How much can you contribute

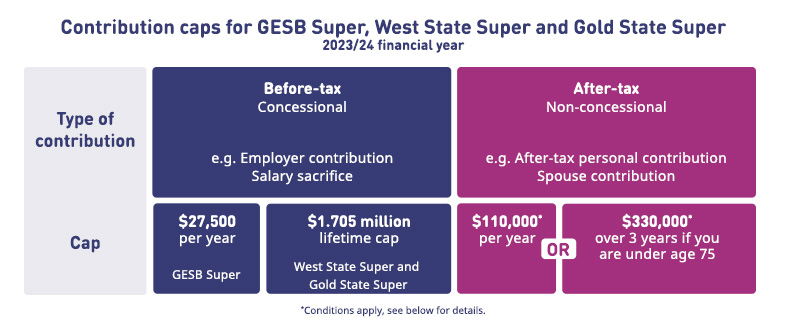

Since your super account receives tax concessions that can reduce the amount of tax you pay, there are limits on the amount that you or your employer can contribute. There are two types of limits, or caps:

- Concessional contributions cap

This is a limit to the amount of concessional (before-tax) contributions you or your employer can make to your super each financial year. If you have more than one super account, all of the concessional contributions made to all of these accounts count towards this cap. The exception is if you have a West State Super or Gold State Super account, as these are constitutionally protected funds, and different caps apply. - Non-concessional contributions cap

This is a limit to the amount of non-concessional (after-tax) contributions you can make. If you have more than one account, all of your non-concessional contributions made to all of your accounts are added together and counted towards this cap.

If you reach your cap and still make contributions to your super, then you may have to pay more tax. Contributions count in the financial year when your super fund receives the money.

Concessional contributions cap for GESB Super

GESB Super is an example of a taxed fund. There’s a limit on how much you can salary sacrifice to a taxed fund, and this limit is known as the concessional contributions cap.

Both your salary sacrifice contributions and your employer’s Superannuation Guarantee (SG) contributions count towards this cap. If you have more than one super account, generally all of the concessional contributions made to all of your accounts are included in the cap.

| Type of contribution | General cap |

|---|---|

| Concessional contributions | $27,500 p.a.1 |

Carry-forward concessional contributions

From 1 July 2019, the carry-forward rules allow you to make extra concessional contributions above the general concessional contributions cap. This means:

- If you have a total super balance of less than $500,000 on 30 June of the previous year, you can ‘carry forward’ any unused concessional cap amounts from 1 July 2018

- Unused cap amounts that have not been used after five years will expire

For example, the general concessional contributions cap in the 2018/19, 2019/20 and 2020/21 financial years was $25,000. It was $27,500 for 2021/22 and 2022/23 financial years. If you made $15,000 of concessional contributions in each of 2018/19, 2019/20, 2020/21, 2021/22 and 2022/23 you will have $55,000 of unused concessional contributions cap amounts carried forward that you can use to make additional concessional contributions above the general concessional contributions cap for the 2023/24 financial year, provided your total super balance at the end of 30 June 2023 was less than $500,000. The 2018/19 unused cap amount of $10,000 that is not used by the end of 2023/24 will expire.

Tax on your concessional contributions

Concessional contributions below your concessional contributions cap are generally taxed at what’s known as ‘the concessional rate’ of 15%2.

If you reach your cap and still make contributions to your super, then you may have to pay extra tax. The extra contributions will be included in your assessable income and taxed at your marginal tax rate.

If you have made contributions over your cap, you can choose to have 85% of these contributions withdrawn from your super to assist in paying your income tax assessment.

Concessional contributions for West State Super and Gold State Super

West State Super and Gold State Super are untaxed, constitutionally protected super funds.

Unlike taxed schemes such as GESB Super, employer contributions (including salary sacrifice), and personal deductible contributions made to West State Super are generally not taxed when the contributions are accumulating.

Concessional contributions to West State Super and Gold State Super don't count towards your concessional contributions cap. However, they do count towards your cap for contributions to a taxed scheme.

For example, if you made $27,500 in concessional contributions to West State Super (including your employer contributions) you wouldn’t be able to make any further concessional contributions to a taxed scheme in that financial year.

Please note, Gold State Super notional employer contributions count towards the annual concessional contributions cap. Read our fact sheet to find out more about notional employer contributions.

With West State Super and Gold State Super, there’s an untaxed plan cap of $1.705 million3 per super fund for the 2023/24 financial year, which applies to the untaxed element of your benefit. This is the amount that can be paid as a lump sum or transferred to a taxed fund and still be subject to tax concessions.

Non-concessional contributions cap

Non-concessional contributions are contributions usually made after income tax has already been deducted. Generally, you won’t pay any more tax on these amounts if you stay below your non-concessional contributions cap.

| Non-concessional contributions cap | Special arrangement |

|---|---|

| $110,000 p.a.4 |

If aged under 75 at any time in the financial year, you may be able to bring forward one or two years of contributions depending on your total super balance on 30 June of the previous financial year. If your total super balance is less than $1.68 million, you can bring forward one or two years of contributions i.e. $110,000

plus $220,000, giving you a cap of $330,000 over three years5. The amount available under the bring-forward rule depends on your total super balance as at 30 June in the previous financial year. |

Find out more about how your contributions are taxed

Every account is different. For more information about how contributions are treated in your account, visit:

1 For the 2023/24 financial year. The concessional contributions cap is indexed annually in line with Average Weekly Ordinary Time Earnings in increments of $2,500 rounded down.

2 If you are a high income earner whose adjusted taxable income and low tax contributions exceed $250,000 then you may be liable for Division 293 tax. It applies to both GESB Super and West State Super members.

3 For the 2023/24 financial year, indexed annually in line with Average Weekly Ordinary Time Earnings, in increments of $5,000 rounded down. The untaxed plan cap applies for each untaxed scheme you are a member of.

4 For the 2023/24 financial year, indexed annually. This cap is equal to four times the general concessional contributions cap (which is currently $27,500).

5 The amount available under the bring-forward rule depends on your total super balance as at 30 June in the previous financial year. Where the bring-forward rule has been triggered, the future years' entitlements are not indexed and the contributions must be made before you turn 75 or within the 28 days following the end of the month in which you turn 75 years old. For more information, please read the Contributing to your super brochure.

6 This cap will be indexed annually against Consumer Price Index (CPI), rounded down to the nearest $100,000.

7 If you have a total superannuation balance greater than or equal to $1.9 million for the 2023/24 financial year your non-concessional contribution cap will be nil. In this case, if you make a non-concessional contribution they will be excess contributions and will be taxed at 47%.

More information

- Learn more about growing your super

- Read more about adding to your super

- Find out more about salary sacrifice

- Read our Contributing to super brochure

Need help

- Call us on 13 43 72

Thank you for printing this page. Remember to come back to gesb.wa.gov.au for the latest information as our content is updated regularly. This information is correct as at 19 April 2024.