How do I pay my employees’ choice contributions?

From 10 December 2020, Westpac no longer accepts direct debit payments for Choice of Super contributions. Westpac provides our online Clearing House service for employers.

What will change – and what does this mean for me?

Previously, if you were using our Clearing House to pay your employees’ choice contributions, you would have made these payments by direct debit. Now, you need to make a single Electronic Funds Transfer (EFT) into a nominated Westpac bank account for the total amount of these contributions.

You’ll find all the details you need to create this EFT payment in Employer Online. This includes:

- BSB

- Account number

- Account name

- Payment amount

- Payment reference number

Please note, this change only affects choice contribution payments. The payment arrangement for contributions to GESB funds - including Gold State Super, West State Super and GESB Super – hasn't changed. These contributions continue to be debited from your bank account.

Does this change the file format or the way I submit my contributions in Employer Online?

No. This doesn’t affect the way you load, validate and submit your contributions in Employer Online. Only the payment method for your choice contributions has changed.

Where do I find the EFT details?

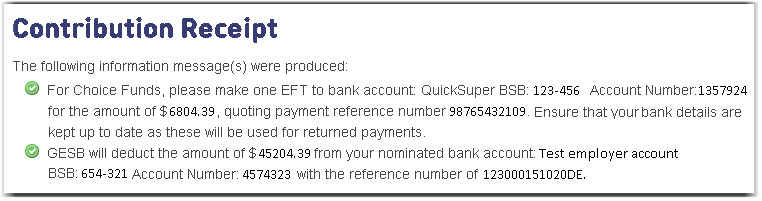

Once you've started making payments by EFT, your contribution receipt will look like this:

Once you receive your receipt, you’ll need to make an EFT payment from your bank account using the EFT details included in your receipt.

Payment reference numbers

As you can see in the screenshot above, the contribution receipt includes a payment reference number, which must be quoted in all choice contribution payments.

You may recognise the payment reference number or think it looks familiar. This is because it is actually your Australian Business Number (ABN).

The payment reference number is used to assist with payment matching in certain circumstances, which makes it an important value to be included. It is therefore a requirement that it be entered in each payment.

We have been notified by some employers that their banking and/or finance system does not allow them to make payments to the same bank account number with a recurring payment reference number.

If this applies to you, please insert the payroll date at the end of your ABN when you enter it in the payment reference number field. This should be added in double digit day/month/year format.

For example, let’s assume your ABN is 1234567891 and the payroll date you are submitting contributions for is 2 March 2021.

The value you enter in the payment reference number field should look like this, with no spacing:

ABN | Date in dd/mm/yy format |

|---|---|

1234567891 | 020321 |

The contribution receipt will continue to only display your ABN in the payment reference number field, and not the payroll date.

This means that you will need to remember to add the payroll date to the payment reference number each time you make a payment.

When should I make the EFT payment?

To ensure your employees’ contributions are credited to their chosen super account promptly, it’s important to make the EFT payment as soon as possible after submitting your contribution return in Employer Online.

What happens if my EFT payment doesn’t match the total amount of choice contributions submitted?

When making EFT payments, please make sure the EFT transaction you create includes the correct BSB, account number, account name, payment amount and payment reference number. You can find this information in the contribution receipt in Employer Online.

If you do make an error, please follow the steps in the relevant section below.

Error: your choice contributions have been underpaid

If your EFT payment is less than the total value of your choice contributions:

- The money will be held by Westpac for three banking days

- You’ll receive an email from our Clearing House to let you know that the contributions remain unpaid

- You’ll then need to create a second EFT payment for the unpaid amount, using the same BSB, account number, account name and payment reference number as the first transaction

If no additional payment is received by Westpac after three banking days, the money held will be credited back to your bank account. You’ll also receive an email from our Clearing House confirming that the funds have been returned to your bank account. Please note, this also means the contributions haven’t been sent to your employees’ chosen funds.

Error: your choice contributions haven’t been paid

If you don’t make an EFT payment:

- You’ll receive an email from our Clearing House to let you know that your choice contributions remain unpaid

- You’ll then need to create an EFT payment using the details in the contribution receipt

Error: your choice contributions have been overpaid

If your EFT payment is more than the total amount of your choice contributions by $5 or less:

- The payment will be matched to the contributions and the money sent to the chosen super funds

- The amount overpaid will be credited to your bank account

If your EFT payment is over the total amount of your choice contributions by more than $5:

- The money paid will be held by Westpac for three banking days

- If no additional choice contributions data has been received by Westpac after three banking days, the payment received will be matched to the choice contributions data and payment will be made to the relevant super funds

- The amount of the overpayment will then be credited back into your bank account

- You’ll receive an email from our Clearing House advising that the money has been returned to your bank account

When will my choice contributions reach the chosen funds?

We have good news: the payment timeframes for EFT transactions are faster than the current direct debit arrangement. This means your employees should see the contributions in their chosen super funds sooner.

Please see the table below for an estimate of how long it takes for your choice contributions to reach the relevant funds.

| Business day | Activity |

|---|---|

0 | You submit your choice contributions in Employer Online. You log into your bank’s payment platform and make an EFT payment using the BSB, account number, account name, amount and payment reference number – which are displayed in the contribution receipt in Employer Online. EFT payments made before the bank’s cut-off time (1pm WST) will be available for matching on the following day. Payments made after the 1pm WST cut-off time will be processed on the following banking day, with all subsequent activities taking place 1 day later than that described in this timeline. |

| 1 | Westpac match the payments received to the contributions submitted. |

2 | Westpac issue payments to the relevant choice funds. |

3 | The payment appears in the choice funds’ bank accounts. |

This means if you submit your contributions in Employer Online and make an EFT payment before 1pm AWST on Monday, the payment would be received by the choice funds on Thursday.

If you would like more information about this change, please contact us.

Thank you for printing this page. Remember to come back to gesb.wa.gov.au for the latest information as our content is updated regularly. This information is correct as at 29 April 2024.