Investment update – December 2023 quarter

Highlights

- Shares and Bonds rallied strongly due to slowing inflation and expectations of interest rate cuts in 2024

- International Shares returned 6.9% while Australian Shares returned 8.4%

- Australian Bonds and Global Bonds returned 3.8% and 5.8% respectively

- My GESB Super and My West State Super returned 5.2%

- RI Allocated Pension Conservative returned 4.0%

Investment market returns: short and medium term

Shares have performed well over the past three years, but Bond returns have been negative over the same period. Property returns have improved, while Cash has generated low but positive returns.

Reasons for recent market returns

- Inflation continued to decelerate

Slowing inflation has seen all major central banks refrain from further interest rate rises, and markets are predicting interest rate cuts in 2024. Lower interest rates can benefit economic growth, company profits and consumer spending. - Share markets responded positively to potential interest rate cuts

Australia Shares was the best performing major asset class and International Shares also delivered strong gains. Returns were driven by interest rate sensitive sectors including information technology, real estate, and consumer discretionary. - Bonds rallied on interest rate expectations

Bond markets experienced their best quarterly performance in over 20 years. The major driver was the perceived shift in interest rate direction from a ‘higher-for-longer’ stance to prospective interest rate cuts.

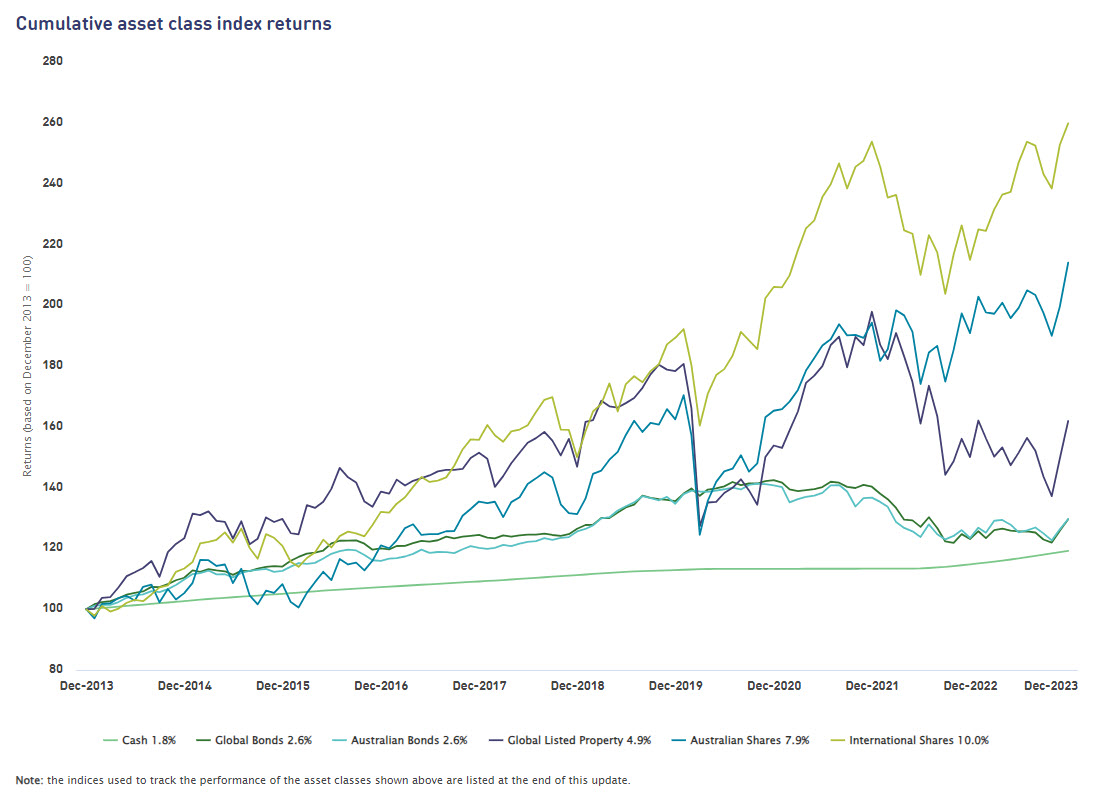

Investment market returns: long term

Over the longer term (10 years), investments such as Shares and Property have produced the highest returns but with greater variability. Cash has delivered the lowest but most stable returns. This is illustrated in the chart below.

What does this mean for your investment?

Performance of asset classes

The graph below shows the returns we achieved in a range of asset classes compared to the benchmark return over the three years to 31 December 2023.

As shown in the above graph, we have performed above benchmark in most asset classes over the past three years.

Performance of investment options

Investment returns over both the short and long term for some of our diversified plans are shown in the table below. You can also see the investment return history for all of our available plans.

| Dec quarter 2023 | 1 year | 3 years (p.a.) | 5 years (p.a.) | 10 years (p.a.) | |

|---|---|---|---|---|---|

RI Allocated Pension Conservative plan1 | 3.94% | 5.15% | 2.34% | 3.71% | 4.03% |

Transition to Retirement Pension Balanced plan2 | 4.72% | 9.27% | 4.78% | 5.99% | - |

My GESB Super1 | 5.16% | 10.84% | 5.76% | 6.83% | 6.29% |

My West State Super3 | 5.23% | 10.61% | 4.84% | 6.57% | 6.25% |

RI Term Allocated Pension Balanced plan1 | 5.41% | 10.18% | 4.9% | 6.48% | 5.93% |

RI Allocated Pension Balanced plan1 | 5.45% | 10.34% | 5.05% | 6.63% | 6.23% |

West State Super Growth plan3 | 6.09% | 13.30% | 6.66% | 7.96% | 7.16% |

Returns greater than one year are annualised.

Despite market volatility in recent times, our diversified plans have delivered sound returns over the long term.

More information

- Try our Selecting your investment plan tool

- Find out more about investing with us

- See our super investment options or retirement investment options

Need help

- Investment FAQ's

- Find a personal financial adviser

- Call us on 13 43 72

1 Returns are reported net of fees and taxes.

2 Transition to Retirement Pension was incepted on 15 June 2017, so 10-year returns are not available. Returns are reported net of fees and taxes.

3 Returns are reported net of fees.

Indices: Australian Shares - S&P/ASX 300 Accumulation Index; International Shares - MSCI All Country World ex-Australia Net Index (partially hedged); Global Listed Property - FTSE EP/NAR DEV NET HDG AUD; Australian Bonds - Bloomberg AusBond Composite 0+ Yr Index; Global Bonds - Bloomberg Barclays Global-Aggregate Total Return Index Value Hedged AUD; Investment Grade Bonds – 50/50 combination of Australian and International Bonds; Cash - Bloomberg AusBond Bank Bill (BB) Index; Listed Infrastructure - FT Dev Core Infr 50/50 Hdg; Medium Risk Alternatives - Bloomberg AusBond BB Index + 3.75%pa; Defensive Alternatives - Bloomberg AusBond BB Index + 1.75%pa; Private Equity – Blended Benchmark of Australian and International Shares.

Performance information should be used as a guide only, is of a general nature, and does not constitute legal, taxation, or personal financial advice. The performance of your investment plan is not guaranteed and returns may move up or down depending on factors such as investment market conditions. Past performance should not be relied on as an indication of future performance. In providing this information, we have not considered your personal circumstances including your objectives, financial situation or needs. We are not licensed to provide financial product advice. Before acting or relying on any of the information in this website, you should review your personal circumstances and assess whether the information is appropriate for you. You should read this information in conjunction with other relevant disclosure documents we have prepared and where necessary seek advice specific to your personal circumstances from a qualified financial adviser.

Thank you for printing this page. Remember to come back to gesb.wa.gov.au for the latest information as our content is updated regularly. This information is correct as at 27 April 2024.