How do I make a contribution to my super through Member Online?

You can make contributions to your super in two different ways; before tax (salary sacrifice) or after tax.

You can make after-tax contributions to your account through your employer, by using BPAY® or by cheque or money order. These are known as personal contributions - and we don’t charge you any fees for contributing to your account in these ways.

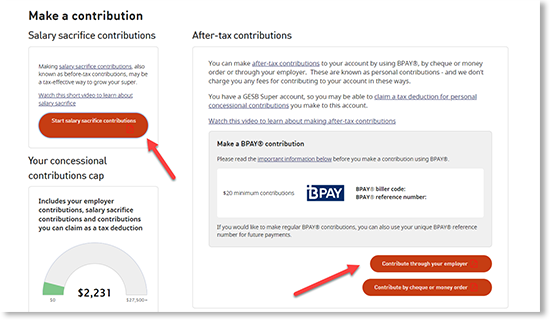

In Member Online you can submit a request to your employer to start making contributions to your super from your pay. Please note, some employers can’t accept our form, so you’ll need to get a form directly from your employer. Check with your payroll department for details.

To make contributions, we need to have your tax file number (TFN). You can provide your TFN through Member Online in the ‘Personal details’ section, if you haven’t done this already.

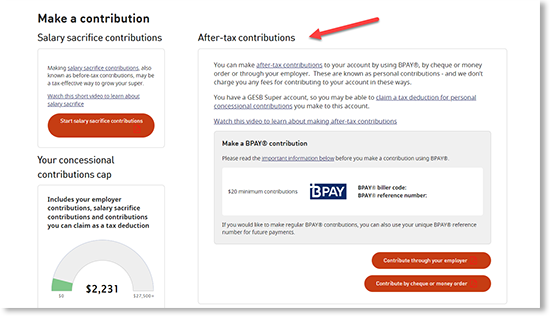

To make a contribution, log in to Member Online and visit the ‘Contribute’ page.

![]()

You’ll find a section called ‘Before-tax contributions’ and a section called ‘After-tax contributions’.

If you’d like to make an after-tax BPAY contribution, you’ll find the biller code and your unique BPAY reference number in this section. You can copy or print these details to make your contribution through your bank or financial institution.

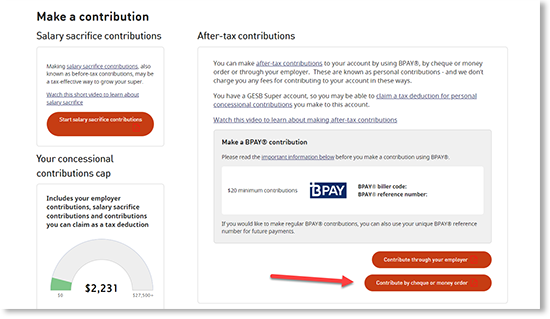

You’ll also find links to contribute through your employer or contribute by money order or cheque.

These links will direct you to a form to complete, depending on which type of contribution method you choose.

You can complete and print the money order or cheque form and post in with your contribution.

If you choose to make a contribution through your employer, you can choose whether you would like to make a before-tax (salary sacrifice) or after-tax contribution. You can choose whether you’d like to contribute a set amount or percentage of each pay, if you’re eligible.

Once you’ve completed the form, you’ll need to read and agree to a declaration and submit your form.

We will then send your request to your employer and confirm this with you by email.

Whether you make a BPAY, cheque or money order or an employer contribution, your contributions will appear in your transactions on your ‘Accounts’ page once they’ve been processed.

Thank you for printing this page. Remember to come back to gesb.wa.gov.au for the latest information as our content is updated regularly. This information is correct as at 20 April 2024.