How to make a payment variation

When you have a Retirement Income Pension (including RI Allocated Pension and Transition to Retirement Pension) account and you want to change your payment frequency, the Change of details and pension payment variation form allows you to make this change.

You can also use this form if you need to change your name, your financial institution, notify us of your retirement, or change your pension amount.

If you have a RI Term Allocated Pension account and need to make changes, please contact your Member Services Centre on 13 43 72.

Action summary

- Time it takes

It may take up to 20 minutes to complete the form - Hardest thing

To organise certified proof of identification (where relevant) - Cost

There is no cost involved in updating your payment frequency - Result

You’ll receive your regular income payments when it suits you

What you’ll need

- Certified proof of identification

Need help

- Call us on 13 43 72

1. Download the Change of details and pension payment variation form

First, click the link to download the Change of details and pension payment variation form.

When you complete the form, you’ll need to complete six sections. You might like to print the form first then use this page as a guide as you complete each section.

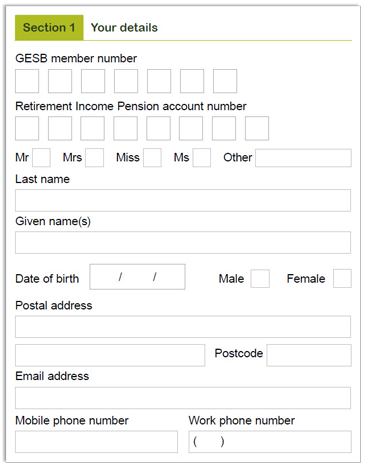

2. Provide your personal details

These details include your member number, your Retirement Income Pension account number, name, date of birth and contact details.

You can find your member number and account number on any statement you’ve received from us.

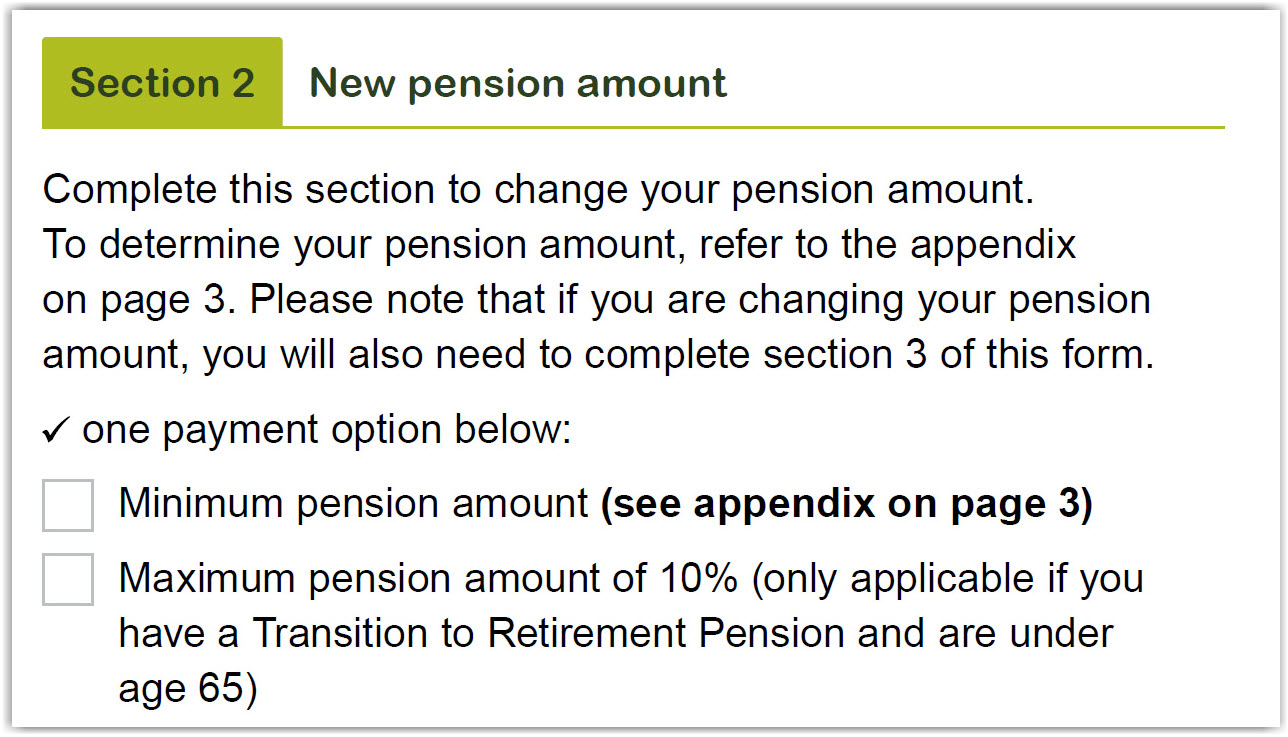

3. Do you want to change your payment amount?

You can either:

- Receive the minimum pension amount as specified on page 8 of the Retirement Income Pension Product Information Booklet.

- Receive the maximum amount of 10% if your account is set up under transition to retirement rules.

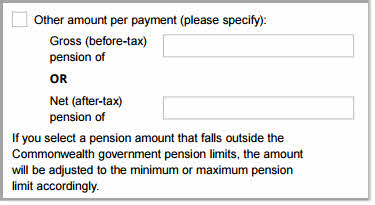

- Receive a specified amount. This can be either gross or net. Simply enter the amount in the ‘gross’ box if you want any tax to be deducted from the payment amount, or enter the amount in the ‘net’ box if you want the tax to be deducted from your account in addition to the amount you specified. If you choose an amount that falls outside the set limit(s), we’ll adjust it so it falls within Commonwealth government rules.

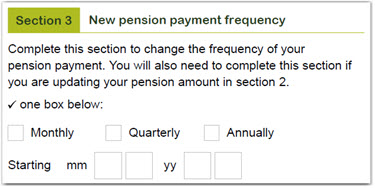

4. Do you want to change your payment frequency?

You can choose from monthly, quarterly or annual payments. If you want to change the interval at which your regular pension payments are made, you can switch options here. You can also tell us when you want the payments to start if you are choosing the longer intervals.

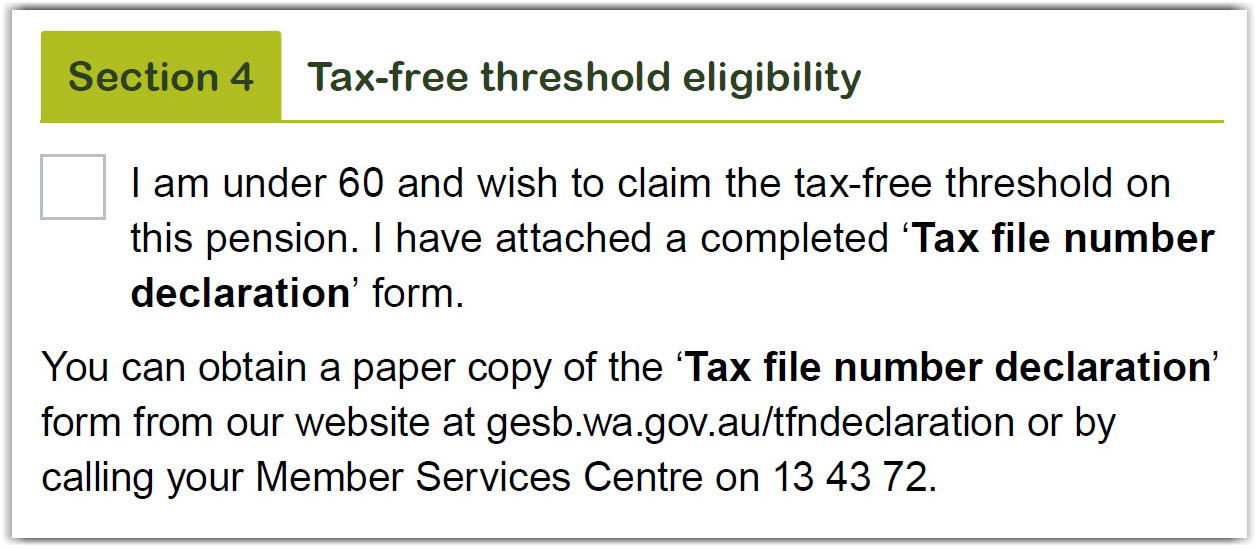

5. Are you under the age of 60?

If you are under the age of 60 and wish to claim your tax-free threshold from your pension, you will need to complete a Tax file number declaration form.

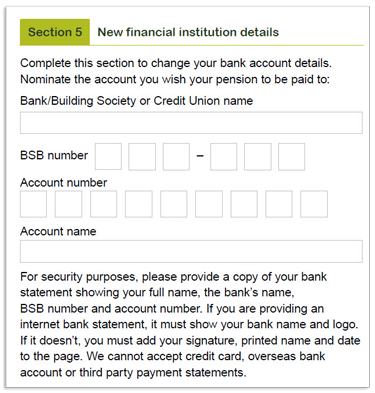

6. Has your bank account changed?

This is where you tell us what bank account you want your regular pension payments to go into.

You’ll need to provide a copy of your bank statement which includes your full name, the bank’s name and BSB number as well as your account number. If you are providing an internet bank statement, it must show your bank name and logo. If it doesn't, you must add your signature, printed name and date to the page. You’ll also need to complete the relevant boxes on the form to confirm your bank account details.

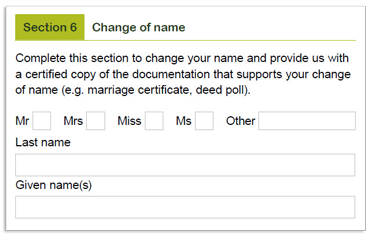

7. Have you changed your name?

You can tell us your new name in this section. You will need to provide proof of identity which supports the name change with this form. It could be a certified copy of your marriage certificate or the deed poll record. Find out more about how to provide certified proof of identification.

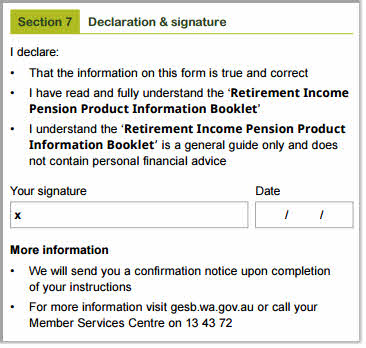

8. Read the declaration and sign the acknowledgement

You’ll need to read the declaration and confirm that the information provided is correct, that you’ve read the Retirement Income Pension Product Information Booklet and acknowledge you understand that this brochure doesn’t provide financial advice.

We will send you confirmation when we’ve completed your instructions.

9. Send the form in

Now that you’ve completed and signed the 'Change of details and pension payment variation' form, you need to send your completed form and supporting documentation to:

GESB

PO Box J 755

Perth WA 6842

Australia Post can take up to six business days to deliver regular mail. Please take this into account when submitting your form to us, especially when you need to meet a processing deadline.

We’re here to help

If you have questions about changing your payment details or need more help with the 'Change of details and pension payment variation' form, please call us on 13 43 72 between 7.30am and 5.30pm (AWST), Monday to Friday.

Thank you for printing this page. Remember to come back to gesb.wa.gov.au for the latest information as our content is updated regularly. This information is correct as at 20 April 2024.