How do I change my investment plan?

Each investment plan comes with its own level of ‘likely’ risk and return, so it’s important to make an informed decision. Before you change your plan, we recommend you explore the features of each investment plan. You might like to try our Selecting your investment plan tool if you need help finding the plan that is right for you.

Once you’ve decided which investment plan suits your needs, there are two ways you can change your plan:

- Download a paper form and return it to us

- Login to Member Online and change your plan online

Download a paper form

You can’t type directly onto the form, so you’ll need to download and print the form for your type of account and fill it out by hand:

- GESB Super investment choice form

- West State Super investment choice form

- Retirement Income Pension investment choice form

- RI Term Allocated Pension investment choice form

Once you’ve completed and signed your 'Investment choice' form, simply post it to us at:

GESB

PO Box J 755

Perth WA 6842

You can also email the form to: memberservices@gesb.com.au

If you need help filling out the form, please call your Member Services Centre on 13 43 72 Monday to Friday 7.30am - 5:30pm.

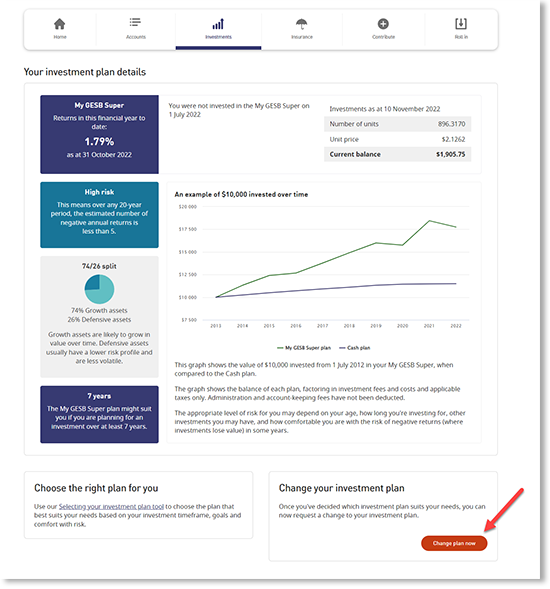

Login to Member Online

Once you have logged in, visit the ‘Investments’ page.

![]()

You’ll find a link to ‘Change your investment plan’.

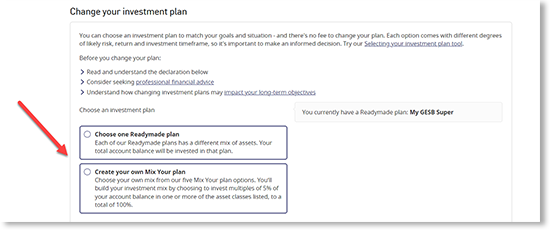

You’ll find the option to either:

- Choose one Readymade plan - each of our Readymade plans has a different mix of assets. Your total account balance will be invested in that plan

- Create your own Mix Your plan - you can choose your own mix from our five Mix Your plan options. You’ll build your investment mix by choosing to invest multiples of 5% of your account balance in one or more of the asset classes listed, to add up to a total of 100%

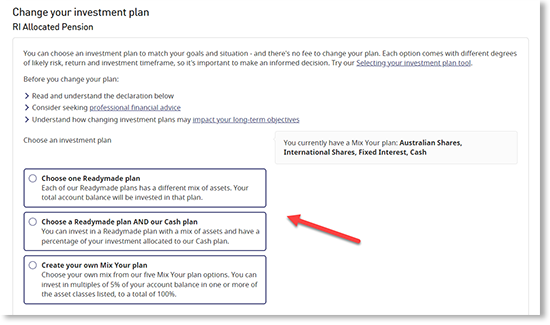

If you have a Retirement Income account, you’ll find the option to either:

- Choose one Readymade plan

Each of our Readymade plans has a different mix of assets. Your total account balance will be invested in that plan - Choose a Readymade plan AND our Cash plan

You can invest in a Readymade plan with a mix of assets and have a percentage of your investment allocated to our Cash plan - Create your own Mix Your plan

You can choose your own mix from our five Mix Your plan options. You’ll build your investment mix by choosing to invest multiples of 5% of your account balance in one or more of the asset classes listed, to add up to a total of 100%

Choose the type of plan you’d like to invest in.

More options will then appear, depending on which type of plan you choose.

If you choose to ‘Create your own Mix Your plan’, you’ll then need to choose your investment mix allocation by choosing a percentage to invest in each type. You can choose to invest multiples of 5% which need to add to a total of 100%.

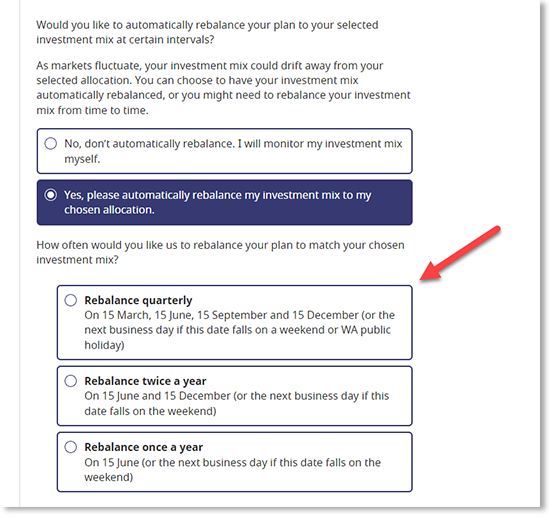

If you have a GESB Super or West State Super account, you can then choose to have your investment mix automatically rebalanced. Or you might prefer to rebalance your investment mix yourself from time to time. Rebalancing means monitoring your mix regularly and adjusting the percentage of your mix when you need to. For example, if you choose 50% Australian Shares and 50% Cash as your Mix Your plan, and the Australian Shares grows to 55% of the value of your account - by rebalancing your mix, you’ll choose to bring that percentage back to 50% of your total investment mix.

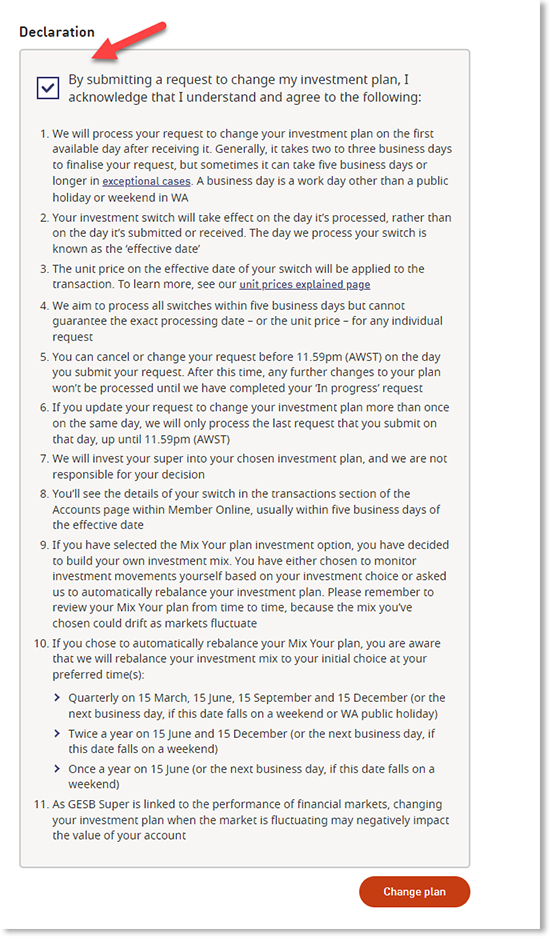

Once you’ve chosen the details of your new investment plan, you’ll need to tick the box to confirm you’ve read and agreed to the declaration. Then, you can select the ‘Change investment plan’ button to take the next step.

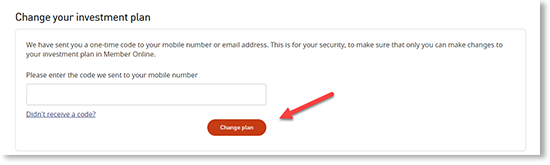

To make sure only you can make changes to your investment plan, we’ll send a code to your mobile or email for you to complete our two-part identity check known as multi-factor authentication (MFA).

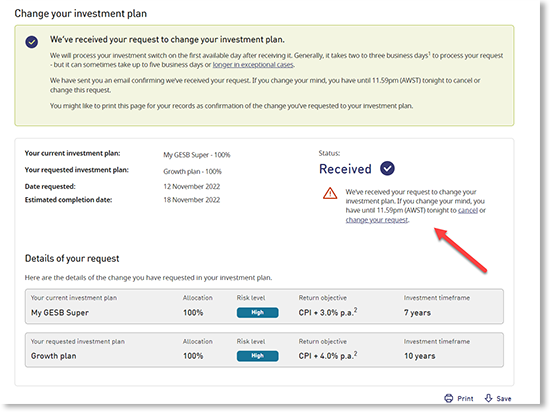

Once you’ve completed this identity check, you’ll see a message appear on-screen that your request to change your investment plan has been received. We’ll also send you an email to confirm this.

If you change your mind about requesting a change to your investment plan, you can cancel your request before 11.59pm (AWST) on the same day. Otherwise, you’ll be able to request further changes once your current request has been completed.

We’ll process your request to switch investment plans on the first available business day after you’ve submitted it. In most cases, your request will be completed within two to three business days but it can sometimes take longer.

Once your change of plan has been confirmed, your updated investment plan information will appear on your ‘Investments' and ‘Accounts’ pages in Member Online.

Thank you for printing this page. Remember to come back to gesb.wa.gov.au for the latest information as our content is updated regularly. This information is correct as at 27 April 2024.