Payroll support

Our Payroll General team provides key support for Employer Online, which is our secure and convenient super contribution portal for HR and payroll administrators.

If you have an issue with processing your payroll file, or you have an Employer Online question, you can email payroll.general@gesb.com.au for help.

You might also find the answer in our employer FAQ's:

What can I do in Employer Online?

You can use Employer Online to:

- Manage your employee data

- Pay contributions through direct debit or direct credit

- View your contribution status and submission history

- Access GESB account details

- Access Gold State Super liability invoices

- Generate reports

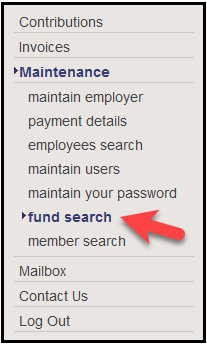

1. Log in to Employer Online and navigate to the 'maintenance' section, and select 'fund search'.

2. On the 'fund search' page you can search for a fund by entering the fund's name, Unique Superannuation Identifier (USI), Superannuation Product Identifier Number (SPIN), Superannuation Fund Number (SFN) or Australian Business Number (ABN) in the search field and clicking 'search'.

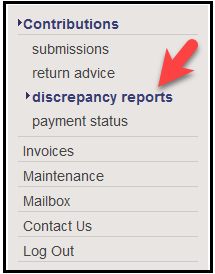

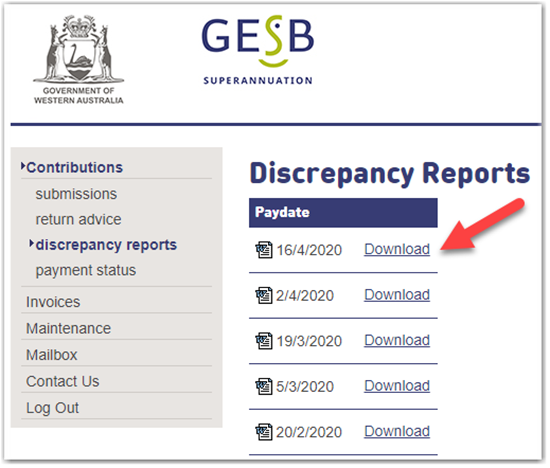

1. Log in to Employer Online and navigate to the 'contributions' section, and select 'discrepancy reports'.

2. Discrepancy reports let you know that the contribution we received from you in the previous fortnight doesn't match the current contribution amount due.

Select the 'download' link to download or save the discrepancy report as a Word document.

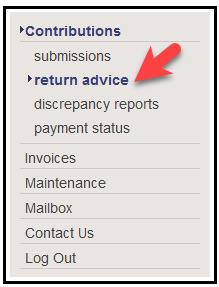

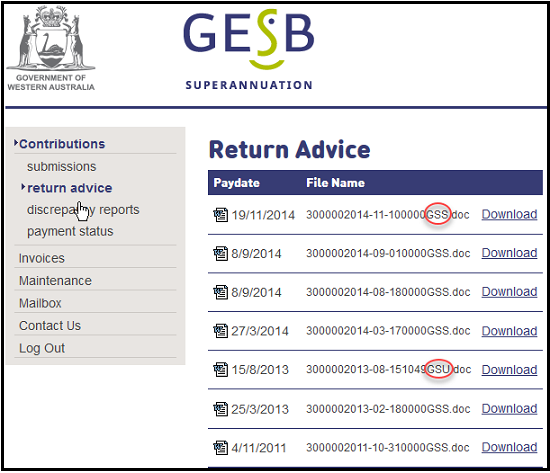

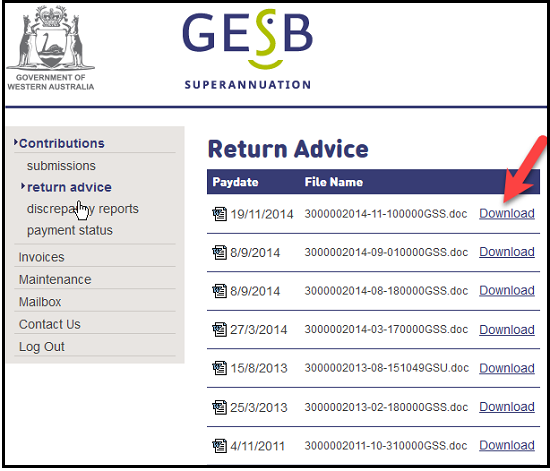

1. Log in to Employer Online and navigate to the 'contributions' section, and select 'return advice'.

2. There are two types of Return Advice reports available for download on the 'Return Advice' page:

- Gold State Super report (look for the file name ending with 'GSS')

These reports let you know that a Gold State Super member’s contribution amount has changed. A member's contribution amount can change because of an annual adjustment, salary reduction or an arrears payment plan. If the change is not processed on the next pay date, it will appear on your discrepancy report.

- GESB Super report (look for the file name ending with 'GSU')

These reports confirm that we have created a GESB Super account for your new employee when we have received their first Superannuation Guarantee (SG) contribution.

3. Select the ‘download’ link to download or save the Return Advice report as a Word document.

The employment details you provide help us to work out insurance entitlements for our GESB Super and West State Super members, so it’s important you comply with our reporting standards.

Here’s how you need to report the FTE value of your employees when sending your contributions file through Employer Online:

- If your employee is defined as ‘casual’, the FTE value should be ‘0’ (zero)

- If your employee is defined as a permanent employee, contractor, or anything other than casual, the FTE is calculated as the ratio of their normal hours (excluding overtime) to the normal award or agreed hours of a full-time employee under their award or agreement

For example:- For an employee working full time, the FTE value is 100

- For an employee working four days per week from a possible five, the FTE value is 80

If you’re unable to work out the FTE value for an individual employee who isn’t casual, please report an FTE value of 100.

For further guidance, please read the instructions in column 75 on pages 17 and 18 of our SuperStream Alternative File Format (SAFF) data specification.

What happens if I process a superannuation contribution overpayment in Employer Online?

If you overpay West State Super and/or GESB Super contributions, these can’t be recovered automatically without our approval and your employee’s approval first.

For more information on the refund recovery procedures, please download the superannuation overpayment process flowchart document and complete the employer refund request form and employee authorisation form available from Employer Online.

Once we have received and processed these two forms, the overpayment will be deducted from the overall file total in the pay period you choose to recoup the funds.

Thank you for printing this page. Remember to come back to gesb.wa.gov.au for the latest information as our content is updated regularly. This information is correct as at 20 April 2024.