Modern slavery statement 2021/22

This statement covers the following topics:

1. Message from our GESB Chair and CEO

Modern slavery can affect people in any country. It can occur in any sector or industry, at any point in a supply chain. The International Labour Organization and the Walk Free Foundation estimated there were more than 40 million victims of modern slavery worldwide in their Global Estimates of Modern Slavery report1.

With around 245,000 members and over $33 billion in funds under management (as at 30 June 2022), we are the largest superannuation fund in Western Australia. We have investments across a range of industries, both in Australia and globally, and we engaged more than 50 service providers in 2021/22. We believe we have a responsibility to our members, stakeholders and the broader community to address the risks of modern slavery, a significant global human rights issue.

This is our first modern slavery statement, relating to the 2021/22 financial year. Our statement outlines the steps we’ve taken to identify, assess and address the risks of modern slavery in our supply chains and operations, including our investments.

During the past financial year, we established a modern slavery working group with representatives from all key functions of our business. Our focus was to identify our key service providers and conduct a high-level assessment of the potential risks of modern slavery in our operations and supply chain.

As part of this process, we engaged PwC Australia to review the information in this statement against the requirements of the Modern Slavery Act 2018 (Cth) and better practice guidance. We used the findings to identify areas of improvement and inform our future actions.

We recognise that we are only at the beginning of our journey to address the issue of modern slavery. We’re committed to continuous improvement and will share more details as our work progresses.

Jo Gaines - Chair

Ben Palmer - Chief Executive Officer

2. Introduction

About GESB

The Government Employees Superannuation Board (GESB) is a statutory authority established in Western Australia. As a statutory authority, our GESB Board has powers and functions under the State Superannuation Act 2000 (SSA) and is accountable to the Western Australian Treasurer.

Our office is located in Perth and currently employs 65 staff as at 30 June 2022. We do not own or control other entities.

Our purpose is to help members achieve a quality retirement. In carrying out our functions, we are required to act in the best interests of our members, and ensure that members and employers are fully informed of their rights and obligations under the SSA.

Learn more about our purpose, values and history as an organisation.

Our schemes are consistent with superannuation national standards where practicable

We are a state-regulated public sector fund and not Commonwealth-regulated like most other superannuation funds.

Western Australia is a signatory to the ‘National Superannuation Standards’ Heads of Government Agreement (HoGA) with the Commonwealth. Under this agreement, the State Government is committed to conform to the Commonwealth’s Retirement Incomes Policy to the best of its endeavours.

Broadly, this means that the governance and superannuation benefits we provide through our schemes are consistent with national standards. These standards include rules around preservation and protection of benefits, vesting of benefits, member disclosures and adequate prudential and supervisory arrangements.

This is our first modern slavery statement

This statement outlines the work we have completed so far in identifying modern slavery risks in our operations, supply chains and investments.

We have voluntarily prepared this statement in line with our responsibility to members and stakeholders to manage modern slavery risks. We are committed to identifying modern slavery risks within our operations and supply chains, to avoid directly or indirectly contributing to modern slavery.

Our Board acknowledges the need to maintain high standards of ethical conduct for our Directors, management and staff. Two of our core values are ‘sustainable performance’ and ‘act with integrity’, which align with our commitments toward social responsibility.

We are committed to producing and maintaining a modern slavery statement to share our continued work in this area.

What is meant by ‘modern slavery’?

Modern slavery is defined in the Modern Slavery Act 2018 (Cth) as a group of practices which are considered major violations of human rights and serious crimes. These include people-trafficking, slavery, slavery-like practices (including forced labour and forced marriage) and the worst forms of child labour (including using children for prostitution or in hazardous work).

Modern slavery can affect any country, and can occur in any industry and at any point in a supply chain.

3. Our structure, operations and supply chain

By examining our structure, operations and supply chain, we aim to understand our exposure to modern slavery risks. With an enhanced understanding, we can then determine appropriate action to help address this significant global human rights issue.

GESB's risk of modern slavery practices

We consider modern slavery risks across the following areas of our operations and supply chain:

Procurement and outsourcing

- Administration services

- IT services

- Member insurance

- Adhere to State Government’s procurement rules

Investments

- Supply chain – investment managers

- Operations – custodian

Internal operations

- Supply chain – business services suppliers

- Employment and remuneration policies

- Adhere to Prudential Guidelines

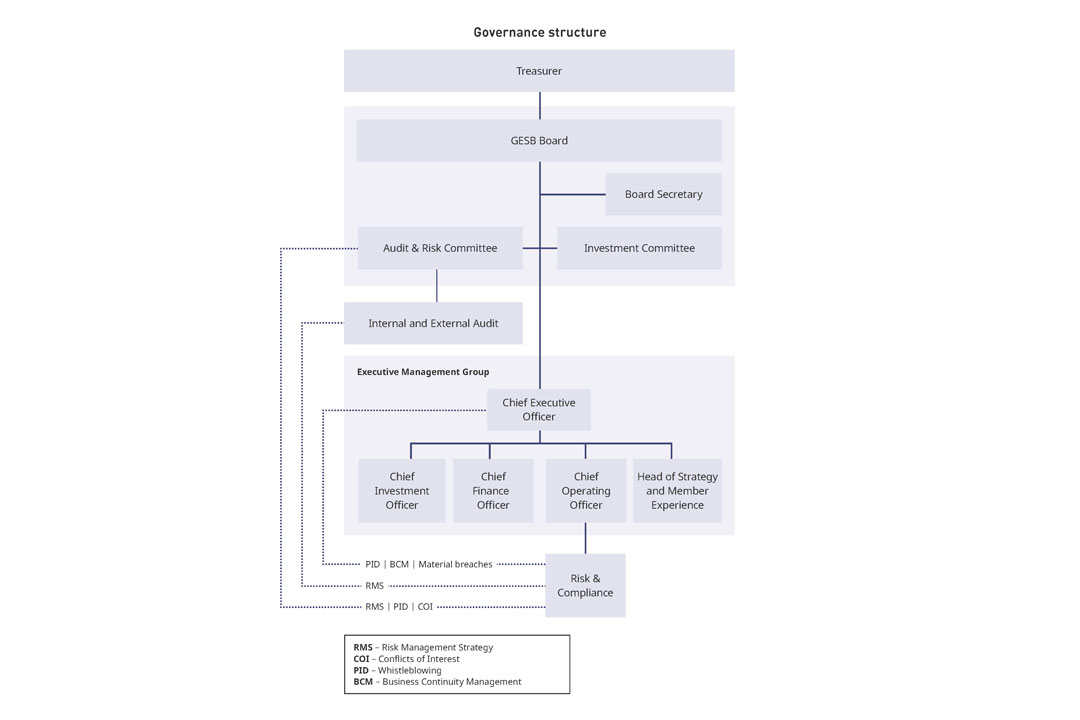

3.1 Our structure

As a Western Australian statutory authority, we operate within the State Government’s policy framework. The WA Treasurer as our responsible minister administers the legislation which underpins our operations.

Our statutory framework is largely derived from the SSA and the State Superannuation Regulations 2001. Our functions under the SSA are to:

- Manage the Government Employees Superannuation Fund (GES Fund)

- Administer our members’ super schemes

- Provide information, advice and assistance to the WA Treasurer on matters relating to super

- Provide or facilitate the provision of products and services to members of super schemes administered under the SSA or any other relevant law and employers in the WA public sector

- Perform any other functions required under relevant law

Our Board is accountable to the WA Treasurer for all matters relating to our operations. The Board comprises a Chair, three Employer Directors and three Member Directors.

Our Board operates within a corporate governance policy framework that incorporates legislative and regulatory requirements aligned to industry best practice and the Australian Securities Exchange governance principles.

This framework reflects our operating environment as a WA Government authority within the financial services market. We operate within the state’s Integrity Framework.

3.2 Our operations

Our business comprises four main functions:

- Investments

- Finance and Business Services

- Superannuation Services

- Strategy and Member Experience

Our main areas of operation include providing superannuation and retirement products and services, and making financial investments on behalf of our members.

We manage superannuation accounts and investments for over 245,000 current and former WA public sector employees. We deliver cost-effective and trusted products, including insurance, and services to our members, employers and the state of WA.

We manage an investment portfolio of $33.2 billion. Of this, 91% ($30.3 billion) is managed for members in market-linked schemes, where members bear the investment risk, and $2.9 billion is managed for the State to support its defined benefit liabilities (information as at 30 June 2022).

Our people

All of our staff members are based in Western Australia. They are employed under either an individual contract or an enterprise agreement, with most employed under the Western Australian Public Sector General Agreement (PSGA). Our remuneration policy complies with the PSGA and our governing legislation.

Our schemes

We administer the schemes established under the SSA and other defined benefit schemes for the State, and provide information and assistance to the Treasurer on superannuation matters.

In accordance with the SSA, our GESB Board also formulates and gives effect to an investment strategy for the fund to achieve prudent diversification and deliver returns that meet investment objectives. Our investment framework operates in accordance with Prudential Guidelines for Investments issued by the Treasurer.

We are primarily a self-funded agency, though we recover the operational costs of administering the State’s defined benefit schemes and other Government related activity, including the cost of Government services, from the Consolidated Account.

3.3 Our supply chain

3.3.1 Service providers (other than investment managers)

To help us deliver high-quality, efficient and effective services to members, we use third party service providers for most of our key activities. We expect our service providers to operate ethically and responsibly. We achieve oversight and governance through formal contractual agreements and independent external reviews.

Our procurement processes

As a State Government agency, we comply with the SSA and the State Government of Western Australia’s procurement rules which apply to all agencies, where applicable.

These procurement rules streamline the State’s approach to procurement and:

- Promote the delivery of added sustainable economic, social and environmental benefits for Western Australians

- Reduce barriers to small and medium business participation

- Strengthen integrity measures to promote ethical and accountable practices

- Allow for coordinated whole-of-government procurement leadership, with localised accountability and decision making

Under these procurement rules, any service provider which fails to meet their obligations under the Australian Modern Slavery Act 2018 (Cth) will be barred from access to the Western Australian Government’s $27 billion procurement contracts on goods, services and public works.

Our service providers in 2021/22

During 2021/22, we sourced goods and services from more than 50 service providers.

All of these service providers have offices located in Australia, with a small number of providers having headquarters located outside Australia.

Our service providers operate mainly in the information technology and industrial sectors which includes businesses such as professional services. Other service providers provide selected consumer staples and consumer discretionary services such as stationery, training and newspapers.

3.3.2 Investment managers

We invest our funds across a wide range of local and international investment markets, assets and strategies. This includes investments in cash, fixed income, public and private equity, property, infrastructure and hedge fund strategies. This means we invest across a range of industries and businesses that operate all over the world, which can include exposure to the risks of modern slavery.

How we work with investment managers

Our investment managers buy and sell assets on our behalf. For example, our investment managers for Australian Shares work within our risk guidelines to decide which companies to buy and sell Shares in, and then place orders for those Shares.

This approach means we can use the skills of a range of investment managers from around the world and benefit from diversification in investment style. It allows us to maintain a balance of assets across a range of investment managers, which helps us to achieve our investment goals over the long term.

Engagement with investee companies is carried out by our investment managers. Engagement seeks to have a positive influence on outcomes and a key avenue for understanding the risk of modern slavery in our investments.

The appointment of investment managers

We appoint a diversified group of external investment managers to invest our funds. To avoid a concentrated exposure to a particular investment manager or a particular investment style, we typically appoint multiple investment managers in each asset class.

The Western Australian Treasurer is responsible for approving investment managers in accordance with the Treasurer’s Prudential Guidelines for Investments. These guidelines also detail the kinds of investments permitted.

We regularly review our choice of investment managers. We understand their risk and return profiles and make sure that they meet our expectations.

4. Examining the risks of modern slavery practices

Modern slavery risk is primarily about risk to people. Regardless of the size, scale, location or industry, the operations and supply chain of any business can contribute to modern slavery practices.

This could be directly through staff employment conditions or the actions a business takes which could facilitate or incentivise modern slavery. The business operations, products or services could also be connected to modern slavery through the activities carried out by the service providers that the business has relationships with.

For this reason, we are committed to understanding the potential modern slavery risks which may exist within our operations, supply chains and investments – and how we can address these risks.

4.1 The risks of modern slavery in our internal operations

Our workforce allows us to deliver on our purpose to help our members achieve a quality retirement and our mission to responsibly manage our members’ retirement savings, deliver strong long-term investment returns and offer relevant support so members can make informed decisions.

Our staff have a range of specialised financial services, public sector and administrative skills. They work in our Perth office in the Perth central business district, or remotely within reasonable proximity to the Perth metropolitan region.

One of our strategic objectives is to create positive and supportive organisation. This creates an environment where our staff approach every aspect of work ethically and adopt policies which allow us to operate transparently.

We do not operate in any foreign countries or deal directly with any overseas institutions in relation to providing our designated services.

Based on our assessment of the above, we consider the risk of modern slavery within our internal operations to be low.

4.2 The risks of modern slavery in our supply chain and procurement processes

We have contractual relationships with a range of businesses who offer different products or services to support our delivery of superannuation products and invest on behalf of our members.

We carried out a high-level assessment to identify the potential risks of modern slavery in our supply chain from a procurement perspective.

While we engage several service providers, our risk assessment focuses on key providers, most of whom are within professional and administrative services and supplies, including legal, consulting and accounting services.

Our initial risk assessment considered four high-level risks indicators:

- Sector and industry risks

- Product and services risks

- Geographic risk

- Supply chain model risks

These indicators were used in the risk screening tool developed by the Australian Government to assess the risks of existing or new procurement contracts.

To gather the information for these assessments, we used the supplier procurement questionnaire prepared by the Australian Border Force.

At a high-level, our findings included:

- Our first level of protection is procuring under the State Government procurement guidelines

- Most of the goods and services we procure come from suppliers and contractors based in Australia

- In the rare case where goods and services are procured from suppliers and companies outside of Australia, we have taken steps to factor in modern slavery risk in our risk assessment of suppliers

- A response to our modern slavery questionnaire coupled with a modern slavery statement, if available, has allowed us to assess our key service providers who support our operations

Based on the above, we have determined a low-risk status for the suppliers of our goods and services, in relation to modern slavery.

4.3 The risks of modern slavery in our investment activities

Our investment managers and underlying investments are an important part of our supply chain:

- We invest members’ super across a range of different asset classes and sectors, both within Australia and internationally

- We invest across more than 50 countries, with assets in a number of sectors including energy, information technology, materials, financial services and healthcare

- Our external investment managers are appointed for specific mandates to implement investment strategies and select underlying investments within asset classes

- As at 30 June 2022, our assets were managed under 44 different mandates by 34 investment managers

- Our external investment managers are located both within Australia and overseas and have their own operations and supply chains

We recognise that the scope of our investment allocation has the potential for exposure to the risks of modern slavery.

The chart shows our total portfolio investment allocation (aggregated at a fund level) by region, as at 30 June 2022.

The importance of environmental, social and governance (ESG) factors

As part of our due diligence, we review each investment manager’s investment approach to understand how they integrate ESG considerations into their investment decisions. This is carried out in conjunction with our asset consultant.

Some issues our investment managers consider as part of their investment approach include human rights, modern slavery, child labour and supply chain management.

The growing importance of ESG means it is now an integral part of our operational due diligence process. We aim to understand the ability of our investment managers to deliver the necessary operational standard and capabilities.

ESG is broader than what we invest in. It covers culture and workplace behaviour and should be considered alongside a review of our investment managers’ operational functions.

Determining the risks associated with investments made on our behalf

We worked with our asset consultant to circulate a due diligence questionnaire prepared by the Financial Services Council to all external investment managers.

These questionnaires aimed to help us better understand our investment managers’ modern slavery reporting obligations, governance and due diligence processes, operational and supply chain risk assessment outcomes and, importantly, the modern slavery risks associated with their investment activities.

We recognise that there is heightened risk of modern slavery in high-risk geographies and high-risk sectors, both of which we may have exposure through the investments our investment managers make on our behalf.

Our ongoing commitment to addressing modern slavery risks

We have not included a review of our investments in this statement. We intend to expand on our reporting by providing an initial assessment of our investments for the report.

We continue to work with our external investment managers, ensuring that modern slavery risk is considered alongside other ESG risks when integrating ESG into investment decisions.

Our Investment team meets with our investment managers regularly, providing an opportunity to discuss ESG issues more broadly and/or to discuss any issues raised by the investment managers related to specific investments. Modern slavery forms part of these discussions.

Find out more about our approach to ESG, including human rights and labour related risks.

5. Our actions to assess and address the risks

In 2021, we established a dedicated working group to assess and implement modern slavery reporting requirements to help support better practices with respect to governance. Our working group includes representatives across all key functions of our business, including our Executive Management Group.

Understanding the risks of modern slavery

In its first year, our working group aimed to establish a baseline to understand the risks of modern slavery in our internal operations, supply chain and investments. This included:

- Identification of the key service providers who support our operations

- A high-level assessment of the potential risks of modern slavery within these supply chains, with questionnaires sent to these key service providers (including a questionnaire developed by Financial Services Council for external investment managers)

- Identification of areas of improvement based on the responses from key service providers

Our supplier questionnaire, for example, provided us with comprehensive information about our suppliers’ operations as well as their strengths and weaknesses in relation to addressing modern slavery risks. In many cases, the questionnaire responses were supported by the supplier’s own modern slavery statement and accompanying policies, which formed the basis of our supplier risk assessment.

We recognise that this is an ongoing process and will continue to work with our staff, service providers and investment managers to expand our understanding and take appropriate action.

Our policies support our practices

In addition to the work carried out by our working group to date, we have a number of policies in place to ensure we adopt good governance and operate in a responsible manner, including addressing the risks of modern slavery.

These policies are covered as part of our induction of new staff and reinforced through regular training and information sessions:

Our Environmental, social and governance (ESG) and responsible investment policy describes how we incorporate ESG factors into investment decisions. This includes climate change, human and labour rights, and modern slavery. Learn more about our responsible investing approach.

Our Whistleblowing policy facilitates public interest disclosures by our staff, contractors or members of the public, which can be made anonymously to our Public Interest Disclosure Officer.

Our Governance framework includes an outline of the structures, activities, instruments and monitoring arrangements that have been adopted to comply with legislation and other obligations.

Our Risk management strategy facilitates the management of all risks that may adversely impact our members, staff, assets, operations and outsourced service providers.

We have a Code of conduct that sets standards for ethical and accountable behaviours in our workplace.

Our Dignity at work policy reinforces the expectation for all staff to model appropriate workplace behaviours and take care that their actions do not harm or exclude others.

![]() Our Workplace inclusion network promotes and supports diversity and inclusion in our workforce, representative of the members and community we serve.

Our Workplace inclusion network promotes and supports diversity and inclusion in our workforce, representative of the members and community we serve.

Further support for our modern slavery risk management practices

In support of our Risk management strategy, we have an established and independently reviewed anti-money laundering and counter terrorism financing (AML/CTF) program.

This program:

- Complies with the requirements of the Anti-Money Laundering and Counter Terrorism Financing (AML/CTF) Act 2006 as regulated by the Australian Government agency AUSTRAC

- Considers the risks we face in relation to money laundering and terrorism financing, which are critical in identifying and addressing ongoing modern slavery risks, given the nature, size and complexity of GESB, and our reliance on third party service providers

- Includes employee due diligence which involves activities associated with assessing and managing the integrity risk of our employees

This program is reported to our Board on a quarterly basis.

6. How we assess the effectiveness of our actions

Our working group is committed to assessing the effectiveness of our approach each financial year, to mitigate the risks associated with modern slavery.

Moving forward, our working group will progress its efforts to identify and address the risks of modern slavery in the following areas.

| Area of our organisation | Working group actions |

|---|---|

Supply chain and procurement |

|

Operations and governance |

|

Investments |

|

This is our first modern slavery statement. We recognise that our review and assessment of our actions to identify and address our modern slavery risks in our operations and supply chain will be an ongoing and evolving process.

1 International Labour Office and Walk Free Foundation, Global Estimates of Modern Slavery: Forced Labour and Forced Marriage, available at www.ilo.org.

Thank you for printing this page. Remember to come back to gesb.wa.gov.au for the latest information as our content is updated regularly. This information is correct as at 10 May 2024.