Transferring lost super to the ATO

If we haven’t been able to get in touch with you in a while, and if there hasn’t been any activity with your super account for some time, we must report your account as lost and transfer it to the Australian Taxation Office (ATO).

Here’s what happens

Your account is identified as 'lost'

Your super may be considered lost if it fits the definition of ‘uncontactable’ or ‘inactive’.

We report your account to the ATO

We report accounts we’ve identified as at risk of becoming lost or unclaimed to the ATO, who provide updated contact details for these accounts.

We try to contact you

We then use these contact details to try to get in touch with you, to let you know we’ve been given updated contact details and ask you to make sure they are correct.

We transfer your super to the ATO

If you don’t take action, we’ll transfer your lost or unclaimed super to the ATO, where it’s held in a central location and fees don’t apply.

Important note for West State Super members: if your account is transferred, it will be closed and cannot be reopened.

Stop your super from being transferred

If you’ve been notified that we received updated contact details for you from the ATO, you’ll need to either check the updated details we’ve put on your record are correct, or verify and update your contact details on your record yourself. What you’re asked to do will depend on how your lost account is defined according to lost super legislation.

Check your details

If you’ve received a communication from us asking you to check your updated contact details in Member Online (MOL) but take no further action if they are now correct, you can login to MOL and view these details in your online account. If they’re now correct, you don’t need to do anything further - your account is considered ‘found’.

Verify and update your details

If the communication we send you asks you to contact us to update your details, you will need to contact us directly to verify your details before your account will be considered ‘found’. To do this, you can update your contact details in MOL yourself, or call us on 13 43 72 (or otherwise contact us ) to confirm your details and we can update them for you.

West State Super members with lost accounts

If your West State Super account is transferred to the ATO, your account will be closed and you won't be able to open another one, even if you start working in the WA public sector again.

This is because West State Super is now a closed scheme. It also means that any insurance you may have attached to your West State Super account will cease.

Find out more about the unique features of West State Super.

If you’d like to transfer your super back to GESB, you can open a GESB Super account.

FAQs

Are you considered uncontactable or inactive?

Your super may be considered lost if it fits the definition of uncontactable or inactive.

This means:

- Uncontactable - you have never provided a contact address, or your recorded contact details have become invalid (for this to happen, we must receive two pieces of returned mail and/or a returned email for the addresses we have on file, depending on the details we have), and we haven’t received a contribution or roll in for you within the last 12 months

- Inactive - you joined us through your employer more than two years ago and your account has had no contributions or roll ins in the last five years

How can I stop my account from becoming lost again?

You can make sure your super isn’t at risk of becoming lost by:

- Telling us if you change address, phone number or email address

- Making regular contributions to your super account

- Logging into Member Online to manage your super regularly

- Providing us with your tax file number in Member Online - this will also help make sure you’re not paying more tax than you need to

How do I check and update my details?

Check and update in Member Online

You can check your details in Member Online at any time. If you need to make a change to your contact information, you can update the ‘Personal details’ page once you login.

You can also:

- Use ‘Live chat’ online to speak to a Member Services Consultant in real time

- Call your Member Services Centre on 13 43 72

Complete and submit a form

If you would prefer to complete a form, on this page you’ll find instructions on how to complete the 'Change of details' form to update:

- Your name

- Your address

- Other contact details including your phone number and email address

To change any other information, please contact our Member Services Centre on 13 43 72.

Action summary

- Time it takes

It could take up to 10 minutes to complete the form - Hardest thing

You’ll need to get your ID certified if you are changing your name - Result

With your contact details up-to-date, you’ll always receive important information from us - What to consider

You can update your details in Member Online to avoid having to post the form to us

What you’ll need

- Print the change of details form

- Certified proof of identification if you are changing your name

Need help

- Call us on 13 43 72 if you have any questions

1. Download the form

First, click this link to download a Change of details form. You can type your details directly into the form, and then print out the form to provide your signature.

The form has five sections.

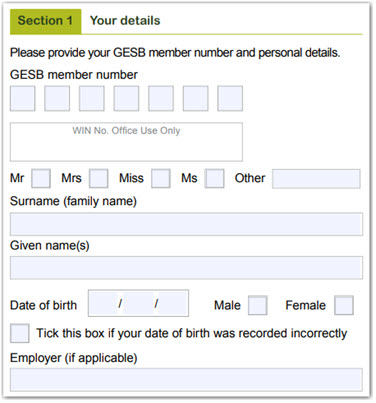

2. Provide your personal details

These details include your member number, name, date of birth, and your employer if applicable.

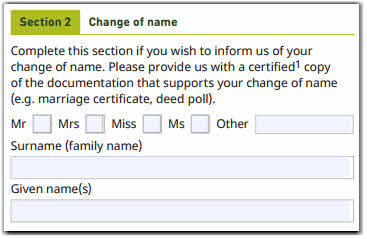

3. Provide your new name

You’ll only need to complete this section if you’ve changed your name. You will need to provide a certified copy of the relevant document. Instructions are included on the form or you can learn how to get copies of your ID certified.

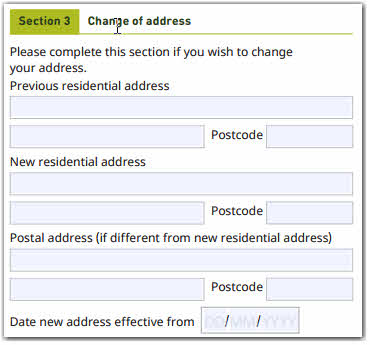

4. Provide your address details

You’ll be asked to first list the residential address we’ve got for you now. Next you’ll complete your new residential address, and if your new postal address is different, you can provide that here too.

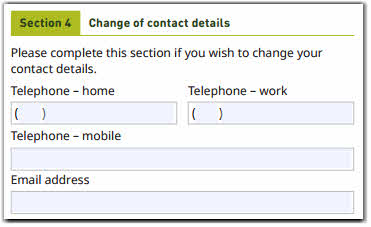

5. Provide your contact details

In this section, you’ll be able to provide your home, work and mobile number as well as your email address.

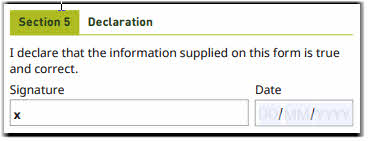

6. Check your details

You’ll need to sign and date the form to confirm the details you’ve provided are true and correct.

7. Send the form in

Now that you’ve completed and signed the form, you need to send your completed form, and certified copies if you’re changing your name, to:

GESB

PO Box J 755

Perth WA 6842

If you don’t have to supply proof of identity, you can also fax the form to 1800 300 067.

Note: Australia Post can take up to six business days to deliver regular mail. Please take this into account when submitting forms to us.

How do I find lost super?

You might have lost track of some of your super if you've ever changed your name, address or job. After some time, if any of your super accounts have not received contributions, then your super could be held by the Australian Taxation Office (ATO) on your behalf.

Here we’ll look at how to find your super including any held by the ATO.

Action summary

- Time it takes

It can take up to 20 minutes to complete the process - Hardest thing

Registering for myGov if you haven’t already done so - Cost

We don’t charge a fee to combine any other super into your GESB account - What to consider

The other fund may charge a fee when you roll out

What you’ll need

- Know your myGov login details

- You must have linked the ATO to your my Gov account

Need help

- Use the myGov help guide

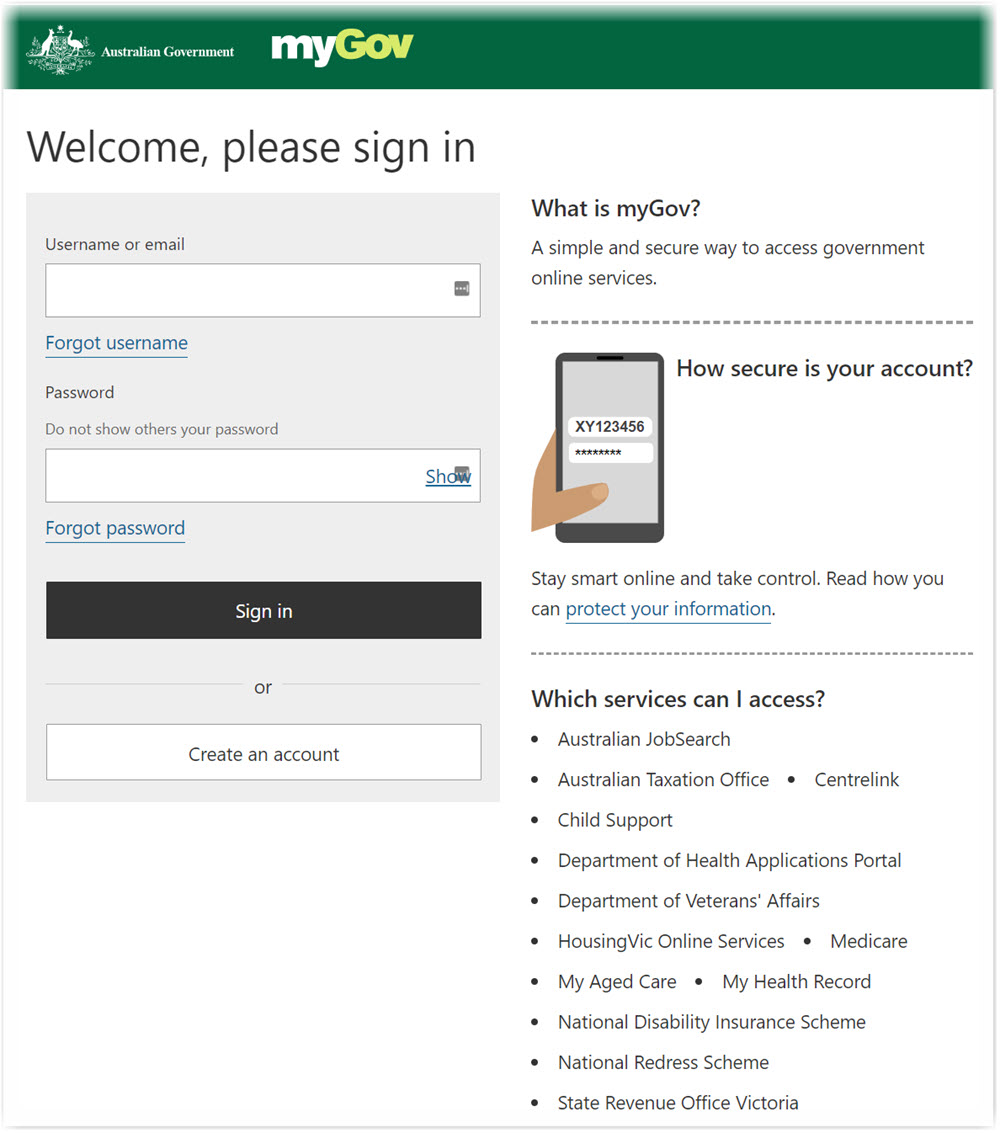

1. Create a myGov account

The first step in finding your super is to create or log in to your myGov account.

You can also use this account to check, consolidate and keep track of your super online.

If you haven’t created a myGov account yet, the ATO provides step-by-step instructions on how to create your account. Open the myGov help guide.

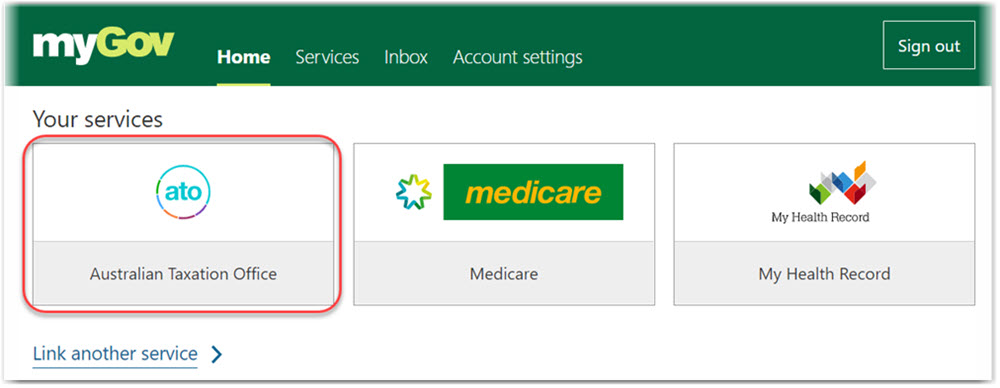

2. Check that your account is linked to the ATO

Once you’ve logged in, check to see that the ATO is showing under your linked services. If it isn’t, then access the myGov help guide for instructions on how to link a service.

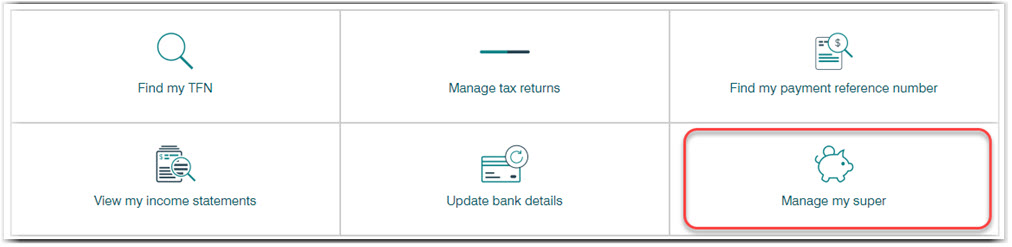

If the ATO is linked, click the ATO logo to visit the ATO section of myGov. You'll now have a number of options available to you.

Select ‘Manage my super’ and follow the prompts to find your super.

Things to remember

- If you find and then combine your super online via myGov, it generally takes less than a week for your request to be processed

- We don’t charge a fee for rolling super money into your GESB account

- If the ATO shows you have super money with another fund, you can roll that into your GESB account too. The other fund may charge a fee for combining your super

- If you have insurance with another super fund, check your existing insurance cover to see if it’s right for you. If you choose to leave your other fund, you may lose any insurance benefits you have with them

- You can review or even change your insurance cover with us in Member Online. Details of your insurance cover with us are also included on your member statement

More information

- Visit the ATO website for more information about lost and unclaimed super, including which accounts may be transferred to the ATO

- Register for or login to Member Online

- Find out more about West State Super

Need help

- Call us on 13 43 72

- Connect with us in real time via Live chat

Thank you for printing this page. Remember to come back to gesb.wa.gov.au for the latest information as our content is updated regularly. This information is correct as at 20 April 2024.