Calculate how much super you could have in retirement

When you find out how much super you’re likely to have, you can work out whether you need to take action to help grow your super before you retire.

If you want to keep enjoying your current lifestyle when you retire, our experience tells us that you’ll need to save enough to provide you with at least 70% of your current annual income to cover the cost of living in retirement.

According to the Association of Superannuation Funds of Australia (ASFA) report1 a single person aged around 67 living a modest lifestyle would spend around $32,665.66 a year, while couples would spend $46,994.28.

For singles and couples around the same age living a comfortable lifestyle, these amounts increase to $51,278.30 and $72,148.19 a year, respectively.

How much will you have by the time you retire?

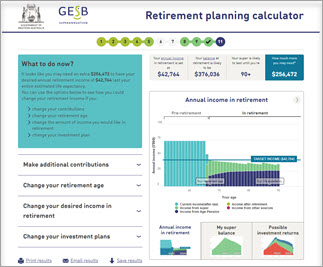

Try our Retirement planning calculator to work out how much super you'll have by the time you retire and how long it will last. When you use the calculator:

- You’ll answer a few questions about your super and other savings

- You’ll be asked what type of account you have as it makes a difference in the calculation. If you have a GESB Super account, you need to select the ‘taxed’ option. If you have a West State Super account, you’ll need to select the ‘untaxed’ option

- You can adjust variables, such as your retirement age and amount of contributions and see the impact of the adjustments on your final super balance and how long it will last

For an estimate that more closely matches your situation, you can also adjust your investment plan, your insurance cover or the fees.

There's a Gold State Super calculator

If you're a Gold State Super member, we have a calculator just for you. It shows how your defined benefit will grow, and lets you adjust variables such as Completed Months of Service and Final Remuneration to see how simple changes can affect your final balance.

Take your calculations and take action

Once you’ve done your calculations, you’ll have an idea of what retirement could look like for you. Will your current projection be enough for the kind of retirement you’d like?

If it isn’t, there are things you can do to grow your retirement savings. The quickest way is to add extra money to your super.

1 The Association of Superannuation Funds of Australia (ASFA), Retirement Standard, aged around 67, September quarter 2023.

More information

- Find out more about ASFA Retirement Standard

- Try the Retirement planning calculator

- Try the Gold State Super benefit calculator

- Look at options to add money to your super

Thank you for printing this page. Remember to come back to gesb.wa.gov.au for the latest information as our content is updated regularly. This information is correct as at 27 April 2024.