Transition to Retirement Pension

Our Retirement Income Pension can be taken as either an RI Allocated Pension, a standard allocated pension product, or as a Transition to Retirement Pension, for those who want to access their super as an income stream whilst still working. The main differences between these two pensions are in how your retirement income gets paid to you, your working situation and how tax applies.

Here we provide an overview of our Transition to Retirement Pension option.

Once you’ve reached your Commonwealth preservation age, you can use your super to start a regular pension such as our Transition to Retirement Pension. Your Transition to Retirement Pension will be set up in one of our Transition to Retirement Pension investment plans, and you’ll be subject to the minimum and maximum pension limits. Try our quiz to see if transition to retirement could be right for you.

You can't make lump-sum cash withdrawals with this type of pension, so it is also known as a non-commutable income stream. However, once you retire, you’ll be able to review your options and consider setting up a regular RI Allocated Pension.

New members welcome

Transition to Retirement Pension is open to all current and former GESB members and their partners.

Your income options

Choose to be paid monthly, quarterly or annually into your nominated bank account.

Investment plan

Choose the type of assets your super is invested in through your investment plan.

Set up a Transition to Retirement Pension.

We’re here to help. Call us on

13 43 72 if you have any questions about your account.

-

Overview

We’ve looked after your super and we can help you transition to retirement too.

With our Transition to Retirement Pension, you can:

- Convert part or all of your super into a regular non-commutable income stream

- Choose to receive between the minimum 4% and a maximum of 10% of your super account balance each financial year, calculated at the start of the financial year

- Invest your account balance in a choice of investment options

- Use Member Online to manage your account online

- You can also change your super account structures if your personal circumstances change

- Receive payments directly into your bank account monthly, quarterly or annually

- Change the amount of pension you receive each year, subject to minimum and maximum limits set by the Commonwealth government

- Continue to work and have your contributions paid into your GESB Super or West State Super account

If you’re 60 or over, your pension payments will be tax free.

Make the most of our tools, services and expertise

If you'd like to learn more and make informed decisions about how to manage your super and retirement savings, we can help. As a GESB member, you have access to:

- Tools including calculators, seminars and webinars

- Member Online, a secure way to manage your account

- Our Perth-based Member Services Centre to help with your questions by phone or online

- Our Retirement Options Service

At GESB, we have over 85 years’ experience managing the super savings of current and former WA public sector employees.

With around 247,000 members and over $39 billion in funds under management (as at 31 March 2024), we're the largest super fund in WA*.

* Research Solutions, Member and employer satisfaction research, 2022 and SuperRatings 2023 Annual Benchmarking Report.

-

What is a Transition to Retirement Pension?

Our Transition to Retirement Pension is an account which allows you access to your super as an income stream while you are still working. This could suit you should you choose to reduce your work hours, as the income you receive from your super benefits can help to make up for any loss of salary you may have.

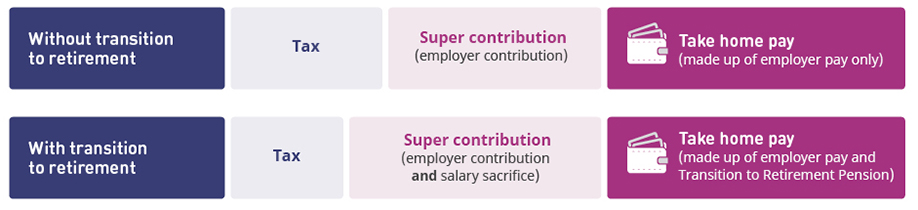

If you still want to work the same hours, you may consider using a Transition to Retirement Pension as a way to increase your income, or to maximise your retirement savings through salary sacrifice. There may be some tax benefits for you, however we recommend that you seek personal financial advice before making a decision.

To be eligible to open a Transition to Retirement Pension, you must have reached your Commonwealth preservation age (shown below).

A Transition to Retirement Pension does not allow lump-sum cash withdrawals, so it is also known as a non-commutable income stream. However, once you retire, you’ll be able to review your options and consider setting up a regular RI Allocated Pension.

Is transition to retirement right for you?

Transition to retirement is a way you can access your super while you’re still working.

Take our simple quiz to see whether it could be right for you.

The benefits of a Transition to Retirement Pension

With a transition to retirement strategy in place, you could:

- Increase your super - you'll continue to work and can sacrifice some of your salary to super

- Reduce your hours - you can work less without reducing your overall income, as your pension can make up for your lower salary

- Increase your income - you'll be receiving an income stream from a pension as well as your normal salary

You can find the right balance to suit your needs, with the flexibility to change your strategy as your circumstances change. We recommend that you speak with a financial adviser, accountant or tax adviser to help you decide if our Transition to Retirement Pension is right for you.

There are a number of ways you can use transition to retirement to benefit you:

- Transition to retirement with GESB Super

- Transition to retirement with West State Super

- Transition to retirement with Gold State Super

What is your Commonwealth preservation age?

To be eligible to open a Transition to Retirement Pension from your GESB Super or West State Super account, you need to have reached what’s known as your preservation age:

- If you were born on or before 30 June 1964, you can access your super when you turn 59

- If you were born on or after 1 July 1964, you can access your super when you turn 60

If you’re a Gold State Super member, you can start a Transition to Retirement Pension from the age of 55 but you’ll pay more tax if you access your super before you reach the Commonwealth preservation age.

Transfer balance cap

It is important to note that the transfer balance cap of $1.9 million does not apply to transition to retirement income pensions. Find out more about the transfer balance cap.

-

Your investment options

We invest your super across a range of different asset classes to give you the best chance to grow your retirement savings. You can have your super automatically invested in the Balanced plan TTR - or you can choose your investment plan. This means you can:

- Choose the asset classes your super is invested in, from Shares to Cash

- Choose how much of your super is allocated between the asset classes

- Change your investment plan to suit your retirement savings goals

Your super might be one of the biggest investments you’ll ever make. The investment plan you choose now can make a difference to the amount of income you receive from your pension and how long it will last.

Different assets create different returns

Your Transition to Retirement Pension offers a range of investment plans. These plans invest in different assets, with the returns linked to how the financial markets perform.

You can choose to invest in a range of different asset class allocations through our Readymade plans or create your own combination of asset classes with Mix Your plan.

You can choose a Readymade plan

There are four Readymade plans with different levels of risk and return expectations.

Transition to Retirement Pension Readymade plans Investment plan Investment risk label Growth plan TTR

High

Balanced plan TTR

Medium to high

Conservative plan TTR

Medium

Cash plan TTR

Very low

For more details, please see Investment options - Transition to Retirement Pension.You can choose the Cash plan TTR and another Readymade plan

This means some of your money will be invested in the Cash plan TTR and the rest of your money in another Readymade plan. You can have your pension paid from the two plans in a certain order - for example, the Cash plan TTR first. Or you can choose a percentage of your pension payment to be taken from each investment plan. If there are not enough funds in your chosen plan, then the rest of your payment will be taken from your other plan.

The amount of money in each investment plan will reduce as your pension payments are made. From time to time, you might like to review the amounts in your investment plans and transfer money between them.

You can Mix Your plan

There are five Mix Your plan options which allow you to select your own mix of asset classes.

Transition to Retirement Pension Mix Your plan Investment plan Investment risk label Australian Shares TTR

Very high

International Shares TTR

High

Property TTR

High

Fixed Interest TTR1

Medium

Cash TTR

Very low

You can choose the order or the percentage of your pension to be paid from each of your asset classes. To maintain your chosen percentage, you’ll need to check there is enough money invested in your asset classes. If there are not enough funds in one of more of your asset classes, the rest of your payment will be drawn from across your other asset classes.

You may also need to make changes to your Mix Your plan to make sure the percentage held in each asset class remains the same over time. Find out more about How Mix Your plan works.For more details, please see Investment options - Transition to Retirement Pension.

Need more help with your investment plan?

- Find out more about choosing the right investment mix for you

- Find out more about How Mix Your plan works

- Call your Member Services Centre on 13 43 72

To change your investment plan, download the Investment choice - RI Allocated Pension and Transition to Retirement Pension form.

1 Mix Your plan Fixed Interest invests in Investment Grade Bonds. These are bonds with a credit quality which is considered to have a relatively low level of default risk by an independent bond-rating agency.

-

Fees and other costs

Please note: we no longer charge service fees for transactions, such as Family Law splitting and full or partial withdrawals, effective 15 December 2018.

For more information on these changes, read our article: We’ve removed our service fees.

We may make changes to the fees we charge

From time to time, we might need to change our fees to make sure the structure and level of fees is appropriate, including any extra costs from government taxes or statutory charges.

We’ll always let you know about any changes through our website or your member statement. If the change is an increase in fees or charges, we’ll give you at least 30 days’ notice.Fees are charged in different ways

Below is a general guide to the fees and costs for a Transition to Retirement Pension account.

Other fees, such as fees for personal advice, might be charged, depending on the type of advice you choose. Entry fees and exit fees will not be charged.

Transition to Retirement Pension fees Type of fee or cost

Amount

How and when paid

Ongoing annual fees and costs1 Administration fees and costs

The fee for managing your account

Nil

Not applicable

Costs incurred that relate to the administration and operation of the Transition to Retirement Pension and that are not otherwise charged as a fee mentioned in this table are deducted from the fund assets before the daily unit price is calculated. The administration fee is noted as nil because it is not a separate fee and is included in the ‘Investment fees and costs’ shown below

Investment fees and costs2

Estimated to be between 0.18% p.a. and 0.52% p.a. of the value of your investment, depending on which investment plan you choose

Fees and costs that relate to the investment of assets that are not charged directly to your account as an administration fee or other fee. These costs are deducted from the fund assets, before the unit price is calculated on a daily basis

Transaction costs Estimated to be between 0% p.a. and 0.08% p.a. of the value of your investment, depending on which investment plan you choose

Transaction costs are costs incurred when assets are bought and sold. Transaction costs are incurred over the course of the year and disclosed as a percentage of the average assets of the relevant investment option3 Member activity-related fees and costs Buy-sell spread

Nil

Not applicable

Switching fee

The fee for changing your investment plan

Nil

Not applicable

Other fees and costs

Nil

Other fees and costs such as activity fees, advice fees or insurance fees may apply. Please refer to the ‘Additional explanation of fees and costs’ section on page 11 of the Retirement Income Product Information Booklet For more information on the types of fees and costs that may apply to your account, see page 10 of the Retirement Income Pension Product Information Booklet.

A fee applies for our Retirement Options Service

If you choose to make an appointment for our Retirement Options Service, a fee applies. You can ask us to deduct this fee directly from your account.

Find out more about our Retirement Options Service.

1 If your account balance is less than $6,000 at the end of the financial year, certain fees and costs charged to you in relation to administration and investment are capped at 3% of the account balance. Any amount charged in excess of that cap must be refunded.

2 Investment fees and costs includes an amount of 0.00% p.a. to 0.06% p.a for performance fees. The calculation basis for this amount is set out under the ‘Additional explanation of fees and costs’ section on page 11 of the Retirement Income Product Information Booklet. Please note, the transaction costs percentage is also included in the investment fees and costs percentage shown in the table.

3 Please see the ‘Additional explanation of fees and costs’ section on page 11 of the Retirement Income Pension Product Information Booklet, which provides further detail about the items included in transaction costs. -

Your income options

A Transition to Retirement Pension converts your super into a regular income, which you can adapt to suit your needs. This means you can:

- Choose how much income you’re paid, within limits set by the Commonwealth Government

- Get paid monthly, quarterly or yearly into a bank account in your name

- Change how much you’re paid and how often by completing a payment variation form

How to choose an income that suits your needs

When you’re deciding the best way to receive your pension payments, it can help to think about:

- Your lifestyle and expenses

- Any other income you receive from other sources

- How much your partner earns (if you have a partner earning an income)

- How long you might need your pension to last

- Your minimum and maximum annual pension (see the section below)

Learn more about the benefits of our Transition to Retirement Pension and if it’s right for you.

You might also want to ask us about our Retirement Options Service or seek personal financial advice for your situation.

You need to withdraw a minimum amount every financial year

The Commonwealth Government has set a minimum annual pension limit. This is the percentage of your pension account balance that we need to pay you each financial year.

Your minimum annual pension rate depends on your age:

Minimum annual pension rate Age

Percent of account balance

– default rate (%)Under 65

4%

65-74

5%

75-79

6%

80-84

7%

85-89

9%

90-94

11%

95 and above

14%

Each year, we multiply your pension account balance on 1 July by your minimum annual pension rate. We’ll let you know what your new minimum annual pension is, and if we need to change your payments to ensure you receive at least this amount.

During your first year, we use your account balance on the date you joined and we work out your minimum pension on a pro-rata basis. If you open an account in June, you can also choose to receive your first payment after 1 July.

Use our example to work out your minimum annual pension

Chris is 60 years old and has $200,000 to invest in a Transition to Retirement Pension on 1 July 2023. We’ve worked out his minimum annual pension below. If you print this page, you can add your own details in the space provided.

Work out your minimum annual pension income Chris’ details

Chris

Your details

You

Account balance (A)

$200,000

Your account balance (A)

Chris’ age (years) (B)

60

Your age (years) (B)

Minimum annual pension payment (C)

(from table above)4%

Your minimum annual pension payment (C)

(from table above)Chris’ minimum annual pension income

Chris must receive a pension income of at least this amount for this financial year

$200,000 x 4% = $8,000

Your minimum pension amount (A multiplied by C)

You must receive a pension income of at least this amount for this financial year

A maximum limit also applies for your pension payments

With a Transition to Retirement Pension you can select a maximum payment of 10% of your account balance as calculated at the start of each financial year.

Use our example to work out your maximum annual pension

Work out your maximum annual pension income Chris’ details

Chris

Your details

You

Account balance

$200,000

Your account balance

Chris’ maximum annual pension income

$200,000 x 10% = $20,000

Your maximum pension amount (account balance multiplied by 10%)

Ready to set up your regular pension payments?

Find out How to open a Transition to Retirement Pension account.

-

Transition to Retirement Pension and tax

When you open a Transition to Retirement Pension account, you might need to pay tax on the money you transfer from your super. How you’re taxed depends on whether you have a taxed fund, like GESB Super, or an untaxed fund, like West State Super or Gold State Super.

In general, you pay less tax when you transfer your super to a transition to retirement product, than you do if you take your super as a lump-sum payment. Find out more about Paying tax when taking your super money out.Your investment earnings are taxed up to 15%

Investment earnings in your pension account are taxed at a concessional rate of up to 15%.

Here’s a summary of the tax rules that apply to your Transition to Retirement Pension account.

Different parts of your pension are taxed differently

Your Transition to Retirement Pension account may include two different parts or ‘components’. Each part is taxed differently, depending on where the funds come from. You might have:

- A tax-free component This is the tax-free part of your super benefit that was transferred to your pension account. You do not pay tax on this amount. For example, it would include personal contributions made to your super that you didn’t claim as a tax deduction. If you transferred from West State Super or Gold State Super, it would also include any part of your benefit that was taxed at 47% because your balance was above the untaxed plan cap.

- A taxable component This is the taxable part of your super benefit that was transferred to your pension account. You may pay tax on this part of your pension when you access it. For example, it would include employer and salary sacrifice contributions.

To find out more about the tax components of your pension account, please call your Member Services Centre on 13 43 72.

How tax applies to your regular income payments

The two tables below provide a summary of how tax applies to your regular income payments from your Transition to Retirement Pension.

Tax treatment for the 'Taxable component - taxed element' of your pension account

Tax treatment for the 'Taxable component - taxed element' of your pension account Age Income stream payments tax withheld rate (plus 2% Medicare Levy) Taxed at your marginal tax rate, with no tax offset1

Commonwealth preservation age - 59

Taxed at your marginal tax rate, less a 15% tax offset on the taxable component

60+

Nil

Tax treatment for the 'Tax-free component' of your pension account

Tax treatment for the 'Tax-free component' of your pension account Age Income stream payments tax withheld rate (plus 2% Medicare Levy) Under Commonwealth preservation age

Nil

Commonwealth preservation age - 59

Nil

60+

Nil

You will pay no income tax if you’re aged 60 or over

If you are 60 or over, your regular income stream payments from your Transition to Retirement Pension will be tax free and you won’t need to include these payments in your personal income tax return.

Examples of how regular income payments are taxed

If your pension account has a tax-free and a taxable component, your regular income payments will include a proportional amount drawn from each component, based on the total value of your pension.

Here are two examples of how income payments are taxed according to your age and the components of your account.Examples of Transition to Retirement Pension tax treatment based on age Example 1: Fiona, aged over 60 Example 2: Frank, aged under 60 - Fiona is 63 and transfers $250,000 to a Transition to Retirement Pension

- Her $250,000 is made up of a $210,000 taxable component and a $40,000 tax free component

- She chooses monthly income payments of $1,600

- Her monthly pension will include the following components:

40,000/250,000 x 1,600 = tax free: $256

210,000/250,000 x 1,600 = taxable-taxed: $1,344

Tax free + taxable-taxed = $1,600

Fiona is over 60, so the total amount of her pension payment will be tax free.

- Frank is 57 and transfers $350,000 to a Transition to Retirement Pension

- His $350,000 is made up of a $310,000 taxable component and a $40,000 tax-free component

- He chooses monthly income payments of $1,400

- His monthly pension will include the following components:

40,000/350,000 x 1,400 = tax free: $160

310,000/350,000 x 1,400 = taxable-taxed: $1,240

Tax free + taxable-taxed = $1,400

Frank is 57, so he will need to pay tax on the taxable-taxed component at his marginal tax rate (plus Medicare Levy of 2%). A 15% tax offset on the taxable component is available to reduce the amount of tax he needs to pay. He will not pay tax on the tax-free component.

To learn more about how your Transition to Retirement Pension is taxed, you can:

- Register for an upcoming Transition to Retirement seminar or webinar

- Read the tax section on page 34 of the Retirement Income Pension Product Information Booklet

- Call your Member Services Centre on 13 43 72

1 Tax offset is available for a disability super benefit.

2 For the 2023/24 financial year, indexed annually in line with Average Weekly Ordinary Time Earnings in increments of $5,000 rounded down. -

Important documents

To make the most of your retirement savings, it’s worth learning as much as you can about your Transition to Retirement Pension account, including the tax considerations and investment plans available.

Product Information Booklet

Schedule of fees

Information on our website

Download PDF

Transition to Retirement Pension fees Retirement Income Pension Product Information Booklet Open an account

Forms

Online form through Member Online

Download PDF printable form

Retirement Income Pension application form Printable form (page 47 onward) Update your details

Forms Online form through Member Online Download PDF printable form Change your details

Proof of identity fact sheetOnline form | Help guide

How to provide proof of identityPrintable form | Form instructions

Proof of identity fact sheetChange your details and pension payment variation form Retirement Income Pension Printable form | Form instructions Our performance

Information on our website Download PDF Investment returns Annual Fund Update Unit prices Your investments

Information on our website

Download PDF

Transition to Retirement Pension Readymade plans

Transition to Retirement Pension Mix Your planRetirement Income Pension Product Information Booklet Forms Online form through Member Online Download PDF printable form Change investment plan Online form Printable form | Form instructions Accessing your money

Forms

Online form through Member Online

Download PDF printable form

Withdrawal form Retirement Income Pension Printable form | Form instructions Retirement planning

Information on our website Download PDF Retirement Options Service Retirement Options Service fact sheet Questions for advisers fact sheet Get personal financial advice Obtaining personal financial advice Divorce and separation

Information on our website Download PDF Divorce and your super

Divorce and your Retirement Income PensionYour super and Family Law, GESB Super and Retirement Income fact sheet Complaints and Freedom of Information

Information on our website Download PDF Complaints Resolving your complaints brochure Information Statement - Freedom of Information Information Statement - Freedom of Information fact sheet

Thank you for printing this page. Remember to come back to gesb.wa.gov.au for the latest information as our content is updated regularly. This information is correct as at 17 April 2024.