Coronavirus and the impact on super

5 October 2020

How could the COVID-19 coronavirus affect my super?

Investment markets are closely linked to world events that occur, such as economic, political and even global health events, such as the ongoing impact of COVID-19.

Mainly due to the impact of COVID-19, global share markets dropped by around 15-20% over March 2020, which resulted in returns from My GESB Super and My West State Super being around -12%. The main reason why markets have reacted in this way, is that COVID-19 will result in a decline in economic growth given the meaningful restrictions on buying and selling certain goods and services.

Over April to June, investment returns improved somewhat, with global share markets achieving positive returns and My GESB Super and My West State Super achieving returns of around +7% for the three months. Whilst we remain in the midst of lockdowns across the globe, there has been a gradual relaxation of restrictions and investment markets are showing some signs of stability.

What has GESB been doing in this environment?

We continue to take a prudent approach to managing investments, ensuring we balance short-term risks with long-term expected returns. Our exposure to shares was lower than our long-term targets (Strategic Asset Allocation) during March but this is now close to long-term targets. Our current approach is to re-balance asset class exposures towards long-term targets.

We’re also focused on ensuring there is ample cash in the Fund to meet all obligations to our members. Our cash exposure has increased over the past month, ensuring we have more than enough in cash to meet payments – both now and into the future.

Remember, super is a long-term investment

It’s important to consider the longer-term context. Share markets do go up and down from time to time - and by large amounts - and this can vary your super balance.

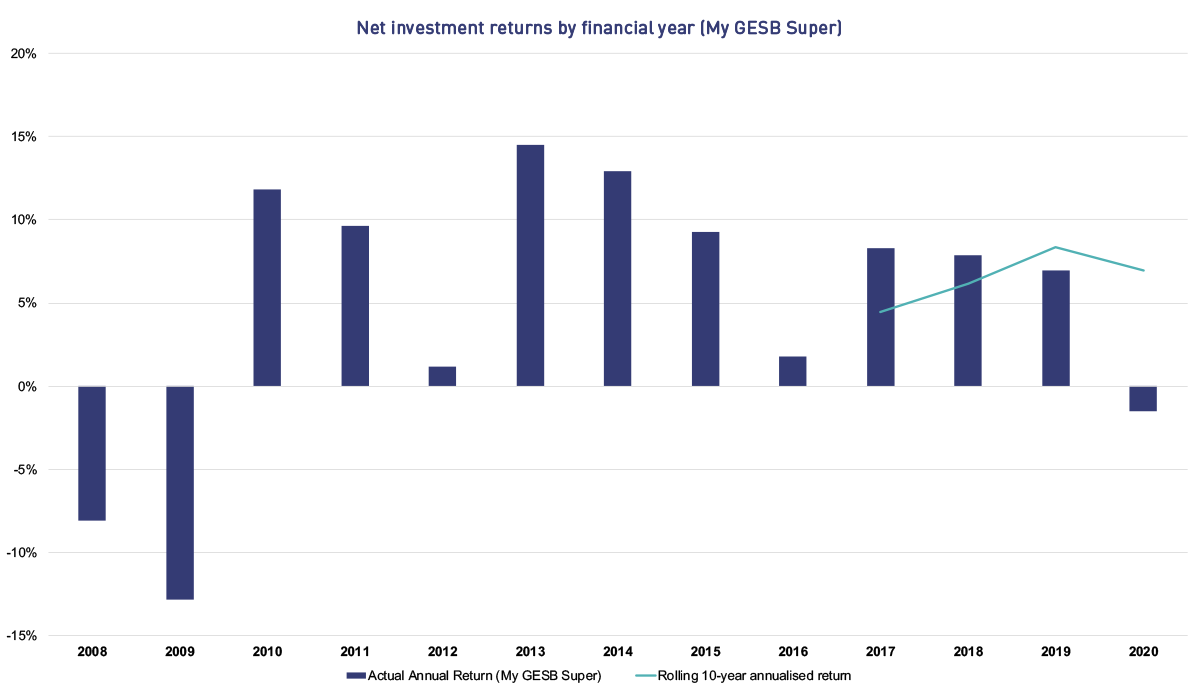

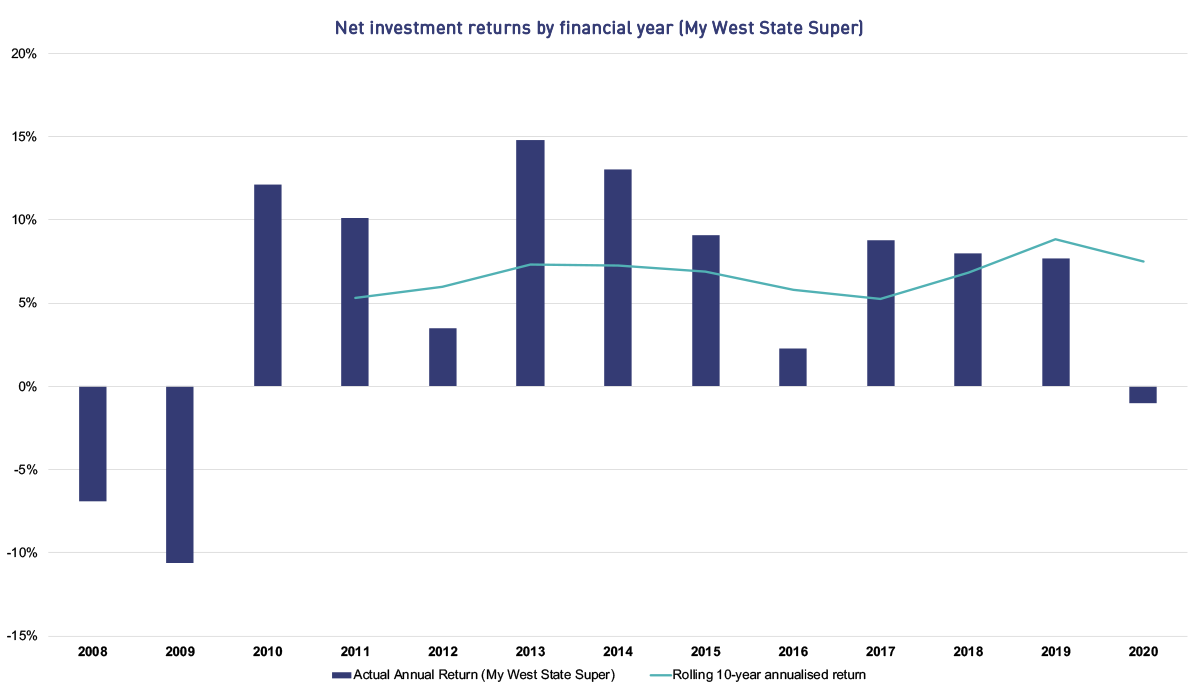

To illustrate, the graphs below show the annual returns since 2008 for both My West State Super and My GESB Super, our default plans:

All returns are reported net of Indirect Cost Ratio (ICR), are based on transactional prices, and include applicable taxes. The ICR includes all of the investment costs and any additional underlying costs relating to your investment.

All returns are reported before-tax, are net of Indirect Cost Ratio (ICR), and are based on transactional prices. The ICR includes all of the investment costs and any additional underlying cost relating to your investment.

As can be seen, recent losses (2020 Financial Year to Date) are smaller than what has been experienced previously and what can happen from time to time. Even including this recent downturn, returns on a 10 year basis (the grey line) remain positive and consistent with long-term targets.

For more information

To find out more, read our article Investing in uncertain times for some tips on how to stay focused on your long-term objectives.

If you have any other concerns around coronavirus related to GESB accounts, see Coronavirus: keeping you informed for more details.

Alternatively, our Member Services Centre is available on 13 43 72. Please be aware that we are experiencing higher than normal call volumes at this time.

Additional information

- Download the Australian Government Department of Health’s PDF on Covid-19 Coronavirus what you need to know

- The Government of Western Australia Department of Health's website

- The World Health Organisation’s website

- Download the official Government Coronavirus Australia app in the Apple App Store or Google Play , or join their WhatsApp channel on iOS or Android

Sources

Thank you for printing this page. Remember to come back to gesb.wa.gov.au for the latest information as our content is updated regularly. This information is correct as at 20 April 2024.