How do I change my insurance cover?

You can use Member Online to change your occupation category, sum insured, fix your cover or change some other details.

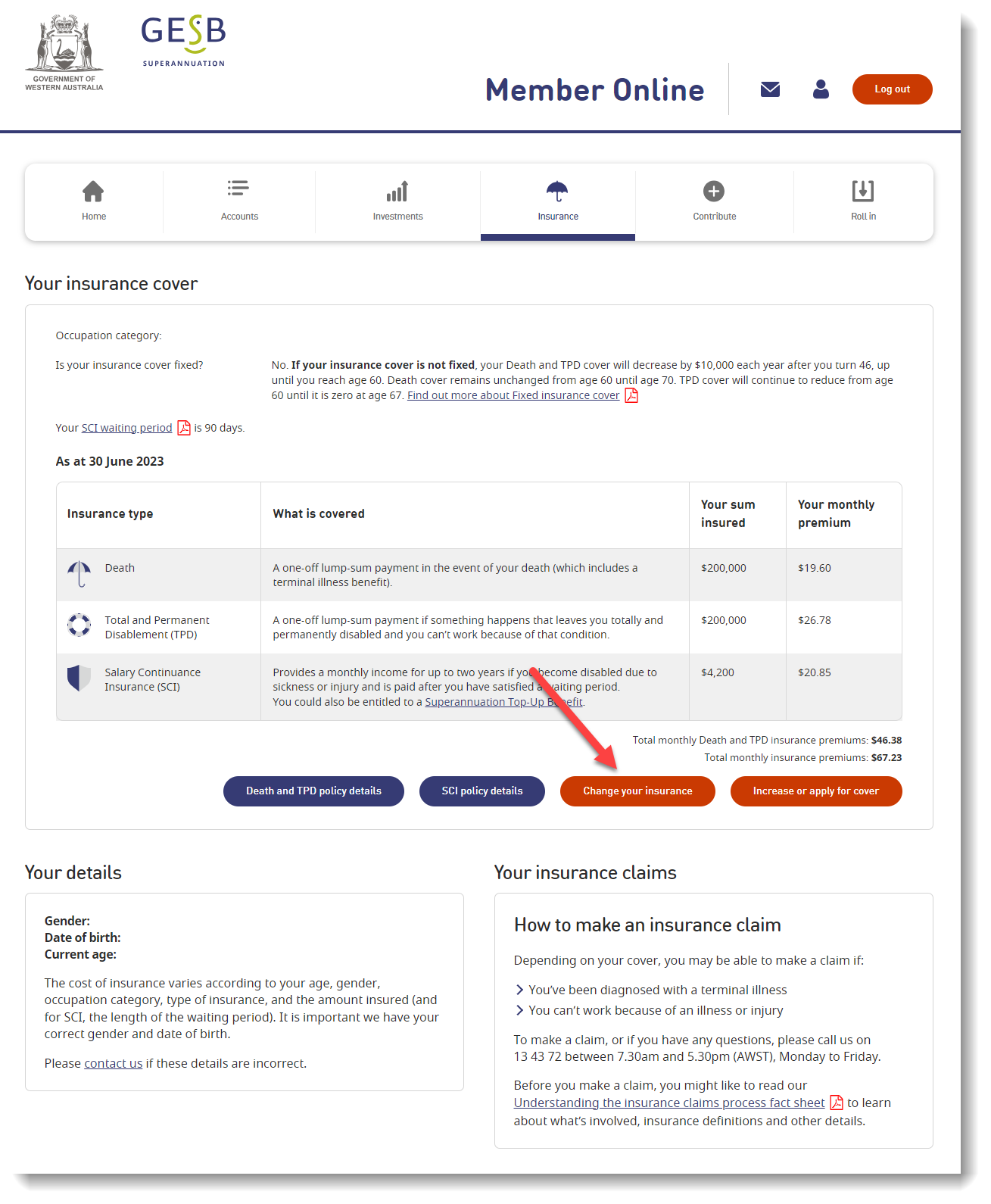

If you’ve decided to make changes to your insurance, log in to Member Online and visit the ‘Insurance’ page.

![]()

You’ll find an option to ‘Change your insurance’. Select this button.

You’ll be directed to a form with a number of options you can select to make various changes to your insurance. For any areas you don’t wish to change, you’ll find a ‘No change’ option for that section.

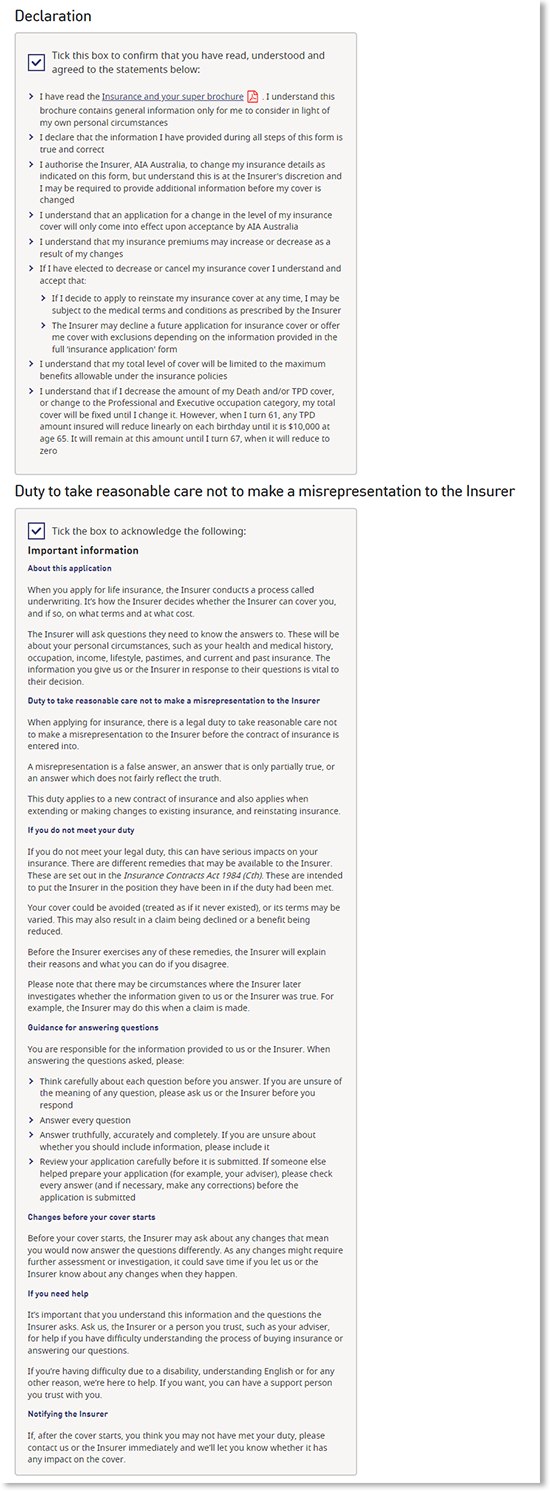

Finally, to submit the changes you’d like to make to your insurance, you’ll need to tick the box to confirm you’ve read and agreed to the declaration which appears.

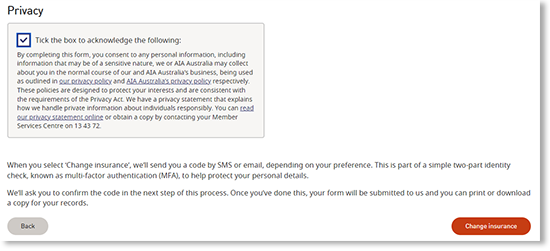

You’ll also need to tick the boxes to confirm you’ve read and agreed to the ‘duty to take reasonable care not to make a misrepresentation to the insurer’ and ‘privacy’ statements. Once you agree to the declarations choose ‘Change your insurance’ button to submit your changes.

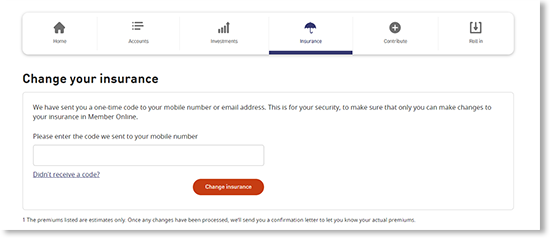

To make sure only you can make changes to your insurance, we’ll send a code to your mobile or email for you to complete our two-part identity check known as multi-factor authentication (MFA).

Once you’ve completed this identity check, we’ll process your changes. On screen, you’ll see confirmation that your request to change your insurance has been received.

Thank you for printing this page. Remember to come back to gesb.wa.gov.au for the latest information as our content is updated regularly. This information is correct as at 25 April 2024.