How to claim or vary a tax deduction

GESB Super members only

You may be able to claim a tax deduction for personal concessional contributions you have made to your GESB Super account.

Follow the steps below to help you find the relevant information and complete the form.

Action summary

- Time it takes

It may take up to 30 minutes to read the information and complete the form - Hardest thing

Deciding how much you want to claim your tax deduction for - Cost

We don’t charge a fee for processing your notice form - What to consider

If you are eligible to claim this tax deduction

What you'll need

- Notice of intent to claim or vary a tax deduction form for the current or previous financial year

Need help

- Call us on 13 43 72.

1. Download the fact sheet and form

If you want to claim a tax deduction on a personal contribution that you’ve made to your account, you need to:

- Fill in the 'Notice of intent to claim or vary a tax deduction' form for that financial year

- Receive a confirmation from us

- Submit your tax return for that year

First, download the ‘How to claim or vary a tax deduction for personal contributions’ fact sheet for the relevant financial year below.

- How to claim or vary a tax deduction for personal contributions - fact sheet 2023/24

- How to claim or vary a tax deduction for personal contributions - fact sheet 2022/23

You will need to print the ‘Notice of intent to claim or vary a tax deduction’ form on pages 3 and 4. You might like to use this page as a guide as you complete each section of the form.

2. Read the fact sheet so you know how the tax deduction works

Please read the ‘How to claim or vary a tax deduction for personal contributions’ fact sheet carefully to make sure your application is valid.

The fact sheet explains the conditions you need to meet to be eligible to claim a tax deduction. Special rules apply when you have withdrawn or rolled over part of your benefit, or if you are a high-income earner.

We recommend that you seek professional financial advice and/or tax advice if you wish to claim a deduction for your super contributions. This is a complex area and it’s important to confirm your eligibility, particularly if there are other tax considerations.

If you have any questions, please contact your Member Services Centre on 13 43 72.

3. Provide your personal details

Once you’ve confirmed your eligibility, complete the 'Notice of intent to claim or vary a tax deduction' form on pages 3 and 4.

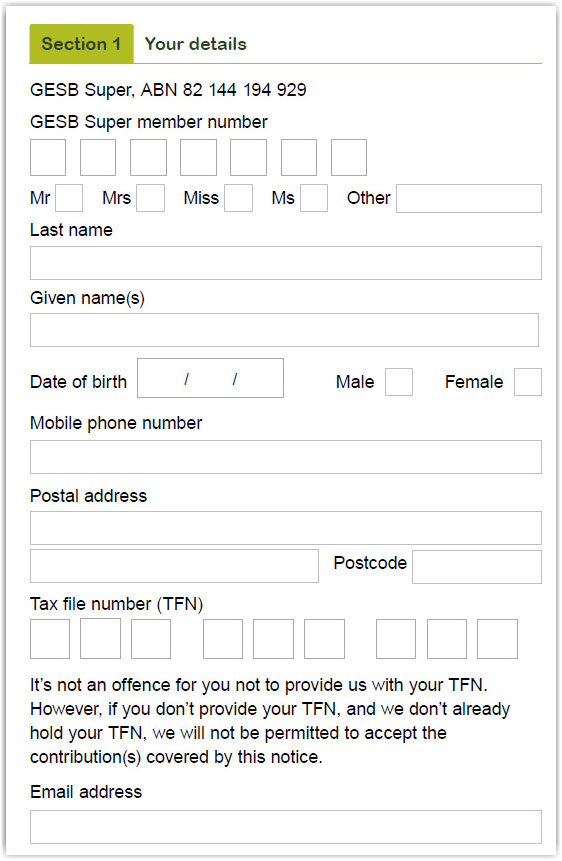

Provide your details in the first section, including your member number, name, date of birth, contact details and tax file number.

You can find your member number and account details on your member statement. To view your statement, log in to Member Online.

4. Tell us if this is a new notice or you are varying an earlier notice

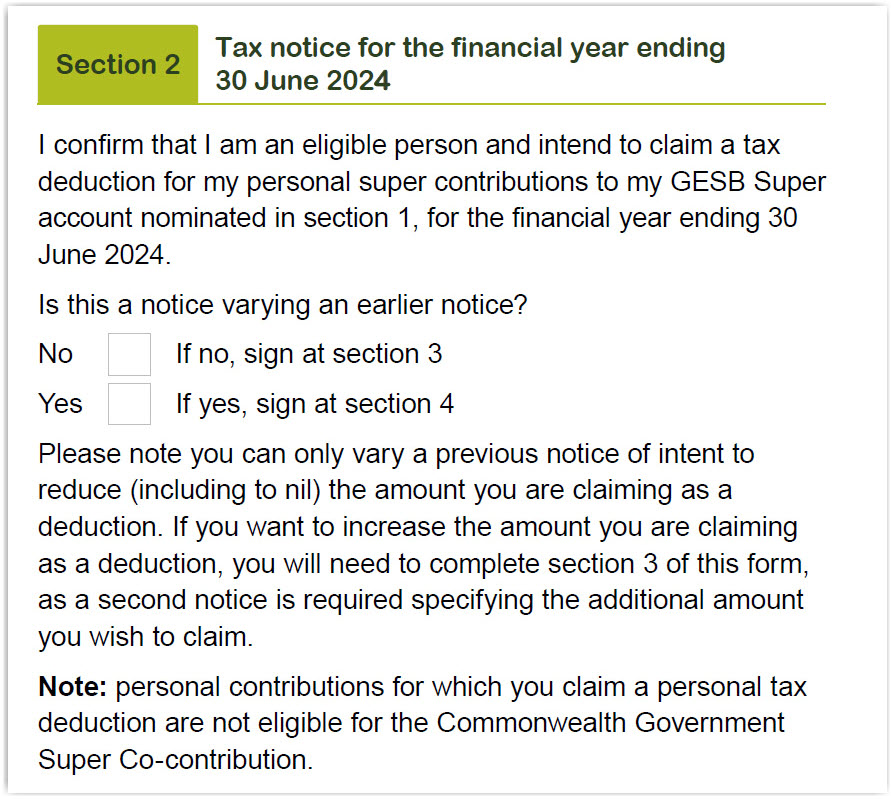

You need to confirm that you are an eligible person, and you intend to claim a tax deduction. If this is the first notice for that financial year, tick the ‘No’ box and move to section 3. If you have previously lodged a notice to claim a tax deduction form for that financial year and you want to reduce the amount you want to claim the deduction on, then tick the ‘Yes’ box and move straight to section 4.

If you want to increase the amount you want to claim the deduction on, then you’ll need to complete section 3.

5. Tell us the amount you want to claim a tax deduction on

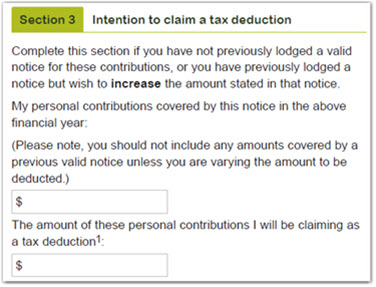

In the first box, you need to tell us the amount of your personal contributions covered by this notice in the financial year you are claiming for.

In the second box, you need to tell us the amount of these contributions that you are claiming a deduction on. If you are increasing the amount claimed from a previous notice, please provide the extra amount you would like to claim.

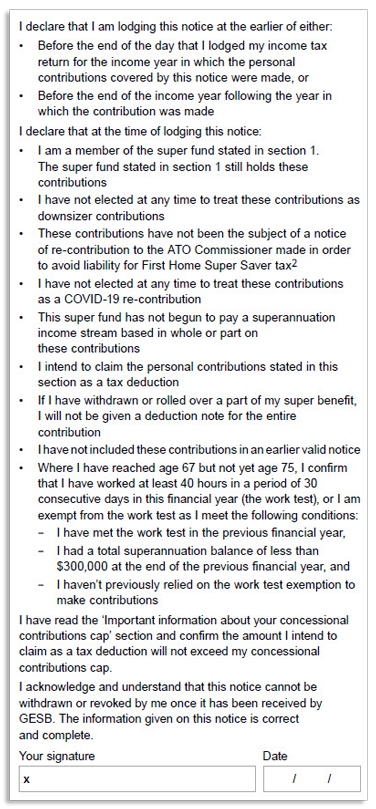

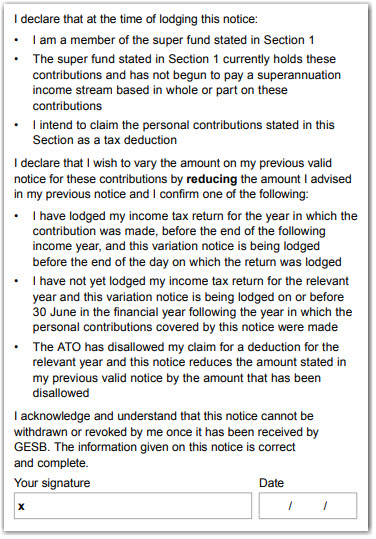

Next, you’ll need to carefully read the declaration to make sure you meet all the requirements.

If you are unsure about any of the declaration statements, contact us on 13 43 72 for more information.

Then sign and date the form.

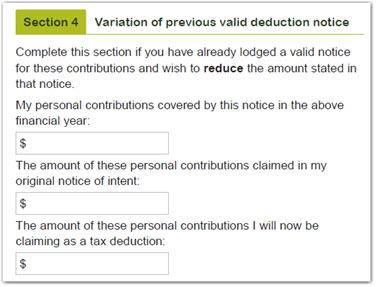

6. Are you reducing the amount you want to claim a tax deduction on?

Use this section if you want to reduce the amount you previously advised us you want to claim a deduction on:

- In the first box - tell us the amount of your personal contributions covered by this notice in the financial year you are claiming for

- In the second box - tell us the amount that you previously advised you wanted to claim a tax deduction on (you will find this in the confirmation letter we sent you after receiving your previous notice of intent form)

- In the third box - tell us the amount of these contributions that you are now claiming a deduction on

Next, you’ll need to carefully read the declaration to make sure you meet all the requirements.

If you are unsure about any of the declaration statements, contact us on 13 43 72 for more information.

Then sign and date the form.

7. Send the form in

Now that you’ve completed and signed the ‘Notice to vary or claim a tax deduction form’, please send your completed form to us at:

GESB

PO Box J 755

Perth WA 6842

Australia Post can take up to six business days to deliver regular mail. Please take this into account when submitting any forms or documents to us, especially when you need to meet a processing deadline.

We’re here to help

If you have questions about claiming a tax deduction on your contributions or need more help with the form, please contact us. We’re available on 13 43 72 Monday to Friday, 7.30am to 5.30pm (AWST), or via Live chat until 5.15pm.

Thank you for printing this page. Remember to come back to gesb.wa.gov.au for the latest information as our content is updated regularly. This information is correct as at 20 April 2024.