Redundancy and your super

Redundancy can have a serious impact on you and it is important to know how it can impact your super and what you can do.

Your entitlement and benefit options will depend on whether you have turned 55 and reached the Commonwealth preservation age1.

This page outlines some important information which you should consider if your role has been made redundant.

Your Gold State Super if you are made redundant

If you are a Gold State Super member and you are made redundant from the WA public sector, you will keep the total benefit built up on your behalf, which could include:

- Contributory Service Benefit - your Gold State Super benefit including your personal and employer contributions

- Transferred Contributions and Interest - your contributions and interest previously transferred from the WA Public Sector Pension Scheme

- Transferred Service Benefit - the extra service benefit (based on past full-time employment) given to you when you transferred from the WA Public Sector Pension Scheme to Gold State Super

However, when you leave the WA public sector, some of these components are treated differently:

- If you are over 55 years of age when you are made redundant, then you have satisfied your condition of release, which means you will have access to your benefit in full. You can then access a benefit payment, open our Retirement Income Allocated Pension account or roll over your benefit to another complying super fund

- The way tax is calculated on your super depends on your age and the preservation age1. If you are considering accessing your benefit before your Commonwealth preservation age, please contact us and review the Tax and super brochure to find out how this will affect you

Here is a summary of how your age affects your benefit.

In redundancy, how does age affect when you can access your benefit

| Age/event | Entitlement |

|---|---|

| Under 55 years of age | |

If you are made redundant or resign on or after 30 December 1995 Extra option if made redundant |

|

| 55 years of age or over | |

If you are made redundant or resign | You have satisfied your condition of release and have access to your benefit in full. You can open our Retirement Income Allocated Pension, take a lump sum or roll over to another complying super fund. |

Your automatic insurance cover will end

When you are made redundant from the WA public sector, your insurance cover for Death and Total and Permanent disablement will end. If you want to replace this, you can make arrangements for your own insurance cover.

When is tax paid?

You won’t pay tax on your benefit until you take it out or roll it over to another taxed super fund. See the Gold State Super and tax page for more information.

Preserving your benefit in Gold State Super

The way your benefit is preserved depends on your age:

- Your Contributory Service Benefit and Transferred Service Benefit (if applicable) will be preserved in Gold State Super until you reach 55 years of age (or earlier in the case of death or disability)

- Your super will be indexed annually at a salary growth factor equivalent to the Perth Consumer Price Index (Perth CPI)3 plus 1% p.a. until you turn 55, and then accrue interest at Perth CPI plus 2% p.a.

- Any Transferred Contributions and Interest can be refunded to you if you are under 55 years of age, or preserved in the fund. If you decide to preserve this portion of your benefit, it will accrue interest annually at Perth CPI plus 2% p.a. Once you reach 55, the option to receive payment of only the Transferred Contributions and Interest is no longer available and the total account balance must be paid

There are other circumstances where you may be able to access your benefit if you are under age 55. If you’re eligible, a discount factor will apply. In this case, the Contributory Service Component of your benefit would be subject to a discount factor of 1.75% p.a. for every year you are under age 55.

For more information, call your Member Services Centre on 13 43 72.

Advantages of preserving your benefit

Choosing to leave your benefit in Gold State Super means:

- You won’t be charged any entry or penalty fees that could apply if you transferred your benefit to another super fund

- Your untaxed benefit will continue to grow until you retire

- Your benefit is not subject to fluctuating market movements

Calculating your benefit

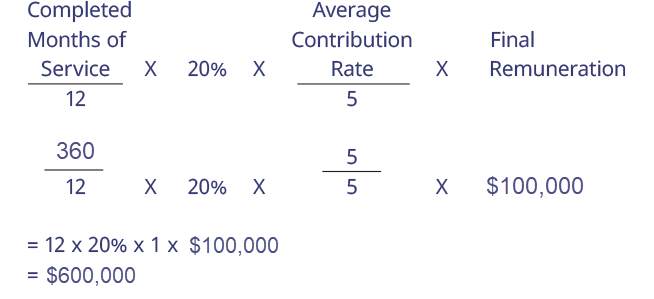

Gold State Super is a defined benefit scheme, which means your retirement benefit is calculated using a formula which considers:

- Your Completed Months of Equivalent Full Time Contributory Service

- Your Average Contribution Rate

- Your Final Remuneration

If you are made redundant, your benefit will be calculated as at your termination date and preserved until you reach age 55.

Meet Matthew

Here is an example of how Matthew’s benefit was calculated on the day he was made redundant.

- Matthew joined Gold State Super when he was 25 years old

- The length of his full-time employment was 25 years

- He was made redundant at age 50

- His Average Contribution Rate was 5% (maximum)

- His Final Remuneration at redundancy was $110,000

- His Completed Months of Service is 300 months (25 years x 12 months)

On the day Matthew was made redundant, his benefit was calculated to be $550,000 (before-tax). However, Matthew can’t access these funds until he reaches 55 years of age, which is another 5 years away.

1 Your Commonwealth preservation age is dependent on your date of birth. For more information on your Commonwealth preservation age, read the Accessing your super brochure.

2 Important: if you are under 55 and transferred from the WA Public Sector Pension Scheme, you can elect to receive the Transferred Contributions and Interest component of your benefit if you are made redundant. There may be tax implications if you elect to receive the Transferred Contributions and Interest component of your benefit as cash. All other funds must be preserved in Gold State Super until you reach 55 years of age.

3 Perth CPI calculated in accordance with the State Superannuation Regulations 2001.

Thank you for printing this page. Remember to come back to gesb.wa.gov.au for the latest information as our content is updated regularly. This information is correct as at 25 April 2024.