How to make your first spouse contribution

Making a contribution to your spouse’s super is a great way to build your shared retirement savings.

There is no minimum contribution you need to make. If your spouse doesn’t already have an account with us, we will automatically open a GESB Super account for them.

Below you’ll find the steps you need to take to make your first spouse contribution. If you have made a spouse contribution before, you can make another one by completing the Additional spouse contributions form.

Action summary

- Time it takes

Approximately 20 minutes to complete the form - Hardest thing

Organising a money order if you don’t have cheques - Cost

No set up fee - Result

You'll grow your combined retirement savings

What you’ll need

- Printed form to complete

- Signatures from both partners on the form

- Cheque or money order made payable to GESB, for the amount you want to contribute

Need help

- Call us on 13 43 72

1. Learn about spouse contributions

We recommend you read the information below to check that making spouse contributions is the right option for you:

- Contributing to your super is about making spouse contributions, including after-tax personal contributions

- Read the GESB Super product information for rules that apply to the scheme and conditions of release

2. Download the form

First, click this link to download a Spouse contributions brochure. You will need to print out the form on pages 3 and 4 as you can’t type directly into the form.

The form has five steps.

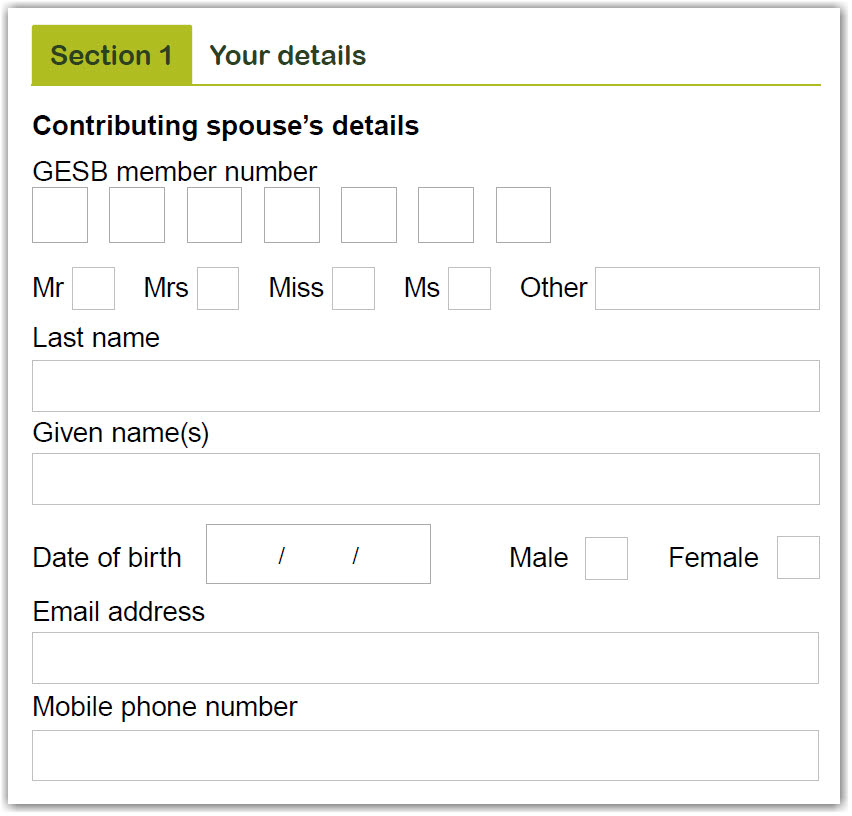

3. Provide your personal details

If you are making the contribution, you are the contributing spouse. If the contribution is made on your behalf, you are the receiving spouse.

These details include your name, date of birth, email address and mobile phone number.

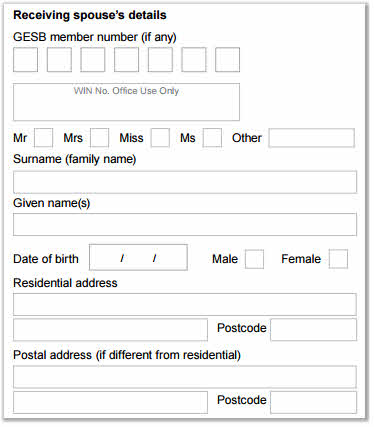

Start with your own details, then provide your spouse’s details. If your spouse already has an account with us, please include their member number. If they don’t have an account yet, we’ll automatically open a GESB Super account for them.

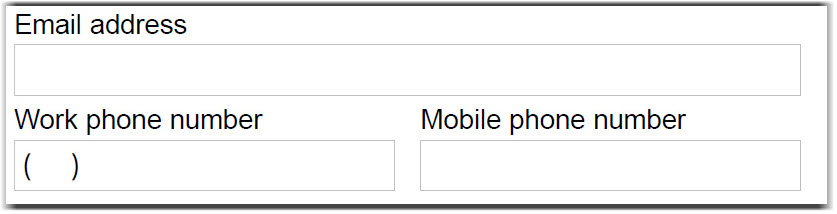

You’ll notice that we ask for more contact details about your spouse, as these details relate to the account the money goes into.

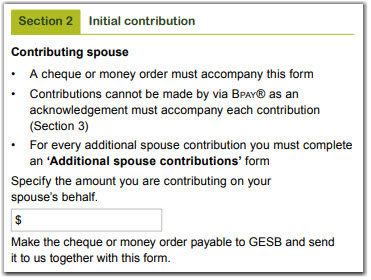

4. Enter the amount you would like to contribute

Write the amount you would like to contribute to your spouse’s account. You can only make this contribution by cheque or money order which must be submitted with the form as you have to sign an acknowledgement.

Please note, as of 1 October 2022 we don't accept foreign cheques.

This form is for the first contribution only. For any further contributions you’ll only need to complete an Additional spouse contributions form.

5. Check that your spouse can receive contributions

You can only receive contributions to your super when you are under the age of 75.

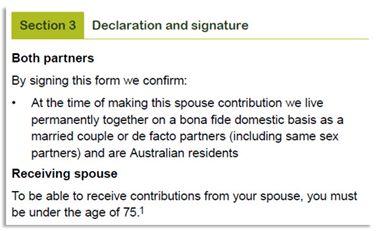

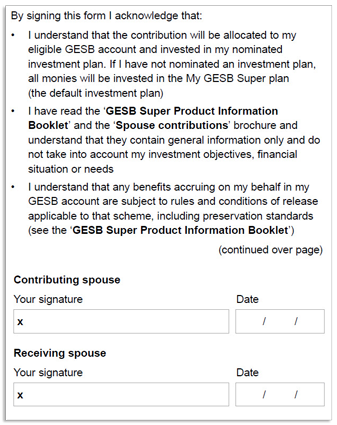

6. Read and sign the declaration

When you sign the form, you’ll need to acknowledge that you live permanently together on a bona fide domestic basis as a married couple or de facto partners (of any gender) and are both Australian residents.

If you’re making the contribution, you sign first, followed by your spouse.

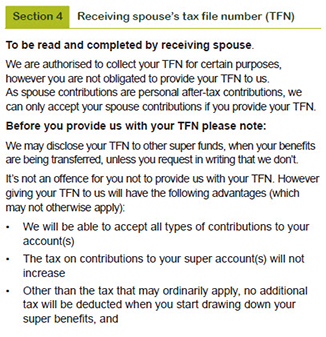

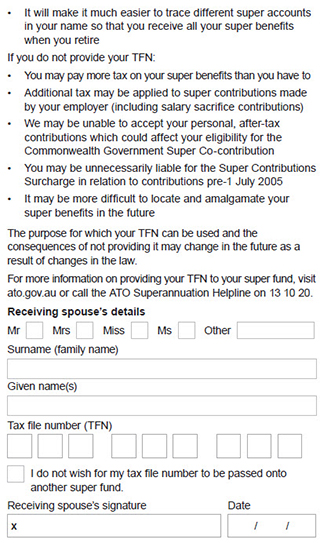

7. Provide your spouse’s tax file number

A spouse contribution is a personal after-tax contribution, so we can only accept your spouse contribution if you provide their tax file number (TFN).

This section has to be signed by your spouse as it is their TFN you need to include on the form.

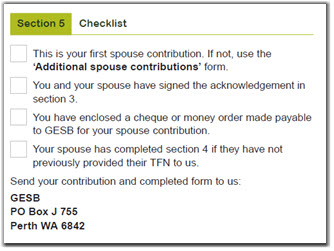

8. Use the checklist to make sure you’ve done everything

We’ve provided a checklist to help you check if you have done everything you need to when making this first spouse contribution.

9. Send the form in

Now that you’ve completed and signed the 'Spouse contributions' form, you need to send your completed form and cheque or money order, made payable to GESB, to:

GESB

PO Box J 755

Perth WA 6842

Australia Post can take up to six business days to deliver regular mail. Please take this into account when submitting contributions to us, especially when you need to meet a processing deadline.

Thank you for printing this page. Remember to come back to gesb.wa.gov.au for the latest information as our content is updated regularly. This information is correct as at 25 April 2024.