Investment update – December 2021 quarter

Key highlights

- International shares experienced a high level of volatility over the three months to 31 December 2021 but ended the quarter with a positive return

- The discovery of the COVID-19 Omicron variant in November led to a decline in global equities and interest rates. However, these declines recovered by the end of December as the variant appeared to be less severe than initially thought. International and Australian shares ended the quarter up 7.2% (including currency movements) and 2.1% respectively

- Over the quarter, both Australian and US 10-year bond yields rose (meaning bond prices went down). In Australia, yields rose from 1.50% to 1.68% and in the US, from 1.49% to 1.51%

- US Federal Reserve chairman Jerome Powell noted that inflation may be here for longer and that three or more interest rate hikes are expected for 2022

- The Reserve Bank of Australia (RBA) maintained a 0.10% cash rate target throughout the quarter. At the December meeting, the RBA agreed to continue purchasing government bonds at the rate of $4 billion a week until mid-February 2022

- Australian unemployment spiked to 5.2% in November (from 4.5% at the end of September), prompted by a surge in COVID cases and lockdowns. This recovered in December, with unemployment dropping to 4.6%

- My GESB Super plan returned 3.27% for the quarter

- My West State Super plan returned 2.93% for the quarter

- RI Allocated Pension Conservative plan returned 1.36% for the quarter

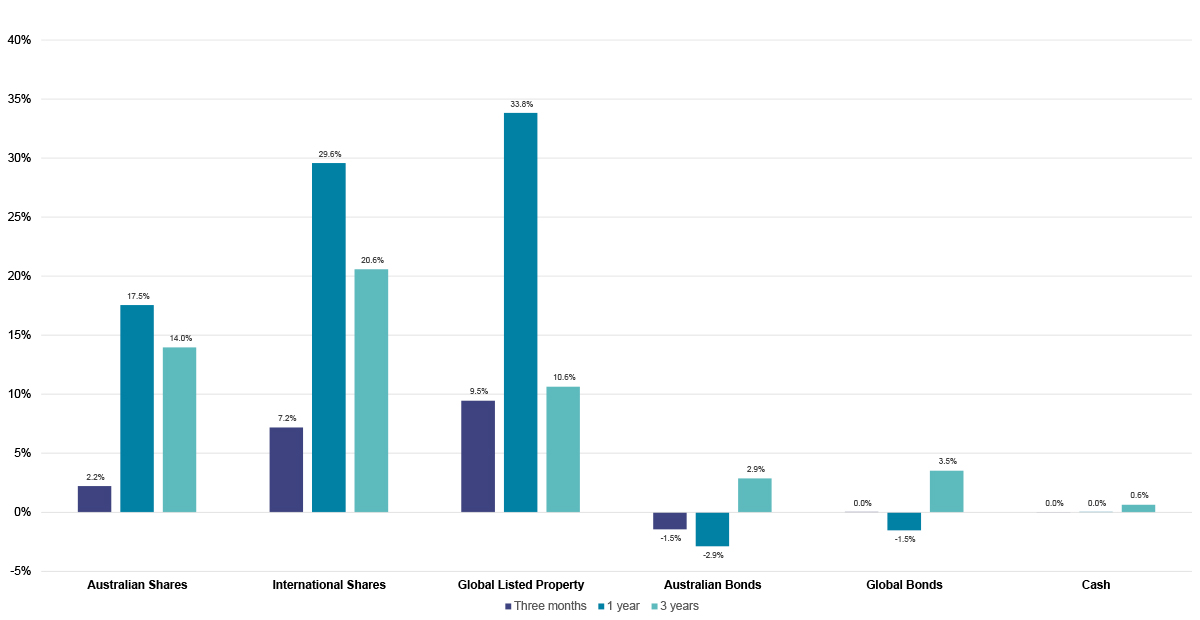

Investment market returns: short and medium term

Growth asset classes, including Australian and International Shares and Global Listed Property, delivered strong returns of more than 17% over the year to December 2021. Returns from the defensive asset classes, Cash and Bonds, were close to zero. There was a similar pattern over the past quarter. Over the past three years, Shares and Bonds have delivered reasonable returns in the range of 2% to 10% per annum.

Asset class index returns

Note: the indices used to track the performance of the asset classes shown above are listed at the end of this update.

What were the main reasons for recent investment market returns?

- Uncertainty around the newly discovered COVID-19 Omicron variant

Uncertainty regarding the severity and contagiousness of the new variant triggered a global stock market decline and increased volatility. Stock markets later recovered by the end of December as reports indicated it may not be as severe as the Delta strain. - Central bank acknowledgement that inflation may be around for longer

In late November, the US Federal Reserve chairman, Jerome Powell, stated it was a good time to drop the word ‘transitory’ when describing inflation, implying that high inflation may be here for longer than expected. This prompted stock volatility and a rise in bond yields, with investors anticipating that official interest rates would rise soon.

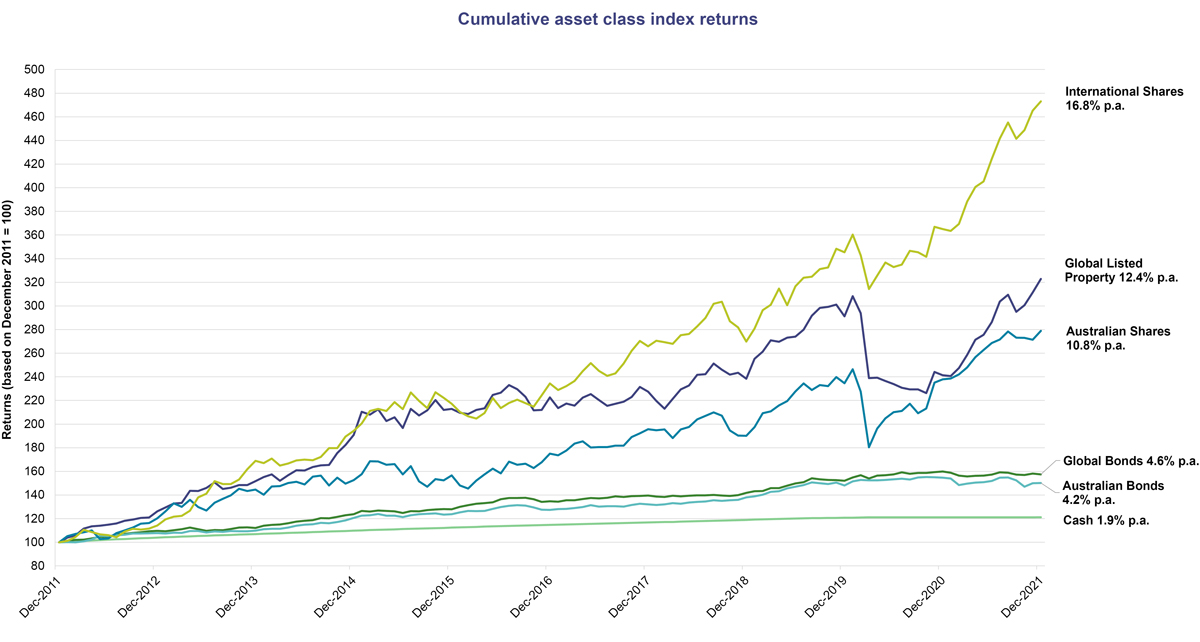

Investment market returns: long term

Over the longer term (10 years), investments such as Shares and Property have produced the highest returns (but with greater variability), while Cash has delivered the lowest (but most stable) returns. This is illustrated in the chart below.

Cumulative asset class index returns

Note: the indices used to track the performance of the asset classes shown above are listed at the end of this update.

What does this mean for your investment?

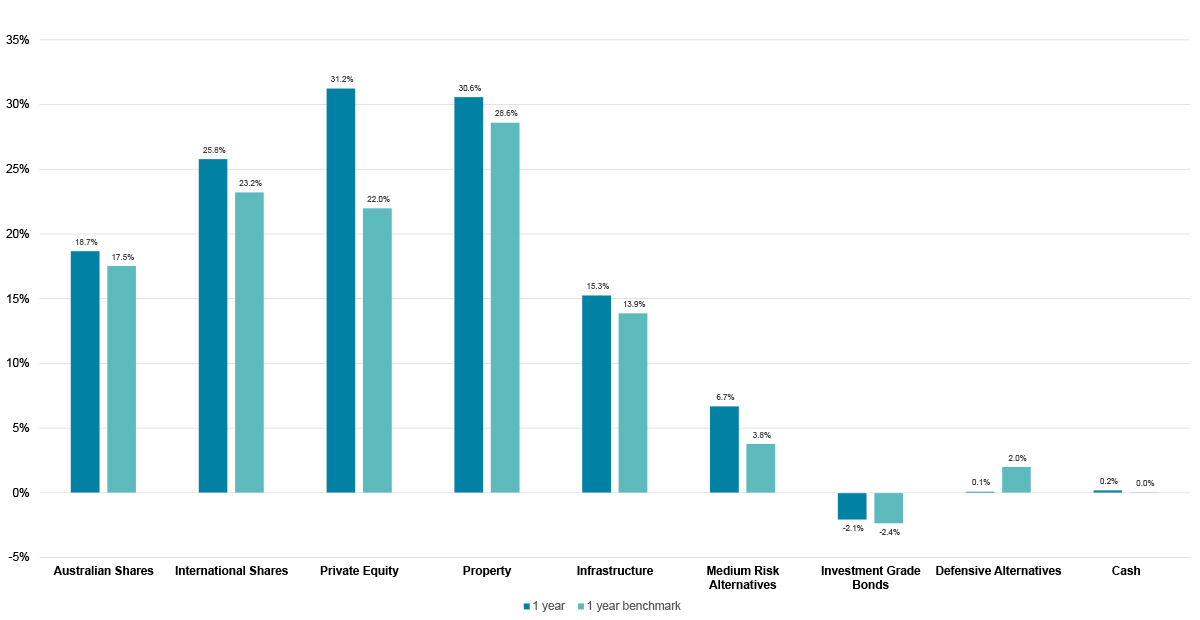

Performance of asset classes

The graph below shows the returns we achieved in each asset class, compared to the benchmark return over the year to 31 December 2021.

Note: the indices used to track the performance of the asset classes shown above are listed at the end of this update.

Performance of investment options

Investment returns over both the short and long term for some of our diversified plans are shown in the table below. You can also see the investment return history for all of our available plans.

| December 2021 quarter | 1 year | 3 years (p.a.) | 5 years (p.a.) | 10 years (p.a.) | |

|---|---|---|---|---|---|

| RI Allocated Pension Conservative plan1 | 1.36% | 5.33% | 5.71% | 4.88% | 5.81% |

| Transition to Retirement Pension Balanced plan2 | 2.70% | 11.59% | 9.13% | - | - |

| RI Allocated Pension Balanced plan1 | 2.74% | 12.27% | 10.18% | 7.96% | 9.00% |

| RI Term Allocated Pension Balanced plan1 | 2.76% | 12.30% | 10.21% | 7.98% | 8.87% |

| My West State Super3 | 2.93% | 12.50% | 10.28% | 8.01% | 9.03% |

| My GESB Super1 | 3.27% | 13.48% | 10.05% | 7.81% | 8.81% |

| West State Super Growth plan3 | 4.43% | 16.37% | 11.99% | 9.10% | 10.20% |

Other investment plans: See the investment returns for all of our available plans

Returns greater than one year are annualised.

Performance over the quarter has been helped by the positive performance from Australian Shares, International Shares and Global Listed Property. Our diversified plans have performed strongly over the past 12 months and, more importantly, over the past five and 10 years. The investment returns of our diversified plans are ahead of primary investment objectives.

More information

Need help

- Investment FAQ's

- Find a personal financial adviser

- Call us on 13 43 72

1 Returns are reported net of fees and taxes

2 Transition to Retirement Pension was incepted on 15 June 2017, so longer-term returns are not available. Returns are reported net of fees and taxes

3 Returns are reported net of fees

Indices: Australian Shares - S&P/ASX Total Return 300 Index; International Shares - MSCI World ex-Australia Net Total Return AUD Index; Global Listed Property - FTSE Custom EPRA/NAREIT Developed Index Net TRI AUD; Unlisted Property - Blended Benchmark; Australian Bonds - Bloomberg AusBond Composite 0+ Yr Index; Global Bonds - Bloomberg Barclays Global-Aggregate Total Return Index Value Hedged AUD; Investment Grade Bonds – 50/50 combination of Australian and International Bonds; Cash - Bloomberg AusBond Bank Bill Index ; Infrastructure - FT Dev Core Infr 50/50 Hdg; Unlisted Infrastructure - MSCI Australia Quarterly Private Infrastructure Fund Index (Unfrozen); Medium Risk Alternatives - Bloomberg AusBond BB + 3.75%pa; Defensive Alternatives - Bloomberg Aus Bond + 1.75%pa; Private Equity – Blended Benchmark

Performance information should be used as a guide only, is of a general nature, and does not constitute legal, taxation, or personal financial advice. The performance of your investment plan is not guaranteed, and returns may move up or down depending on market conditions. Past performance should not be relied on as an indication of future performance. In providing this information, we have not considered your personal circumstances including your objectives, financial situation or needs. We are not licensed to provide financial product advice. Before acting or relying on any of the information in this website, you should review your personal circumstances and assess whether the information is appropriate for you. You should read this information in conjunction with other relevant disclosure documents we have prepared and where necessary seek advice specific to your personal circumstances from a qualified financial adviser.

Thank you for printing this page. Remember to come back to gesb.wa.gov.au for the latest information as our content is updated regularly. This information is correct as at 09 May 2024.