Transition to retirement

Access your super while you’re still working

If you’re eligible, you could use a transition to retirement strategy to access your super as an income stream while you’re still working.

You might choose to cut back on your work hours because the income you receive from your super benefits could help to make up for any loss of salary.

With transition to retirement, your super benefit must be used to start a regular pension such as our Transition to Retirement Pension. This doesn’t allow for lump-sum cash withdrawals and is known as a non-commutable income stream.

Is transition to retirement right for you?

Transition to retirement is a way you can access your super while you’re still working.

Take our simple quiz to see whether it could be right for you.

How transition to retirement works

With transition to retirement you can access your super once you reach your Commonwealth preservation age. You can:

- Start with part or all of your super benefit and start a non-commutable income stream with our Transition to Retirement Pension

- Choose to receive between the minimum 4% and a maximum of 10% of your super account balance each financial year, calculated at the start of the financial year

- Receive payments directly into your bank account monthly, quarterly or annually

- Change the amount of pension you receive each year, subject to minimum and maximum limits set by the Commonwealth Government

- Continue to work and have your contributions paid into your GESB Super or West State Super account You can also change your super account structures if your personal circumstances change.

How to set up a Transition to Retirement Pension

If you’ve explored your options and decided that transition to retirement is right for you, here are the steps you need to take to open an account.

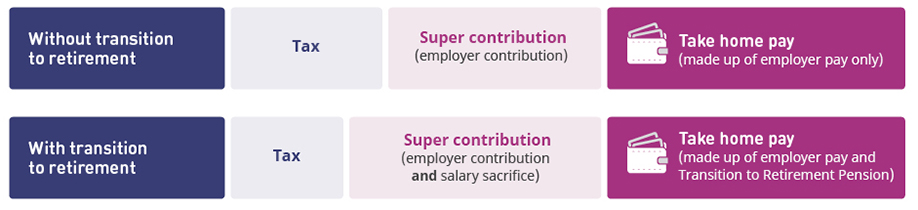

The benefits of transition to retirement

There are a number of ways you can use transition to retirement to benefit you:

- Increase your super - you'll continue to work and can sacrifice some of your salary to super

- Reduce your hours - you can work less without reducing your overall income, as your pension can make up for your lower salary

- Increase your income - you'll be receiving an income stream from a pension as well as your normal salary

You can find the right balance to suit your needs, with the flexibility to change your strategy as your circumstances change. We recommend that you speak with a financial adviser, accountant or tax adviser to help you decide if transition to retirement is right for you.

Find your Commonwealth preservation age

To be eligible for transition to retirement from your GESB Super or West State Super, you need to have reached what’s known as your preservation age:

- If you were born on or before 30 June 1964, you can access your super when you turn 59

- If you were born on or after 1 July 1964, you can access your super when you turn 60

If you’re a Gold State Super member, you can start transition to retirement from the age of 55, but you’ll pay more tax if you access your super before you reach the Commonwealth preservation age.

Book a seminar or webinar

To learn more about preparing for and transitioning to retirement, register for one of our seminars or webinars.

More information

- Learn more about transition to retirement with GESB Super

- Learn more about transition to retirement with West State Super

- Learn more about transition to retirement with Gold State Super

Need help

- Register for one of our seminars or webinars

- Find out about our Retirement Options Service

- Call us on 13 43 72

Thank you for printing this page. Remember to come back to gesb.wa.gov.au for the latest information as our content is updated regularly. This information is correct as at 27 April 2024.