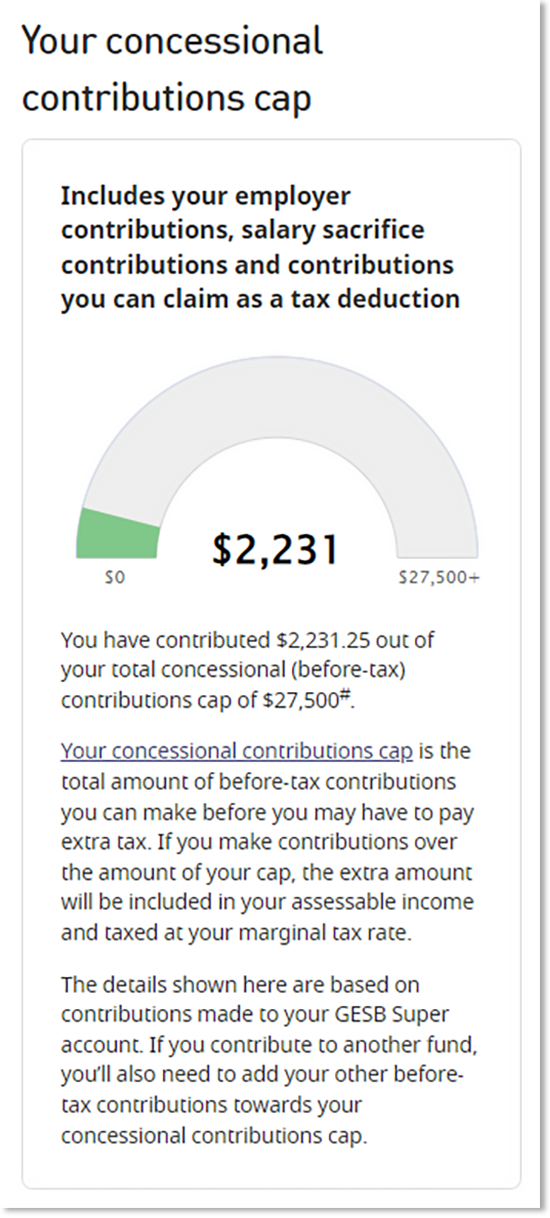

On your Member Online dashboard, you can check how much you have contributed towards your concessional contributions cap.

Your concessional contributions cap is the total amount of before-tax contributions you can make before you may have to pay extra tax. If you make contributions over the amount of your cap, the extra amount will be included in your assessable income and taxed at your marginal tax rate.

The details shown here are based on contributions made to your GESB Super account. If you contribute to another fund, you’ll also need to add your other before-tax contributions to your concessional contributions cap.

For West State Super and Gold State Super members this cap is important when you also contribute to a taxed fund.

An example of your concessional contribution cap if you’re a GESB Super member

Thank you for printing this page. Remember to come back to gesb.wa.gov.au for the latest information as our content is updated regularly. This information is correct as at 24 April 2024.