Calculators

You can use our range of calculators to help you take control of your super and plan for your retirement.

Please note: the calculators are provided for illustrative purposes only to show how different factors can affect the value of super benefits. They are designed as stand-alone tools and should not be used to compare our taxed and untaxed funds. Different assumptions are used in each calculator to reflect the differences between the funds, particularly in respect of when tax is paid on contributions and earnings. We recommend that you consult a suitably qualified adviser before making any decisions.

Growing your super

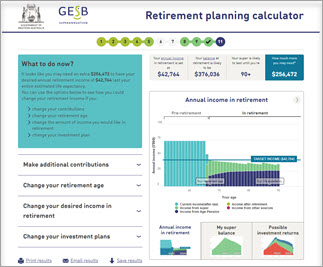

Retirement planning calculator

Work out how much super you'll have by the time you retire, how much your annual income could be and how long your super will last. This calculator allows you to include your partner’s details and Age Pension entitlement. You can also adjust variables, such as your retirement age, amount of contributions or investment plan, to see the impact on your final super balance and income in retirement.

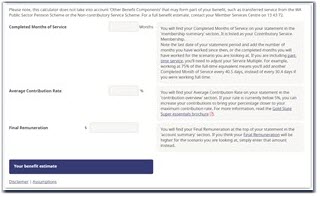

Gold State Super benefit calculator

If you have a Gold State Super account, you can use this calculator to see how your defined benefit will grow. You can also adjust variables such as your retirement age and final salary to see how simple changes can affect your benefit.

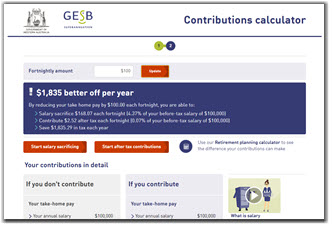

Contributions calculator

Work out how to make the most of your super contributions.

By entering how much you are willing to give up from your take-home pay, we’ll estimate the most effective way for you to make your contributions, before and/or after tax.

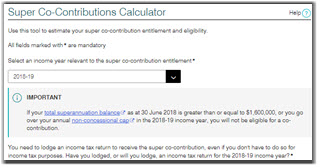

Co-contribution calculator

Find out whether you're entitled to receive a co-contribution payment from the Commonwealth Government. If you are, this ATO calculator gives you an idea of the maximum payment you could expect.

Note: selecting this option will direct you to the ATO website.

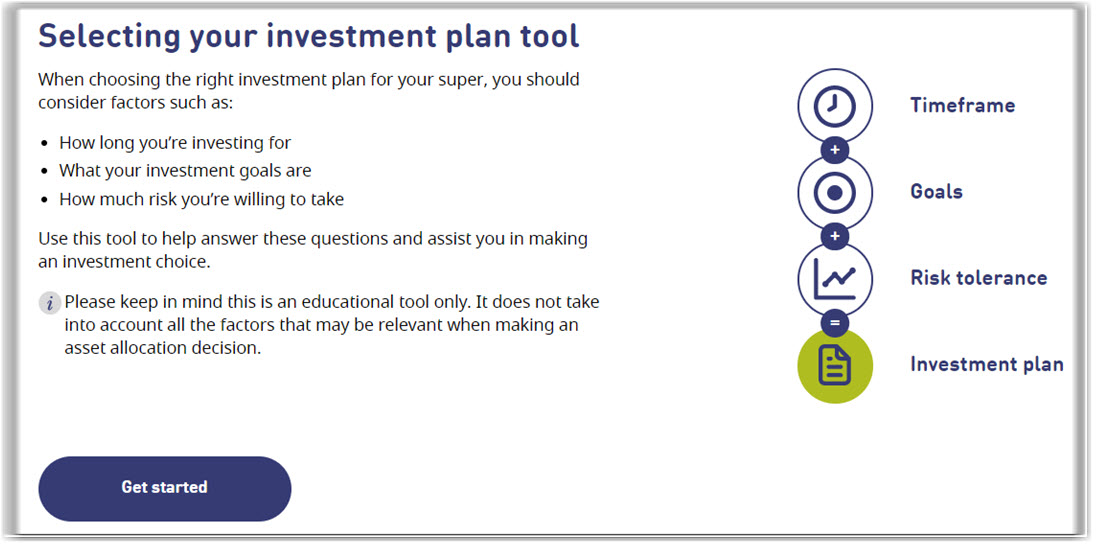

Selecting your investment plan tool

Discover which investment plan might best suit your needs based on your investment timeframe, your investment goals and how comfortable you are with risk.

Insurance

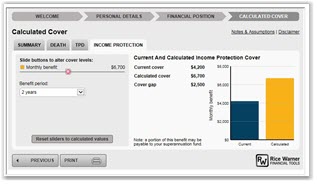

LIFEapp insurance calculator

Our Insurer AIA Australia provides the LIFEapp tool, which will help you determine how much insurance you need. You can request a quote or apply online if you're registered for Member Online.

Note: selecting this option will direct you to the website of our group Insurer AIA Australia.

Approaching retirement

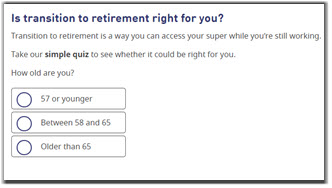

Transition to retirement quiz

This quiz will help you work out if transition to retirement, a strategy that allows you to access your super as an income stream while you’re still working, might be right for you.

With transition to retirement, you may be able to grow your super or reduce your working hours without reducing your overall income. Your income can even be increased as you'll be receiving an income stream from a pension as well as your normal salary.

Preservation age calculator

Your Commonwealth preservation age is the minimum age you can access your super money.

Work out when you’ll reach preservation age.

Need help

- Book a Retirement Options Service appointment

- Call us on 13 43 72

Thank you for printing this page. Remember to come back to gesb.wa.gov.au for the latest information as our content is updated regularly. This information is correct as at 27 April 2024.