Pre-1 July 1983 service and tax

If you are a Gold State Super or West State Super member and have an eligible service period that commenced before 1 July 1983, this page is designed to provide important information about your eligible service period and how your tax components are calculated. If you would like to confirm whether this applies to you, please contact your Member Services Centre on 13 43 72.

Examples for illustrative purposes only

This page is not intended to be a substitute for the Gold State Super essentials brochure or the West State Super Product Information Booklet (PIB). These documents include all of the information you should consider before making a decision. You should read the relevant brochure or PIB and consider seeking professional legal, taxation or personal financial advice before you act. All examples and scenarios used on this page are for illustrative purposes only.

Impact of pre-1 July 1983 service on untaxed super funds

The eligible service period before 1 July 1983 forms part of the tax-free component of your super benefit. This portion is commonly referred to as the pre-1 July 1983 amount. Determining the pre-1 July 1983 amount to be included in the tax-free component of your super benefit will depend on the tax status of your super fund.

For taxed super funds such as GESB Super, the pre-1 July 1983 amount was calculated as at 30 June 2007 and was included as part of the tax-free component on that date. This is referred to as crystallisation, as the amount became fixed and formed part of the tax-free component.

For untaxed super funds, like West State Super and Gold State Super, the crystallisation of the pre-1 July 1983 amount for the untaxed element in the fund is only calculated when a lump-sum benefit is withdrawn or rolled over into a taxed super fund.

How pre-1 July 1983 service is calculated

Calculating your pre-1 July 1983 service will have an impact on the tax components of your super benefit and therefore how much tax is payable when you withdraw from the fund.

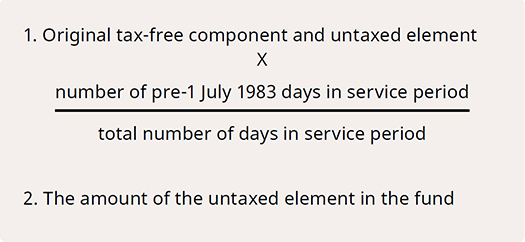

The pre-1 July 1983 amount of your benefit from an untaxed super fund is calculated as the lesser of the two following amounts:

Meet John

John is aged 60, and is a Gold State Super member. He has a Gold State Super account balance of $600,000 calculated as at 1 July 2021. His account balance includes a tax-free component of $60,000 (John’s after-tax contributions to his Gold State Super account) and a ‘taxable component – untaxed element’ of $540,000. John started working for the WA public sector on 1 July 1981 and had continuous service until he retired on 1 July 2021.

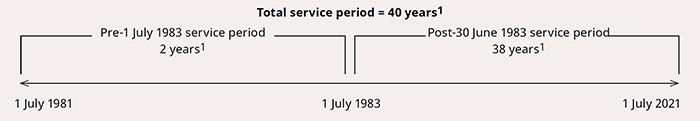

John's total service period of 40 years can be divided to show the pre-1 July 1983 service period of 2 years1 and the pos-30 June 1983 period of 38 years1.

Calculating John’s tax components

If John decides to withdraw his Gold State Super benefit, his pre-1 July 1983 amount will need to be calculated.

The pre-1 July 1983 service period (two years) is divided by the total service period (40 years) and then multiplied by his total benefit of $600,000.

The pre-1 July 1983 amount is calculated as the lesser of:

- (Original tax-free component of $60,000 + untaxed element of $540,000) x 2/40 = $30,000

- The untaxed element of $540,000

The tax-free component of John’s benefit is therefore increased by $30,000. The total tax-free component is now $90,000 (original tax-free component of $60,000 plus the pre-1 July 1983 amount of $30,000).

The taxable component of John’s benefit is now $510,000 (the total benefit amount of $540,000 less the updated tax-free component of $30,000).

The amount of tax payable will depend on how John accesses his benefit.

Here are two scenarios involving John and the impact of having a pre-1 July 1983 service period on his tax payable.

Scenario 1 Taking his full benefit as a cash payment

If John took his Gold State Super benefit as a cash payment, the taxable component of $510,000 is subject to tax of 17%2,3.

This will result in tax payable of $86,700. If John was under the age of 60 and taking a cash benefit, then the rate of tax could be higher.

More information on tax rates can be found in the Tax and super brochure.

Scenario 2 Rolling over his full benefit to a taxed super fund

If John rolled over his Gold State Super benefit to a taxed super fund, such as our RI Allocated Pension, the taxable component of $510,000 is subject to tax of 15%3 by the taxed fund, resulting in tax payable of $76,500.

The table below illustrates the tax impact of having pre-1 July 1983 service when rolling over to a taxed super fund, such as our RI Allocated Pension.

| Component | Amount | Tax component |

|---|---|---|

Pre-1 July 1983 amount | $30,000 | Tax free and no tax applies |

Original tax free (i.e. personal after-tax contributions) | $60,000 | Tax free and no tax applies |

Taxable – untaxed element (i.e. the remainder of the benefit) | $510,000 | Taxable – untaxed element and is subject to tax |

| Gross benefit | $600,000 | |

Tax payable on rollover of 15% | $76,500 | |

| Net benefit (after tax) | $523,500 |

The net benefit (after tax) includes a tax-free component of $90,000 and a taxable component – taxed element of $433,500 (i.e. $510,000 less tax of $76,500).

John gains a tax saving of $10,200 (scenario 1 tax of $86,700 less scenario 2 tax of $76,500). This is because the Medicare Levy is not payable on rollovers as it is with cash payments (as in scenario 1 above). As John is aged 604, any regular income payments or lump-sum payments from his allocated pension will also be tax free.

For more information on our RI Allocated Pension, read the Retirement Income Pension Product Information Booklet.

Maximising your tax-free component

Members who have pre-1 July 1983 eligible service and have an untaxed super fund, such as Gold State Super or West State Super, may be able to maximise their tax-free component by making personal after-tax contributions to their untaxed super fund before accessing their benefit.

This is a complex area and we recommend that you seek professional legal, taxation or personal financial advice.

Gold State Super members who are currently employed in the WA public sector may be eligible to open a West State Super account, provided they have pre-1 July 1983 service. Please contact your Member Services Centre on 13 43 72 to find out more.

Other considerations

Untaxed plan cap

Moving from one untaxed super fund, such as Gold State Super, to another untaxed super fund, such as West State Super, will not trigger the pre-1 July 1983 crystallisation in Gold State Super.

It is also important to understand that rolling over your entire benefit to West State Super will mean you only have one untaxed plan cap3 when you access your Final Benefit. Effectively, the untaxed benefit in Gold State Super is assessed twice: firstly in Gold State Super when you roll over to West State Super (i.e. against your untaxed plan cap3 in Gold State Super), and then again when you access your benefit in West State Super (i.e. against your untaxed plan cap3 in West State Super).

Non-concessional contributions cap

If you are considering making additional after-tax contributions into your West State Super account, then the non-concessional contributions cap of $110,000 per annum for the 2023/24 financial year will apply5.

If you are aged under 75 at any time in the financial year, you may be able to bring forward one or two years of non-concessional contributions i.e. $110,000 plus $220,000, giving you a cap of $330,000 over three years. Where a bring forward arrangement has been triggered, the future years' entitlements are not indexed and they must be made before you turn 75.

If your total super balance is equal or greater than $1.9 million on 30 June of the previous financial year then your non-concessional contributions cap is nil for the financial year. This is tested each 30 June, including during the bring-forward period.

The amount available under the bring-forward rule depends on your total super balance as at 30 June in the previous financial year.

1 Please note, the formula is based on number of days, however we have used years to simplify.

2 Includes 2% Medicare Levy.

3 There is an untaxed plan cap per super fund which is $1.705 million for the 2023/24 financial year (indexed annually in line with Average Weekly Ordinary Time Earnings, in increments of $5,000 rounded down). The untaxed plan cap are taxed at 15% on rollover to a taxed fund. Amounts above your untaxed plan cap are taxed at 47% prior to rollover.

4 If you are aged 60 or over, your regular income stream payments or lump-sum payments will be tax free and you will not be required to include these payments in your income tax return.

5 Non-concessional contributions to all of your super funds will count towards your non-concessional contributions cap (including non-concessional contributions made to Gold State Super and West State Super).

Disclaimer: the information contained on this page is of a general nature, and does not constitute legal, taxation or personal financial advice. In providing this information, we have not considered your personal circumstances including your investment objectives, financial situation or needs. We are not licensed to provide financial product advice. Before acting or relying on any of the information on this page you should review your personal circumstances, and assess whether the information is appropriate for you. You should read this page in conjunction with the relevant Product Information Booklet and disclosure documents. You may also wish to seek advice specific to your personal circumstances from a suitably qualified adviser.

Need help

- Consider getting personal financial advice

- Book a Retirement Options Service appointment

- Call us on 13 43 72

Thank you for printing this page. Remember to come back to gesb.wa.gov.au for the latest information as our content is updated regularly. This information is correct as at 19 April 2024.