How to manage your income payments in an uncertain market

Seeing investment markets drop can be unsettling, especially if you’re retired or close to retiring and relying on a steady income from your super.

Downturns are normal with any long-term investment, including your super, but there are ways you could help to protect your retirement savings and help your money last longer.

Here are some tips to help you keep as much of your retirement savings invested as possible during a downturn.

Keep your withdrawals to a minimum

In a falling market, one of the most important things you can do is to minimise withdrawals from your Retirement Income Pension or Retirement Income Term Allocated Pension account.

This is because when you withdraw money from your account, you are selling units in your investment plan. When the market has dropped, these units much like shares are worth less. You would need to sell more of your units to withdraw the same amount than you would if markets were performing well and unit prices were high.

You can make changes to the amount of your pension payments by completing our Retirement Income Pension change of details and pension payment variation form. If you’re an RI Term Allocated Pension member, please call us on 13 43 72 if you would like to change your payments.

You could keep some cash on hand

It’s always a good idea to have some of your own cash savings in a bank account, ideally enough to cover a few years’ worth of basic living costs. This helps to create a buffer so you can avoid taking money out of your investment in a downturn, giving the market time to recover.

At the same time, keep in mind that any cash you put aside won’t be invested, so it won’t help your retirement savings to grow over the long term.

Watch your spending

Try to cut back on any non-essential spending so that you can keep more of your money invested. This could help to minimise the impact of a falling market on your retirement savings.

You could decide to postpone major expenses, such as travel plans, extra mortgage repayments or buying a car for a few years, while you build up your retirement savings again.

Read our article for tips on how to budget and manage your spending in retirement.

Explore other sources of income

Considering your income options outside of super could mean you don’t need to draw as much as usual from your retirement savings.

For example, you could delay your retirement and continue working, or use any leave you’re entitled to first.

If you’re planning to retire and use your super to open a Transition to Retirement Pension or RI Allocated Pension account, it’s also important to consider your timing. Market falls also provide opportunities to buy units when prices are cheaper.

If you’re already retired, you might decide to return to work on a part-time basis if you are able and wish to do so.

Balance your investments

When you invest in retirement, you need to balance your need for income security with your goal to achieve enough growth to make your money last.

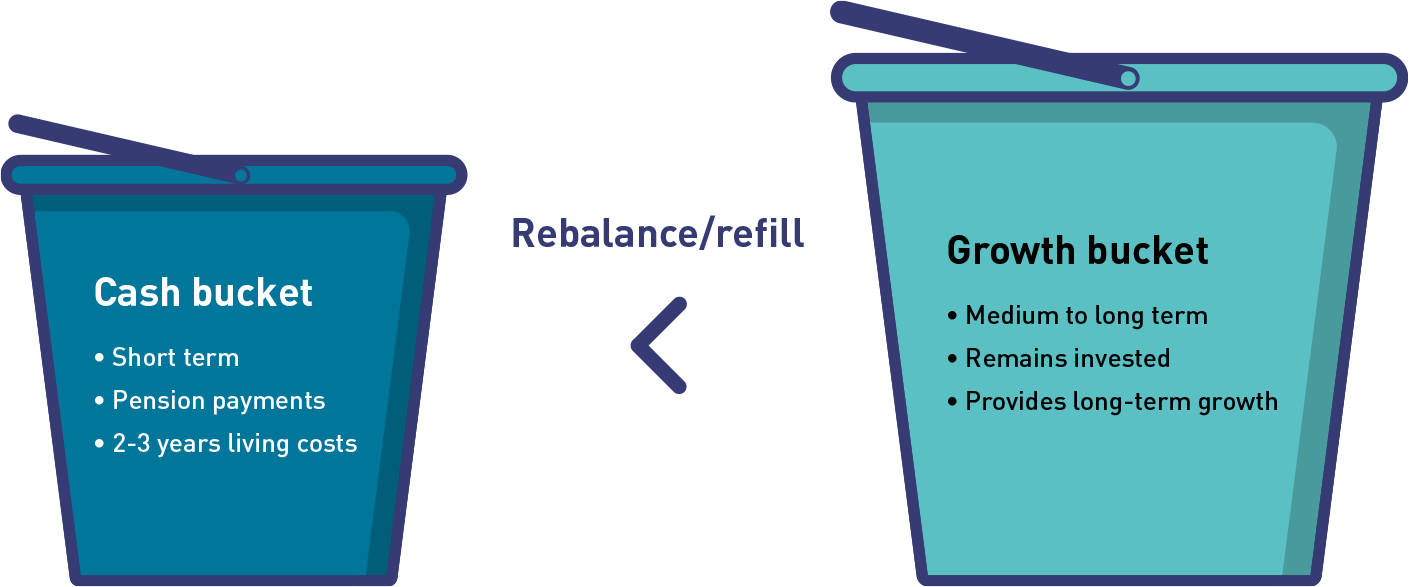

If you have an account-based pension, such as our Retirement Income Pension, you might use what’s known as a ‘bucket strategy’. Here’s how it works:

- A portion of your account balance is invested in the Cash asset class, or similar liquid assets, to provide immediate cash and cover your living expenses over the next two to three years

- Your pension payments would then be drawn from this Cash ‘bucket’

- The rest of your balance remains invested in a range of higher growth assets – for example, through our Growth, Balanced or Conservative plans – which could help to grow your savings and provide income for the long term

From time to time, you will need to rebalance your investments to refill your Cash bucket and pay your pension.

Get help and support

You might be able to take advantage of any government support available to you. If you previously didn’t qualify for the Age Pension because you didn’t meet the assets test, it might be worth reviewing your eligibility if the value of your assets has fallen.

Investing in retirement can be complex, so we recommend you consider whether you need professional advice from a suitably qualified adviser.

Another thing to consider, if you’re a Gold State Super member

If you’re eligible to access your Gold State Super benefit, you could consider partial access through a transition to retirement strategy. This would allow you to keep some of your benefit in Gold State Super, where it is guaranteed by the government and won’t be impacted by investment markets, while only moving the amount you need into a market-linked Transition to Retirement Pension.

By putting some of these strategies in place, you can be better prepared for unexpected conditions in the market.

More information

- Your guide to budgeting for retirement

- Learn more about investing in retirement

Need help

- How to change investment plans

- Call us on 13 43 72

- Get personal financial advice

Thank you for printing this page. Remember to come back to gesb.wa.gov.au for the latest information as our content is updated regularly. This information is correct as at 18 April 2024.