What is super?

‘Super’ is short for superannuation.

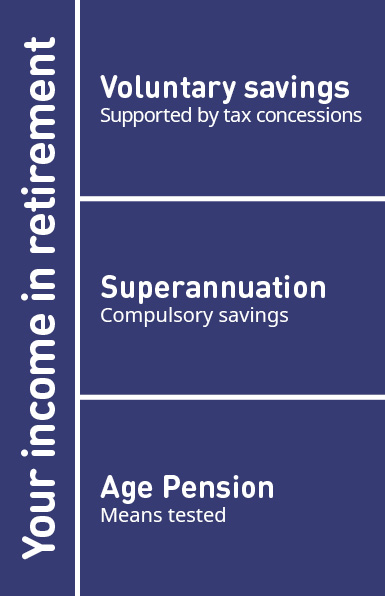

To understand more about your super, it helps to think about how you’ll have money to spend when you retire and won’t have your regular salary. In Australia, our system for providing for people in their retirement is made up of three pillars:

- Voluntary super savings

For most people, SG and the Age Pension (if you’re eligible) wouldn’t provide you with enough to live a comfortable lifestyle in retirement. This is why the government encourages people to save extra for retirement and offers tax incentives to help you grow your savings. - Superannuation

These are compulsory savings towards your retirement. While you’re working, your employer has to contribute to your super fund on your behalf. This is called the Superannuation Guarantee (SG). The current rate is 11% of your salary and is required by law. - Age Pension

The Commonwealth Government provides the Age Pension as a safety net if you have little or no super or other savings. This only covers you for very basic needs.

The term ‘super’ generally refers to the compulsory retirement savings system, but you can add to your own super on top of what your employer pays.

Your employer pays SG into your super account

If you’re a GESB member, we invest this money on your behalf and any earnings on these investments are added to your account. When you retire, you can use this money to create an income to make up for no longer getting a salary or wages from your work.

The SG rate is 11% as of 1 July 2023, so your employer currently needs to pay at least 11% of your salary into your super account. The rate is set to gradually increase to 12% by 1 July 2025.

These contributions from your employer help to grow your super but there's much more you can do. The best way to be more certain that you’ll be able to afford a comfortable retirement is to make your own regular contributions. Super is one of the best ways to save for your retirement because you can take advantage of special tax rules.

Most people working in Australia are entitled to super

It doesn’t matter if you work part time, full time or even work casually. Generally, your employer has to pay a minimum of 11% of your salary into your super fund if:

- You’re over 18 and are paid more than $450 (before tax) in a calendar month

- You’re under 18 and are paid at least $450 (before tax) in a calendar month and work 30 or more hours a week

The rules that apply are different if you’re working for the WA public sector and if you’re a member of a defined benefit scheme, such as Gold State Super.

For each pay period, your employer calculates how much super you’re entitled to and then pays that money into your super account. If you work for the WA public sector, your super is paid fortnightly and you’re entitled to the SG regardless of how much you earn.

Your super money gets invested

When your super gets paid into your account, we invest the money into your chosen investment plan. If you haven’t chosen a plan, your super is invested in the default plan for your scheme, either My GESB Super plan or My West State Super plan.

Super funds charge fees for managing your account

Your fees include administration fees, investment fees and fees for any insurance included in your account.

Find out more about:

How to take charge of your super

Here are some simple steps you can take today which could make a big difference to the way you manage your super:

- Register for Member Online This is a secure service which provides a range of features, information and tools to help you to manage your account online.

- Choose an investment plan Learn more about your investment options, compare our investment plans or choose an investment plan to suit your goals.

- Contribute extra to your super You can make extra contributions now to grow your super to help you afford a more comfortable retirement.

More information

- Find out more about GESB Super

- Learn about West State Super

- Read the Investment choice brochure

Need help

- Read our super tips

- Get started with our Member Online help guide

- Find answers to some frequently asked questions

- Call us on 13 43 72

Thank you for printing this page. Remember to come back to gesb.wa.gov.au for the latest information as our content is updated regularly. This information is correct as at 27 April 2024.